Macrogenics Inc (MGNX) Reports Strong Financial Position and Advancements in Cancer Treatment ...

Cash Position: Increased to $229.8 million as of December 31, 2023, from $154.3 million the previous year.

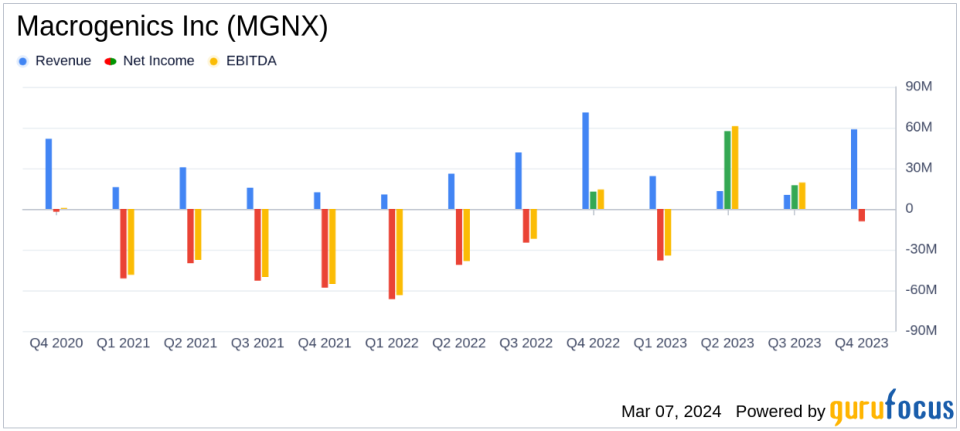

Revenue: Total revenue decreased to $58.7 million in 2023 from $151.9 million in 2022, primarily due to a decrease in collaborative and other agreements.

R&D Expenses: Decreased to $166.6 million in 2023 from $207.0 million in 2022, reflecting lower manufacturing and development costs.

SG&A Expenses: Decreased to $52.2 million in 2023 from $58.9 million in 2022, mainly due to reduced selling costs for MARGENZA.

Net Loss: Significantly reduced to $9.1 million in 2023 from a net loss of $119.8 million in 2022.

Shares Outstanding: As of December 31, 2023, there were 62,070,627 shares of common stock outstanding.

On March 7, 2024, Macrogenics Inc (NASDAQ:MGNX) released its 8-K filing, detailing the company's financial results for the year ended December 31, 2023, and providing an update on its corporate progress. Macrogenics, a biopharmaceutical company, is at the forefront of developing antibody-based therapeutics for cancer treatment, including its product MARGENZA for metastatic HER2-positive breast cancer. The company's strategy leverages partnerships to develop a broad portfolio of pipeline candidates, targeting not only cancer but also autoimmune disorders and infectious diseases. Macrogenics' intellectual property is protected by patents on the composition of its product candidates and the technology used to create them.

Financial Highlights and Clinical Advancements

Macrogenics reported a solid cash position of $229.8 million, an increase from the previous year's $154.3 million. This financial strength is expected to extend the company's cash runway into 2026, supporting ongoing clinical and preclinical studies. Despite a decrease in total revenue from the previous year, the company significantly reduced its net loss from $119.8 million in 2022 to $9.1 million in 2023. This improvement was aided by a gain on royalty monetization arrangement and a milestone payment related to TZIELD.

Research and development expenses saw a decrease, reflecting lower costs associated with manufacturing and clinical trials. Selling, general, and administrative expenses also declined, primarily due to decreased selling costs for MARGENZA. The company's commitment to advancing its pipeline is evident in the progress of several key investigational programs, including the TAMARACK Phase 2 study of vobra duo in mCRPC patients, the initiation of a Phase 1 study of MGC026, and the anticipated submission of an IND for MGC028 by year-end.

"We expect that 2024 will be an important year for MacroGenics, with multiple pipeline advancements anticipated," said Scott Koenig, M.D., Ph.D., President and CEO of MacroGenics. "We plan to present the initial TAMARACK clinical data in the second quarter of this year. Later in the year, we expect to share updated clinical data from the trial."

Analysis of Macrogenics' Performance

The company's strategic focus on advancing its pipeline is crucial for long-term growth, especially in the competitive biotechnology industry. The reduction in net loss and controlled expenses demonstrate effective management and a clear path towards potential profitability. The progress in clinical trials and the expansion of studies into additional cancer types could lead to new treatment options and market opportunities.

Macrogenics' financial achievements, including the extended cash runway, are vital for sustaining its research and development efforts. The company's ability to manage costs while advancing its clinical programs is a positive indicator for investors and stakeholders. The anticipated presentations at ASCO and AACR, along with the initiation of new studies, underscore the company's commitment to innovation and its potential to deliver value through its pipeline.

For detailed financial tables and further information on Macrogenics' corporate progress and financial results, investors and interested parties can refer to the full 8-K filing.

Macrogenics Inc (NASDAQ:MGNX) continues to make strides in the biotechnology sector with a strong financial position and promising developments in its cancer treatment pipeline. The company's strategic focus and disciplined cost management have positioned it well for future growth and innovation in the field of antibody-based therapeutics.

Explore the complete 8-K earnings release (here) from Macrogenics Inc for further details.

This article first appeared on GuruFocus.