Macatawa Bank Corp (MCBC) Reports Solid Full Year Growth Despite Q4 Challenges

Full Year Net Income: $43.2 million, a 24% increase from the previous year.

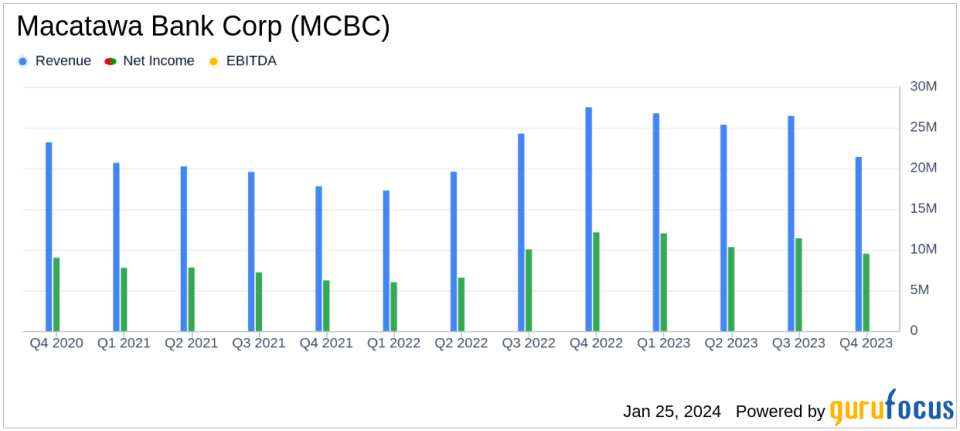

Fourth Quarter Net Income: $9.5 million, a decrease from both Q4 2022 and Q3 2023.

Net Interest Margin: Decreased to 3.28% in Q4 2023 from 3.34% in Q4 2022.

Loan Portfolio Growth: Strong growth sets a positive trajectory for 2024.

Capital Position: Robust with $143 million in excess capital over well-capitalized minimums.

On January 25, 2024, Macatawa Bank Corp (NASDAQ:MCBC) released its 8-K filing, announcing its financial results for the fourth quarter and the full year of 2023. The United States-based holding company for Macatawa Bank, which operates 26 branch offices in Michigan, reported a full year net income of $43.2 million for 2023, marking a significant 24% increase over the $34.7 million recorded in the previous year. However, the fourth quarter saw a decrease in net income to $9.5 million, down from $12.1 million in Q4 2022 and $11.4 million in Q3 2023, partly due to non-recurring costs related to the CEO's retirement.

Performance and Challenges

Macatawa Bank Corp's President and CEO, Jon Swets, expressed satisfaction with the company's profitability and balance sheet results for Q4 2023, highlighting strong loan portfolio growth and excellent asset quality. Despite a decrease in net interest margin to 3.28% in Q4 2023, the bank's strategic positioning and conservative approach have contributed to its robust capital position, with $143 million in excess capital over the well-capitalized minimums.

Challenges faced in Q4 included a $1.3 million non-recurring cost related to the CEO's retirement, impacting net income by $1.0 million after tax. Additionally, the bank experienced a shift in deposits to higher interest-bearing types, which pressured the net interest margin but showed signs of slowing down in recent months.

Financial Achievements

Macatawa Bank Corp's financial achievements in 2023 are notable in the context of the banking industry. The full year net income growth of 24% is a testament to the bank's ability to generate earnings and manage expenses effectively. The improvement in Accumulated Other Comprehensive Income (AOCI) by $10.6 million in Q4 and the maintenance of a robust capital position underscore the bank's financial strength and resilience.

Income Statement and Balance Sheet Highlights

Net interest income for Q4 2023 totaled $21.4 million, a decrease from both Q3 2023 and Q4 2022. The bank's provision for credit losses was $400,000 in Q4 2023 due to loan growth. Non-interest income saw a slight increase from Q3 but decreased from Q4 2022, with various components such as deposit service charges and brokerage income showing mixed results. Non-interest expense increased to $14.0 million in Q4 2023, largely due to the CEO retirement costs.

On the balance sheet, total assets decreased slightly to $2.75 billion at the end of 2023. The loan portfolio grew to $1.34 billion, an increase from both Q3 2023 and the previous year-end. Deposits decreased to $2.42 billion at year-end, with a shift from noninterest bearing to interest-bearing accounts.

Asset Quality and Liquidity

Macatawa Bank Corp maintained strong asset quality, with just one loan past due more than 30 days at the end of 2023. The allowance for credit losses was 1.30% of total loans, and nonperforming loans were an immaterial 0.00% of total loans. The bank's liquidity remained strong, with $418.0 million in federal funds sold and other short-term investments, and nearly $1.0 billion in additional borrowing capacity.

Conclusion

Macatawa Bank Corp's 2023 performance reflects its ability to navigate economic challenges while maintaining strong asset quality and capital levels. The bank's conservative and disciplined approach positions it well for potential economic headwinds and opportunities for loan growth. For more detailed information, investors and interested parties can refer to the full 8-K filing.

Contact:Bryan L. BarkerChief Financial Officer616-494-1448bbarker@macatawabank.com

Explore the complete 8-K earnings release (here) from Macatawa Bank Corp for further details.

This article first appeared on GuruFocus.