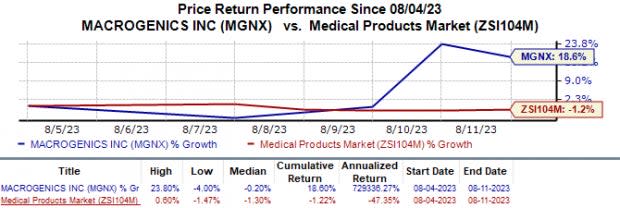

MacroGenics' (MGNX) Shares Jump 19% in One Week: Here's Why

Shares of MacroGenics MGNX have risen 18.6% in the one week against the industry’s 1.2% fall.

Image Source: Zacks Investment Research

This upside occurred after MacroGenics announced its second-quarter 2023 results. In its earnings press release, the company reported earnings per share (EPS) of 92 cents against the 67 cents loss per share reported in the year-ago quarter. The reported EPS beat Wall Street estimates since many analysts expected the company to report loss.

The positive EPS was due to a change in accounting treatment wherein MacroGenics recognized a previously received $100 million upfront payment as a component of other income during the second quarter. This payment was received by MacroGenics after it signed an agreement to sell its royalty interest on future global net sales of diabetes drug Tzield (teplizumab) to DRI Healthcare Trust in March 2023. In addition to the upfront payment, MacroGenics is eligible to receive milestone payments of up to $100 million from DRI and a right to receive a 50% share of the royalty on global net sales of Tzield above a certain annual threshold.

Tzield was originally developed by MacroGenics. The drug was acquired by Provention Bio pursuant to an asset purchase agreement with the company in 2018. Last November, the FDA approved Tzield as the first and only treatment that can delay the onset of stage 3 type 1 diabetes (“T1D”) in adults and pediatric patients aged eight years and older having stage 2 T1D. In April, pharma giant Sanofi SNY added Tzield to its portfolio after it completed the acquisition of Provention Bio for $2.90 billion.

In a separate transaction also completed in April 2023, Sanofi acquired the royalty interest on future Tzield sales from DRI Healthcare Trust. As a result, the need for MacroGenics’ involvement in the transfer of royalty payments to DRI has now been obviated. All payments under the agreement with DRI will now be paid directly by Sanofi.

Alongside its second-quarter results, MacroGenics also announced that it has achieved a milestone payment of $50 million from Sanofi. This milestone payment was triggered last month after Sanofi reported that the phase III PROTECT study evaluating Tzieldin patients with newly diagnosed stage 3 T1D, achieved its primary endpoint. The $50-million milestone payment was triggered as part of the agreement with DRI.

As of June 2023-end, MacroGenics held a cash and cash equivalent balance of $240 million. Combined with the $50 million milestone payment received from Sanofi and future payments, management expects the cash runway to extend into 2026. This will help the company fund its pipeline development, including separate mid-stage studies on wholly-owned pipeline candidates vobramitamab duocarmazine and lorigerlimab in metastatic castration-resistant prostate cancer.

MacroGenics only has one marketed drug in its portfolio, Margenza, which was approved by the FDA in 2020 for the treatment of certain adult patients with metastatic HER2-positive breast cancer. A successful development of its other pipeline candidates will help boost the company’s growth prospects.

Apart from Margenza and Tzield, MacroGenics has also collaborated with Incyte INCY to develop Zynyz (retifanlimab). This PD-1 inhibitor was approved by the FDA this March for treating adult patients with metastatic or recurrent locally-advanced merkel cell carcinoma. Incyte licensed Zynyz from MGNX in 2017. Incyte and MacroGenics are also developing the drug in separate studies for lung cancer and endometrial cancer indications.

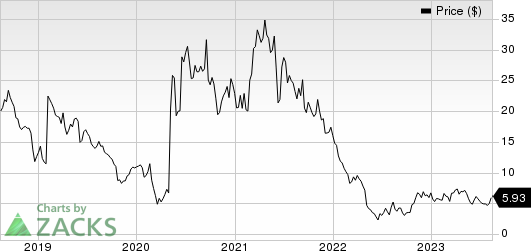

MacroGenics, Inc. Price

MacroGenics, Inc. price | MacroGenics, Inc. Quote

Zacks Rank & Stocks to Consider

MacroGenics currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the overall healthcare sector is Eli Lilly LLY, which sports a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, estimates for Eli Lilly’s 2023 earnings per share have risen from $8.80 to $9.59. During the same period, the earnings for 2024 have risen from $12.11 to $13.02. Shares of Eli Lilly have surged 44.4% in the year-to-date period.

Earnings of Eli Lilly beat estimates in three of the last four quarters while missing the mark on one occasion, witnessing an earnings surprise of 3.73%, on average. In the last reported quarter, Eli Lilly’s earnings beat estimates by 6.57%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sanofi (SNY) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Incyte Corporation (INCY) : Free Stock Analysis Report

MacroGenics, Inc. (MGNX) : Free Stock Analysis Report