M.D.C. Holdings Inc (MDC) Reports Decline in Home Sale Revenues Amidst Merger Developments

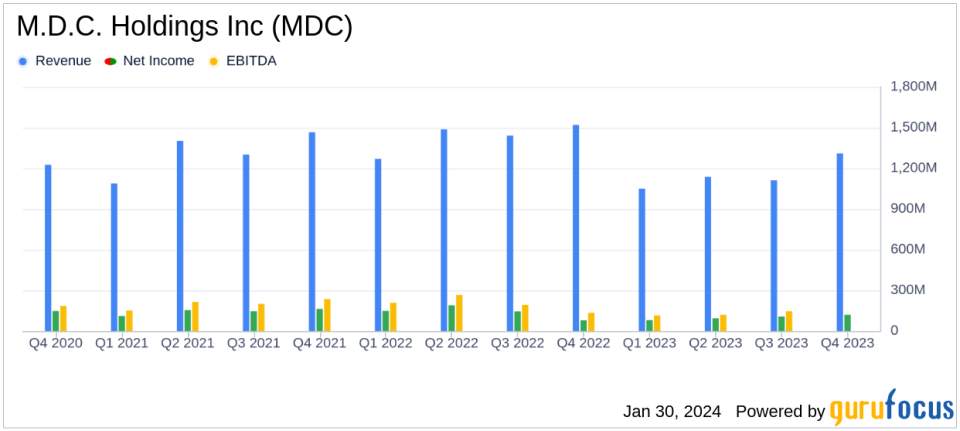

Home Sale Revenues: Q4 home sale revenues decreased to $1.31 billion from $1.49 billion in Q4 2022.

Net Income: Q4 net income stood at $119.5 million, up from $79.8 million in the same quarter last year.

Earnings Per Share: Diluted EPS for Q4 increased to $1.56, compared to $1.08 in Q4 2022.

Cash Position: Year-end cash and cash equivalents significantly increased to $1.48 billion from $696 million in 2022.

Merger Announcement: MDC entered into an agreement to be acquired by Sekisui House, pending approvals.

On January 30, 2024, M.D.C. Holdings Inc (NYSE:MDC) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its Richmond American Homes brand, operates in various states, providing home construction and financial services. Despite a challenging year marked by economic uncertainties, MDC reported a net income increase in the fourth quarter, although home sale revenues saw a decline.

Financial Performance and Market Challenges

M.D.C. Holdings Inc (NYSE:MDC) experienced a decrease in home sale revenues by 12% in Q4 2023 compared to the same period in the previous year, totaling $1.31 billion. This decline reflects broader challenges in the homebuilding sector, including economic conditions, consumer confidence, and interest rate changes. However, the company's net income for the quarter rose to $119.5 million, up from $79.8 million in Q4 2022, indicating effective cost management and operational efficiency.

The importance of MDC's performance lies in its ability to navigate a complex and fluctuating housing market. The company's financial achievements, such as the significant increase in cash and cash equivalents to $1.48 billion, demonstrate a strong liquidity position, which is crucial for weathering market downturns and capitalizing on growth opportunities.

Key Financial Metrics and Commentary

Examining the income statement, MDC's gross profit for Q4 was $245.4 million, a notable improvement from $223.5 million in the prior year's quarter. Selling, general, and administrative expenses were slightly reduced, contributing to the company's profitability. The balance sheet reflects a robust financial position, with a year-end cash and cash equivalents balance that nearly doubled from the previous year. The cash flow statement shows that operating activities generated $561.6 million in cash for the full year, supporting the company's operations and investment activities.

"Our fourth quarter results demonstrate our team's resilience and adaptability in a period of market adjustment," said Derek R. Kimmerle, Vice President and Chief Accounting Officer of M.D.C. Holdings. "Looking ahead, we remain focused on delivering quality and value to our homebuyers while navigating the evolving economic landscape."

Important metrics such as diluted earnings per share (EPS) increased to $1.56 for the quarter, up from $1.08 in the same quarter of the previous year. This metric is a key indicator of the company's profitability on a per-share basis and is closely watched by investors.

Analysis of Company's Performance

The company's performance in the fourth quarter, particularly the increase in net income and EPS, suggests effective cost control and an ability to maintain profitability despite revenue headwinds. The increase in cash reserves positions MDC well for the pending merger with Sekisui House, which could provide strategic benefits and growth opportunities. However, the decline in home sale revenues and the broader economic factors impacting the homebuilding industry will be critical areas to monitor moving forward.

For value investors, MDC's strong balance sheet, improved net income, and strategic merger developments present a potentially attractive opportunity. The company's ability to adapt to market conditions and maintain financial stability is a testament to its operational strength. As MDC navigates the merger process and the evolving housing market, investors will be keenly observing its performance and strategic direction.

For more detailed insights and analysis, visit GuruFocus.com for comprehensive financial data and expert commentary on M.D.C. Holdings Inc (NYSE:MDC) and the homebuilding industry.

Explore the complete 8-K earnings release (here) from M.D.C. Holdings Inc for further details.

This article first appeared on GuruFocus.