LyondellBasell (LYB) & Lightsource Sign Renewable Energy PPA

LyondellBasell Industries N.V. LYB has signed a power purchase agreement (PPA) with Lightsource bp's solar project in Spain to acquire 149 megawatts of renewable electricity capacity.

Lightsource will provide approximately 284,000 megawatt-hours of solar power to LyondellBasell each year under this 10-year agreement. Starting in 2026, this is equivalent to the yearly electricity usage of nearly 78,000 European dwellings. The company will achieve 78% of its entire renewable electricity objective with this latest PPA.

The company's electricity use accounts for around 15% of its 2020 baseline scope 1 and 2 greenhouse gas emissions. LyondellBasell has set a target of procuring 50% of its electricity from renewable sources by 2030, based on 2020 procurement levels, as an important component of its road to net zero by 2050.

Lightsource has signed its first cross-border corporate PPA in Spain, and the business is actively striving to bring over 1 gigawatt (GW) of solar projects into construction. Lightsource is currently developing more than 10 GWs of utility-scale solar projects around Europe, which will be made available to enterprises and utilities looking to cut greenhouse gas emissions linked with their electricity supply.

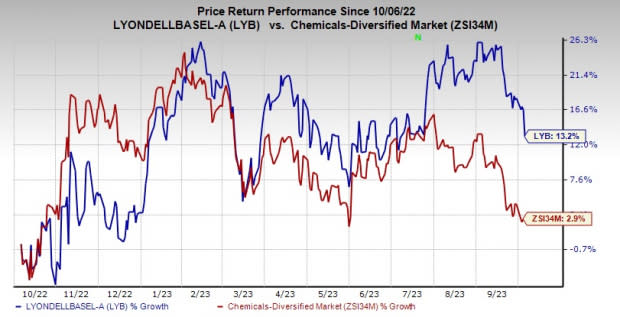

Shares of LyondellBasell have gained 13.2% over the past year compared with a 2.9% rise of its industry.

Image Source: Zacks Investment Research

In the third quarter of 2023, LyondellBasell expects soft demand due to ongoing economic uncertainty to offset the usual benefits from summer seasonality. Challenging petrochemical margins are being influenced by stagnant demand, volatile feedstock costs and increased capacity in North America and China.

However, the company anticipates attractive oxyfuels and refining margins, supported by summer demand for transportation fuels. LyondellBasell plans to maintain average operating rates of 85% for North American olefins and polyolefins (O&P) assets, and 75% for European O&P as well as Intermediates & Derivatives assets, in accordance with global market demand.

Despite the current challenging economic conditions and a slower recovery in China, the company remains committed to its long-term strategy. LyondellBasell is focused on advancing in Circular & Low Carbon Solutions. Its Value Enhancement Program is benefiting shareholders.

Zacks Rank & Key Picks

LyondellBasell currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include Carpenter Technology Corporation CRS, The Andersons Inc. ANDE and Hawkins Inc. HWKN.

HWKN beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 25.6%, on average. The stock has rallied roughly 53.2% in the past year. Hawkins currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1Rank stocks here.

Carpenter Technology currently carries a Zacks Rank #2 (Buy). The stock has rallied roughly 89.6% in the past year. CRS beat the Zacks Consensus Estimate in three of the last four quarters while meeting in one. It delivered a trailing four-quarter earnings surprise of 9.8%, on average.

Andersons currently carries a Zacks Rank #2. It has gained roughly 55.7% in the past year. ANDE beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

LyondellBasell Industries N.V. (LYB) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report