LyondellBasell's (LYB) Q3 Earnings and Sales Beat Estimates

LyondellBasell Industries N.V. LYB recorded third-quarter 2023 profit of $747 million or $2.29 per share, reflecting a rise of 30.6% from the year-ago quarter's $572 million or $1.75 per share.

LYB posted adjusted earnings of $2.46 per share, up 25.5% from the year-ago quarter figure of $1.96. Adjusted earnings surpassed the Zacks Consensus Estimate of $1.98.

The company’s net sales in the third quarter were $10,625 million, which beat the Zacks Consensus Estimate of $10,293.4 million. Net sales decreased around 13.3% from $12,250 million in the prior-year quarter.

Strong oxyfuels margins contributed to a record Intermediates & Derivatives segment EBITDA of $708 million in the reported quarter.

LyondellBasell Industries N.V. Price, Consensus and EPS Surprise

LyondellBasell Industries N.V. price-consensus-eps-surprise-chart | LyondellBasell Industries N.V. Quote

Segment Highlights

In the reported quarter, the Olefins & Polyolefins — America’s division revenues decreased 22% year over year to $2,881 million, surpassing the Zacks Consensus Estimate of $2,801 million.

Olefins & Polyolefins — Europe, Asia, the international segment’s revenues declined 21.3% year over year to $2,446 million, missing the Zacks Consensus Estimate of $2,806 million.

In the third quarter, Intermediates and Derivatives segment sales were down 6.2% to $3,081 million, topping the Zacks Consensus Estimate of $2,408 million.

The Advanced Polymer Solutions segment's revenues declined 14.3% to $899 million, missing the Zacks Consensus estimate of $959 million.

In the Refining segment, sales in the reported quarter declined 3.2% to $2,665 million, missing the Zacks Consensus Estimate of $2,733 million. The Technology segment's revenues rose 26% to $218 million, surpassing the Zacks Consensus Estimate of $154 million.

Financials

LyondellBasell generated $1.7 billion in cash from operational activities in the third quarter. Third-quarter cash from operations was used to repay maturing bonds, make capital investments and distribute $448 million to shareholders through dividends and share repurchases. During the quarter, cash and short-term investments climbed $350 million. At the end of the quarter, available liquidity was $7 billion.

Outlook

The company anticipates seasonally lower demand across most industries in the fourth quarter. Higher feedstock costs, new industry capacity and slowing Chinese demand growth continue to put pressure on global olefins and polyolefins margins. Following the end of the summer driving season, oxyfuels and refining margins are projected to fall.

Nonetheless, oxyfuel margins are expected to remain significantly higher than historical averages. LyondellBasell plans to operate its assets in line with market demand during the fourth quarter, with average operating rates of 85% for North American olefins and polyolefins (O&P) assets, 75% for European O&P assets and 70% for Intermediates & Derivatives assets.

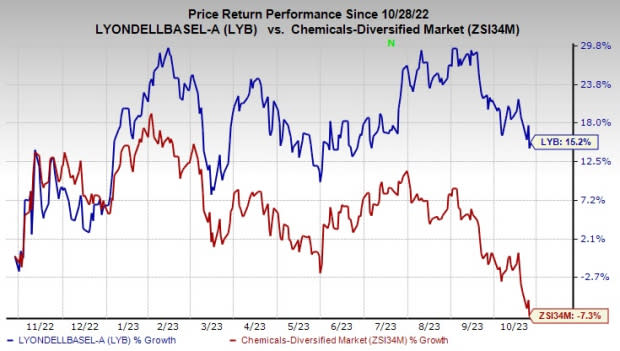

Price Performance

Shares of LyondellBasell have gained 15.2% in the past year against a 7.3% decline of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

LyondellBasell currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include Equinox Gold Corp. EQX, Koppers Holdings Inc. KOP and The Andersons Inc. ANDE.

Equinox has a projected earnings growth rate of 90% for the current year. It currently carries a Zacks Rank #1 (Strong Buy). Equinox delivered a trailing four-quarter earnings surprise of roughly 18.1%, on average. The stock is up around 33.5% in a year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Koppers has a projected earnings growth rate of 7.5% for the current year. It currently carries a Zacks Rank #2 (Buy). Koppers delivered a trailing four-quarter earnings surprise of roughly 21.7%, on average. The stock is up around 46% in a year.

Andersons currently carries a Zacks Rank #2. The stock has gained roughly 43.4% in the past year. ANDE beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Koppers Holdings Inc. (KOP) : Free Stock Analysis Report

LyondellBasell Industries N.V. (LYB) : Free Stock Analysis Report

Equinox Gold Corp. (EQX) : Free Stock Analysis Report