M.D.C. Holdings' (MDC) Subsidiary Unveils Five New Model Homes

M.D.C. Holdings, Inc.’s MDC subsidiary, Richmond American Homes of California, unveiled five model homes in Manteca. The five model homes are named Ammolite, Noble, Pearl, Decker and Seth.

The tours of the five new, fully furnished model homes will be held at the Villa Ticino masterplan on Jun 23. The venue includes two vibrant communities, Villa Ticino and Seasons at Villa Ticino, showcasing 10-inspired ranch and two-story floor plans with eye-catching open layouts and designer details.

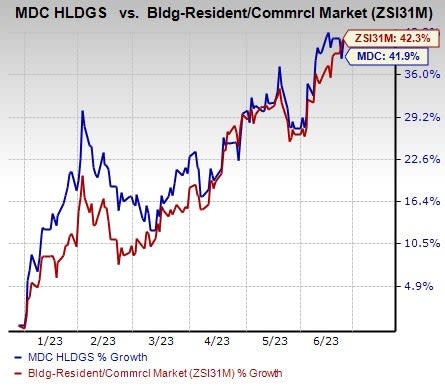

Shares of MDC grew 0.4% after the trading session on Jun 21. The stock has gained 41.9% in the year-to-date period, underperforming the Zacks Building Products - Home Builders industry’s growth of 42.3%.

Image Source: Zacks Investment Research

Although the company’s shares have underperformed the industry year to date, its various strategic growth initiatives and investments in land buyouts will assist it in maintaining its growth trend in the upcoming period.

Growth Initiatives of MDC

M.D.C. Holdings intends to focus on various strategic growth initiatives to maintain its growth momentum despite the ongoing macroeconomic risks. Its Build-to-Order process, also known as “dirt sales,” provides buyers with a wide range of choices in major aspects of their future home and personalized customer experience through in-house community teams. Also, buyers have the flexibility to customize their options according to their preferences and affordability. To have a competitive edge over its peers in the current market condition, the company is offering great opportunities for build-to-order buyers, such as long-term interest rate lock programs and other special incentives.

M.D.C. Holdings limits the number of homes started without a contract, also known as “spec homes,” and follows a strategy of initiating construction only after a purchase agreement has been executed. This reduces inventory risk, enhances efficiencies in construction, and provides greater visibility as well as predictability on future deliveries.

Also, MDC remains focused on the growing demand for entry-level homes, addressing the need for lower-priced homes, given affordability concerns prevailing in the U.S. housing market.

Zacks Rank & Other Key Picks

M.D.C. Holdings currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Some other top-ranked stocks that investors may consider from the Construction sector are Martin Marietta Materials, Inc. MLM, Vulcan Materials Company VMC and Dycom Industries, Inc. DY.

Martin Marietta currently sports a Zacks Rank #1. MLM delivered a trailing four-quarter earnings surprise of 31%, on average. Shares of the company have rallied 27.8% in the year-to-date period.

The Zacks Consensus Estimate for MLM’s 2023 sales and EPS indicates growth of 19% and 33.1%, respectively, from the previous year’s reported levels.

Vulcan Materials currently sports a Zacks Rank #1. VMC has a trailing four-quarter earnings surprise of 7.1%, on average. Shares of the company have risen 20.3% in the year-to-date period.

The Zacks Consensus Estimate for VMC’s 2023 sales and EPS indicates growth of 5.9% and 27.6%, respectively, from the previous year’s reported levels.

Dycom currently flaunts a Zacks Rank #1. DY delivered a trailing four-quarter earnings surprise of 153.7%, on average. Shares of the company have risen 15.9% in the year-to-date period.

The Zacks Consensus Estimate for DY’s fiscal 2024 sales and EPS indicates growth of 8.3% and 41%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vulcan Materials Company (VMC) : Free Stock Analysis Report

Martin Marietta Materials, Inc. (MLM) : Free Stock Analysis Report

Dycom Industries, Inc. (DY) : Free Stock Analysis Report

M.D.C. Holdings, Inc. (MDC) : Free Stock Analysis Report