M&T Bank Corp Reports Mixed Results Amid Economic Headwinds

Net Income: Q4 net income fell to $482 million, down from $690 million in Q3 and $765 million in Q4 of the previous year.

Earnings Per Share (EPS): Diluted EPS for Q4 was $2.74, compared to $3.98 in Q3 and $4.29 in the same quarter last year.

Net Interest Income: Declined to $1,722 million in Q4 from $1,775 million in Q3 and $1,827 million in Q4 of the prior year.

Provision for Credit Losses: Increased to $225 million in Q4, up from $150 million in Q3 and $90 million in Q4 of the previous year.

Efficiency Ratio: Worsened to 62.1% in Q4 from 53.7% in Q3 and 53.3% in the same quarter last year.

Noninterest Income: Rose to $578 million in Q4 from $560 million in Q3 but was down from $682 million in the same quarter of the previous year.

Common Equity Tier 1 (CET1) Capital Ratio: Slightly improved to an estimated 10.98% at the end of Q4.

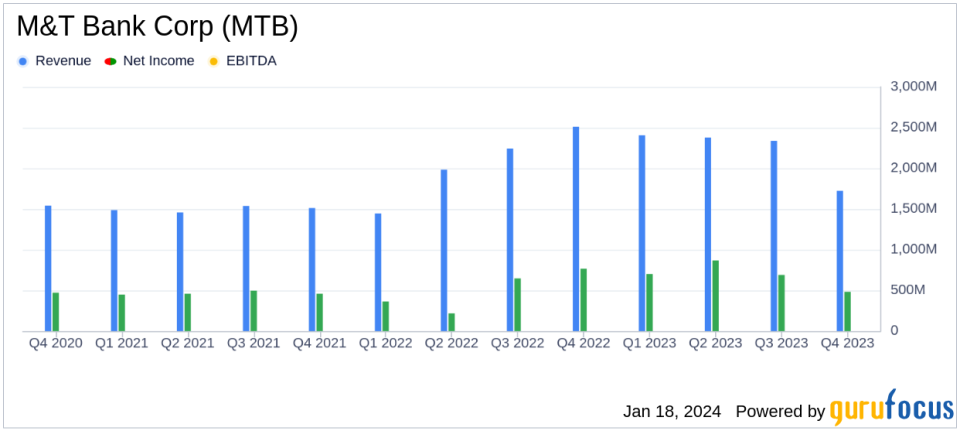

On January 18, 2024, M&T Bank Corp (NYSE:MTB) released its 8-K filing, announcing its financial results for the fourth quarter and full year of 2023. The report revealed a mixed financial performance, with a notable decline in quarterly net income and diluted earnings per share (EPS) compared to both the previous quarter and the same quarter last year. However, the bank's full-year net income showed a significant increase from 2022, highlighting resilience in a challenging economic environment.

M&T Bank, a major regional bank in the United States, has a strong presence in several states and focuses on commercial real estate and related lending, alongside retail operations. The bank's performance is a bellwether for the regional banking sector, with its results reflecting broader economic trends and the health of the commercial lending market.

Financial Performance Overview

The bank's net interest income for Q4 decreased to $1,722 million, down from $1,775 million in the third quarter and $1,827 million in the same quarter of the previous year. This decline was attributed to higher costs paid on deposits and a shift of customer funds to interest-bearing products. The net interest margin also narrowed to 3.61% in Q4 from 3.79% in Q3 and 4.06% in the same period last year.

Provisions for credit losses increased to $225 million in Q4, up from $150 million in Q3 and $90 million in Q4 of the previous year, reflecting pressure on commercial real estate borrowers and an increase in loan balances. The bank's efficiency ratio, a measure of its cost management, worsened to 62.1% in Q4 from 53.7% in Q3 and 53.3% in the same quarter last year, partly due to a special FDIC assessment of $197 million.

Despite the challenges, M&T Bank's CET1 capital ratio modestly strengthened to an estimated 10.98% at the end of Q4, compared with 10.95% at the end of Q3, indicating a solid capital position.

Commentary from the CFO

"M&T enters 2024 with stronger levels of capital, liquidity and credit reserves than a year earlier. Average commercial and consumer loans as well as average deposits all increased in the final quarter of 2023, and expenses remained well controlled after considering the FDIC special assessment. With commercial real estate values and higher interest rates impacting our commercial clientele, our relationship-based approach gives us confidence in our ability to work through those challenges with our customers and appropriately assess the associated credit risk and loss reserves. Over the past year we have strengthened relationships with our customers and welcomed new ones. We thank our employees for consistently showing up within the communities we serve to make a difference."- Daryl N. Bible, M&T's Chief Financial Officer

Looking Ahead

M&T Bank's results indicate a cautious outlook for the banking sector, with rising credit losses and narrowing net interest margins amidst economic headwinds. However, the bank's increase in capital ratios and controlled expenses, excluding the FDIC special assessment, suggest a strategic focus on maintaining financial stability. As M&T Bank navigates the challenges ahead, its relationship-based approach and commitment to community engagement remain central to its business strategy.

Investors and stakeholders will be watching closely to see how M&T Bank adapts to the evolving economic landscape and whether it can leverage its strengths to continue delivering value in the future.

For more detailed information and analysis, readers are encouraged to review the full 8-K filing and stay tuned to GuruFocus.com for the latest financial news and insights.

Explore the complete 8-K earnings release (here) from M&T Bank Corp for further details.

This article first appeared on GuruFocus.