LyondellBasell (LYB) Wraps Up Acquisition of Mepol Group

LyondellBasell Industries N.V. LYB has completed the acquisition of Mepol Group, a maker of recycled, high-performance specialized compounds based in Italy and Poland. Mepol S.r.l., as well as its subsidiaries Polar S.r.l. and Industrial Technology Investments Poland Sp.z.o.o., will join LyondellBasell's Advanced Polymer Solutions (“APS”) business unit.

The APS division is a global leader in compounding solutions, producing and marketing polypropylene compounds, engineered plastics, masterbatches, engineered composites, colors and powders. The company envisions a substantial opportunity to drive the expansion of its APS business by leveraging macro trends in circularity and developing solutions for daily sustainable living, owing to Mepol's strong knowledge of recycled compounds and its strategy and scale.

Through its integrated value chain strategy, LyondellBasell is establishing a leading position to respond to the rapidly expanding need for circular and renewable solutions. To meet the requirements of its clients, the company pledges to produce and sell no less than 2 million metric tons of polymers from recycled or renewable sources yearly by 2030.

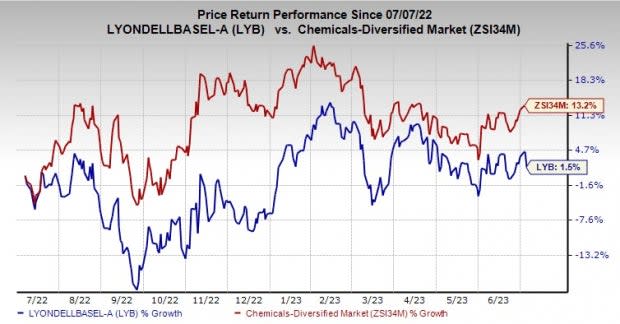

Shares of LYB have gained 1.5% over the past year compared with a 13.2% rise of its industry.

Image Source: Zacks Investment Research

The company, on its first-quarter call, said it anticipates a slight increase in global demand driven by usual seasonal trends. The demand for transportation fuels is expected to increase over the summer, supporting oxyfuels and refining margins. Delays at the beginning of industry-wide capacity expansions for polyethylene in North America are likely to lower new market supply and support polyethylene margins.

To keep pace with the market expectation, LyondellBasell estimates operating Intermediates & Derivatives assets at 80%. It expects to modestly raise global olefins and polyolefins operating rates to 85%. The company will continue to monitor the impact on petrochemical markets in the second half of 2023 of shifting global monetary policies and strengthening economic conditions in China.

LyondellBasell Industries N.V. Price and Consensus

LyondellBasell Industries N.V. price-consensus-chart | LyondellBasell Industries N.V. Quote

Zacks Rank & Key Picks

LYB currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks to consider in the basic materials space include Koppers Holdings Inc. KOP, Silvercorp Metals Inc. SVM and Linde plc LIN. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Koppers currently carries a Zacks Rank #1.The Zacks Consensus Estimate for current-year earnings for KOP is currently pegged at $4.40, implying year-over-year growth of 6.3%. It has a trailing four-quarter earnings surprise of roughly 13.64%, on average. The stock has gained around 55.9% in a year.

Silvercorp Metals currently carries a Zacks Rank #1. The consensus estimate for current fiscal-year earnings for Silvercorp is currently pegged at 27 cents, suggesting year-over-year growth of 28.6%. The stock has jumped roughly 20.4% in the past year.

Linde currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for LIN’s current-year earnings has been revised 3.8% upward in the past 60 days. Linde beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 6.9% on average. The stock has gained roughly 33.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Koppers Holdings Inc. (KOP) : Free Stock Analysis Report

LyondellBasell Industries N.V. (LYB) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report

Silvercorp Metals Inc. (SVM) : Free Stock Analysis Report