Macatawa Bank (NASDAQ:MCBC) Is Due To Pay A Dividend Of $0.08

Macatawa Bank Corporation (NASDAQ:MCBC) will pay a dividend of $0.08 on the 30th of August. This means that the annual payment will be 3.2% of the current stock price, which is in line with the average for the industry.

See our latest analysis for Macatawa Bank

Macatawa Bank's Dividend Forecasted To Be Well Covered By Earnings

We aren't too impressed by dividend yields unless they can be sustained over time.

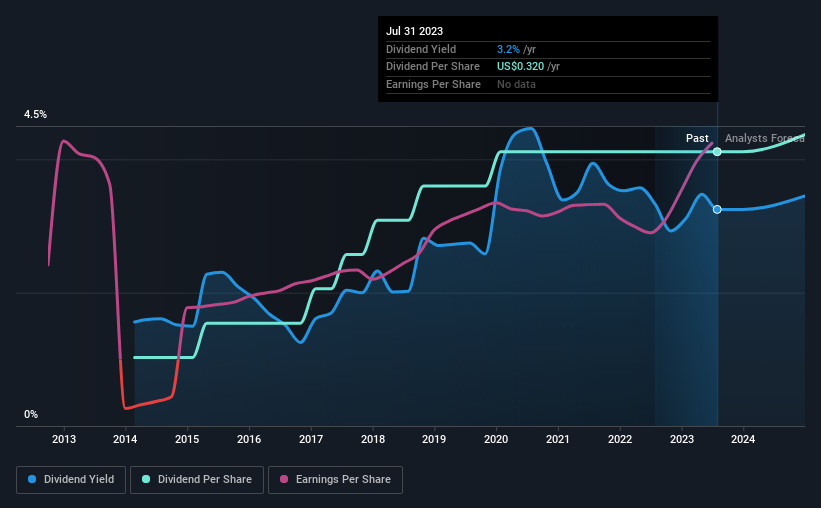

Having paid out dividends for 9 years, Macatawa Bank has a good history of paying out a part of its earnings to shareholders. While past records don't necessarily translate into future results, the company's payout ratio of 25% also shows that Macatawa Bank is able to comfortably pay dividends.

Over the next year, EPS is forecast to fall by 5.2%. But assuming the dividend continues along recent trends, we believe the future payout ratio could be 30%, which we are pretty comfortable with and we think would be feasible on an earnings basis.

Macatawa Bank Is Still Building Its Track Record

Even though the company has been paying a consistent dividend for a while, we would like to see a few more years before we feel comfortable relying on it. The annual payment during the last 9 years was $0.08 in 2014, and the most recent fiscal year payment was $0.32. This implies that the company grew its distributions at a yearly rate of about 17% over that duration. It is always nice to see strong dividend growth, but with such a short payment history we wouldn't be inclined to rely on it until a longer track record can be developed.

The Dividend Looks Likely To Grow

The company's investors will be pleased to have been receiving dividend income for some time. Macatawa Bank has impressed us by growing EPS at 18% per year over the past five years. A low payout ratio and decent growth suggests that the company is reinvesting well, and it also has plenty of room to increase the dividend over time.

We Really Like Macatawa Bank's Dividend

Overall, we like to see the dividend staying consistent, and we think Macatawa Bank might even raise payments in the future. The company is generating plenty of cash, and the earnings also quite easily cover the distributions. However, it is worth noting that the earnings are expected to fall over the next year, which may not change the long term outlook, but could affect the dividend payment in the next 12 months. All in all, this checks a lot of the boxes we look for when choosing an income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come across 2 warning signs for Macatawa Bank you should be aware of, and 1 of them is a bit concerning. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here