MACOM (MTSI) Acquires Wolfspeed's Radio Frequency Business

MACOM Technology Solutions MTSI is enhancing its portfolio offerings on the back of strategic acquisitions.

Notably, MACOM acquired the radio frequency (RF) business of Wolfspeed WOLF for $135 million on Dec 2.

The amount includes $75 million in cash and $61 million of MACOM common stock.

Further, Wolfspeed's RF business offers a portfolio of Gallium Nitride (GaN) on Silicon Carbide products.

MACOM remains well-poised to gain solid traction among high-performance RF and microwave applications on the back of the underlined acquisition. This, in turn, will aid the company in solidifying its footing across automotive, industrial and renewable energy markets.

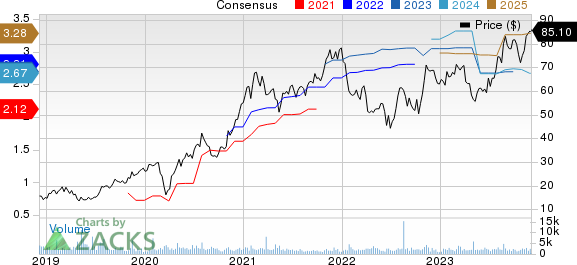

MACOM Technology Solutions Holdings, Inc. Price and Consensus

MACOM Technology Solutions Holdings, Inc. price-consensus-chart | MACOM Technology Solutions Holdings, Inc. Quote

Growth Prospects

The latest move bodes well for the company to strengthen its presence in the global RF components market.

Per a Grand View Research report, the global RF components market size is expected to grow at a CAGR of 14.2% between 2023 and 2030.

A Spherical Insights report indicates the global RF components market will reach $100.9 billion by 2032, exhibiting a GAGR of 15.7% during the forecast period of 2023-2032.

Strong prospects in the booming RF components market will likely instill investor optimism in the stock.

MTSI shares have gained 35.1% in the year-to-date period, outperforming the industry’s growth of 19.6%.

Strategic Acquisitions: Key Catalyst

The latest move is in sync with MACOM’s growing efforts toward boosting its business growth through strategic acquisitions.

Apart from the latest deal, MACOM has acquired OMMIC SAS' manufacturing facilities in France, forming the foundation for its European Semiconductor Center. The facility offers higher frequency GaAs and GaN monolithic microwave integrated circuits.

Further, its Linearizer Communications Group buyout for $49 million remains noteworthy. Linearizer is a market leader in correcting distortion of communication systems and linear optical links.

We believe that increasing strategic buyouts will continue to bolster MACOM’s key offerings, which, in turn, will continue to help it sustain momentum among customers. This, in turn, will drive its financial performance in the days ahead.

However, weakening momentum in China and rising competition in the semiconductor market are major concerns.

In fourth-quarter fiscal 2023, MACOM revenues decreased 15.6% year over year to $150.4 million.

For first-quarter fiscal 2024, MACOM expects revenues between $149 million and $153 million. The Zacks Consensus Estimate is pegged at $151.12 million.

Zacks Rank & Stocks to Consider

Currently, MACOM carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Badger Meter BMI and Arista Networks ANET. While Badger Meter sports a Zacks Rank #1 (Strong Buy), Arista Networks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Badger Meter shares have gained 38.4% in the year-to-date period. BMI’s long-term earnings growth rate is currently projected at 20.39%.

Arista Networks shares have gained 77.3% in the year-to-date period. The long-term earnings growth rate for ANET is currently projected at 19.77%

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Wolfspeed (WOLF) : Free Stock Analysis Report

MACOM Technology Solutions Holdings, Inc. (MTSI) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report