MACOM Technology Solutions Holdings Inc Reports Mixed Q1 FY2024 Results

Revenue: $157.1 million, a 12.7% decrease year-over-year but a 4.5% increase from the prior quarter.

Gross Margin: GAAP gross margin declined to 55.6% from 61.3% year-over-year; Adjusted gross margin was 59.2%.

Net Income: GAAP net income was $12.5 million, down from $29.5 million year-over-year; Adjusted net income was $41.8 million.

Earnings Per Share: GAAP EPS at $0.17, a decrease from $0.41 year-over-year; Adjusted EPS at $0.58.

Balance Sheet: Cash and short-term investments totaled $463.3 million; Total assets stood at $1.65 billion.

Outlook: Q2 FY2024 revenue projected between $178 million to $184 million with adjusted EPS between $0.56 and $0.62.

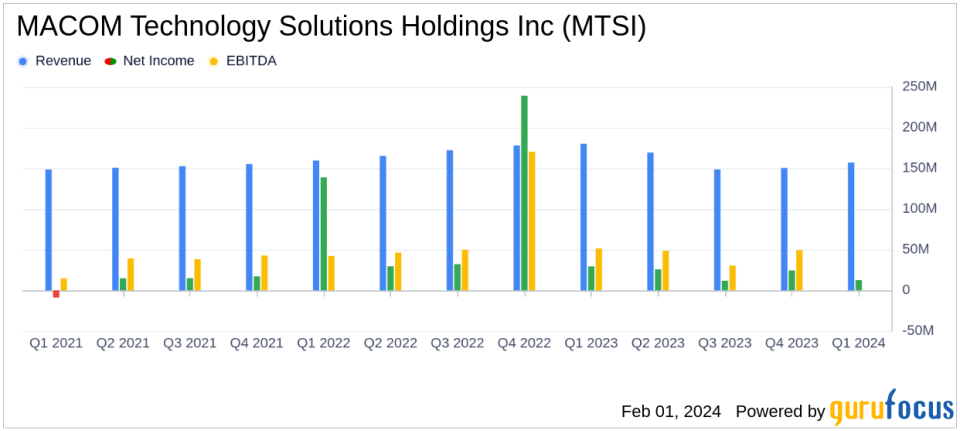

On February 1, 2024, MACOM Technology Solutions Holdings Inc (NASDAQ:MTSI) released its 8-K filing, detailing financial results for its fiscal first quarter ended December 29, 2023. The company, a leading supplier of semiconductor products, reported a year-over-year decline in revenue and gross margin, while managing a sequential increase in revenue and a stable adjusted earnings per share (EPS).

MACOM's revenue for the quarter was $157.1 million, representing a 12.7% decrease compared to $180.1 million in the same quarter of the previous fiscal year. However, this marked a 4.5% increase from the $150.4 million reported in the prior fiscal quarter. The GAAP gross margin also saw a decline to 55.6%, down from 61.3% year-over-year, and a slight decrease from 57.6% in the prior quarter. Adjusted gross margin was reported at 59.2%, indicating a more moderate decline.

Operational Performance and Challenges

Income from operations was $11.0 million, or 7.0% of revenue, a significant decrease from the $38.6 million, or 21.4% of revenue, reported in the previous year's fiscal first quarter. This decline in operating income reflects the challenges faced by the company in maintaining its profitability amidst a competitive semiconductor market. Net income followed a similar trend, with GAAP net income at $12.5 million, or $0.17 per diluted share, compared to $29.5 million, or $0.41 per diluted share, in the same period last year. Adjusted net income was $41.8 million, or $0.58 per diluted share, showing resilience in the face of market pressures.

President and Chief Executive Officer Stephen G. Daly commented on the quarter's results, stating,

Q1 was a solid start to fiscal year 2024. We are pleased with the expansion of our product portfolio, and we continue to see new growth opportunities across the Industrial and Defense, Telecommunications and Data Center markets."

This statement underscores the company's strategic focus on diversifying its product offerings and targeting growth sectors within the industry.

Financial Health and Future Outlook

The balance sheet remains robust, with cash and short-term investments totaling $463.3 million. Total assets stood at $1.65 billion, showcasing the company's strong financial position. Looking ahead, MACOM anticipates revenue for the fiscal second quarter ending March 29, 2024, to be in the range of $178 million to $184 million. Adjusted gross margin is expected to be between 56% and 58%, and adjusted EPS is projected to be between $0.56 and $0.62.

MACOM's performance in the first quarter of fiscal 2024 reflects the dynamic nature of the semiconductor industry, with the company navigating through market fluctuations and competitive challenges. The company's focus on product expansion and strategic market targeting positions it to capitalize on new opportunities, despite the pressures on revenue and margins. Value investors may find the company's stable adjusted earnings and strong balance sheet to be indicators of its resilience and potential for long-term growth.

For more detailed information and to access the earnings call, investors and analysts may visit MACOM's Investor Relations website. The company continues to hold certifications to various international quality and environmental management standards, operating facilities across the United States, Europe, and Asia, with its headquarters in Lowell, Massachusetts.

Explore the complete 8-K earnings release (here) from MACOM Technology Solutions Holdings Inc for further details.

This article first appeared on GuruFocus.