Macerich (MAC), Hudson Pacific Conclude $700M Asset Sale

In a strategic move to fortify their financial positions, Macerich MAC and Hudson Pacific Properties HPP have successfully completed the $700 million sale of One Westside and Westside Two in Los Angeles. The joint venture, with Hudson Pacific holding a 75% interest and Macerich a 25% interest, marked a significant transaction in the real estate market.

The assets, totaling approximately 687,000 square feet, were sold to the Regents of the University of California. The sale at $700 million, before prorations and closing costs, not only showcased the resilience of the real estate market but also demonstrated the companies' strategic prowess in unlocking value from their portfolio.

Macerich's CEO, Tom O’Hern, noted that the transaction exemplifies the company's ability to maximize opportunities for stakeholders. The net proceeds from the sale will enable Macerich, a REIT engaged in the ownership, operation and development of retail and mixed-use properties in top markets, to further deleverage and improve its liquidity profile.

O’Hern highlighted the importance of this liquidity in advancing Macerich’s successful densification-diversification strategy. This strategy involves adding new uses, such as fitness, grocery, medical, residential, hotel and office spaces, to its high-quality portfolio of Regional Town Centers in attractive U.S. markets.

Victor Coleman, the chairman and CEO of Hudson Pacific, echoed the sentiment, emphasizing the opportunistic nature of the sale, stating, "The opportunistic sale of One Westside and Westside Two significantly bolsters our balance sheet and we now have no debt maturities until year-end 2025."

Hudson Pacific transformed the former Westside Pavilion mall into a modern and flexible campus environment, attracting two large-scale, high-quality end-users. Coleman attributed this success to the company's development expertise, commitment to quality and strong relationships.

Hudson Pacific, an office REIT that specializes in serving dynamic tech and media tenants globally, utilized the net proceeds from the sale to repay outstanding amounts on its unsecured revolving credit facility. This not only addressed the company’s debt maturities until December 2025 but also strengthened its compliance with unsecured revolving credit facility covenants. As of Sep 30, 2023, the company's share of net debt to the company’s share of undepreciated book value proforma improved to 35% from 39% for all announced asset sales, showcasing the positive impact of the strategic move.

In conclusion, the successful sale of One Westside and Westside Two not only added substantial value to the balance sheets of both Hudson Pacific and Macerich but also exemplified their commitment to strategic development and maximizing stakeholder returns. Investors should keep a keen eye on these companies as they continue to navigate and capitalize on opportunities in the evolving real estate landscape.

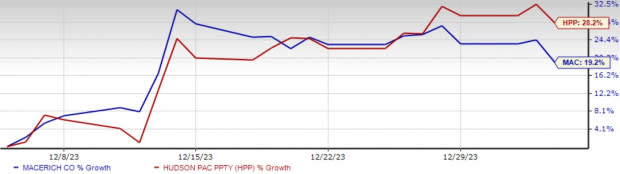

Currently, Macerich and Hudson Pacific Properties each carry a Zacks Rank #3 (Hold). Here’s how shares of Macerich and Hudson Pacific Properties have performed in the past month.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the retail REIT sector are Tanger Inc. SKT and Urban Edge Properties UE, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Tanger Factory Outlet Centers’ 2023 FFO per share has been raised 1.6% in the past two months to $1.94.

The Zacks Consensus Estimate for Urban Edge Properties’ 2023 FFO per share has moved 5% upward in the past month to $1.25.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Disclaimer: This article has been written with the assistance of Generative AI. However, the author has reviewed, revised, supplemented, and rewritten parts of this content to ensure its originality and the precision of the incorporated information.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Macerich Company (The) (MAC) : Free Stock Analysis Report

Tanger Inc. (SKT) : Free Stock Analysis Report

Hudson Pacific Properties, Inc. (HPP) : Free Stock Analysis Report

Urban Edge Properties (UE) : Free Stock Analysis Report