Madison Avenue Partners, LP Boosts Stake in Ovid Therapeutics Inc

Madison Avenue Partners, LP (Trades, Portfolio), a New York-based investment firm, recently increased its holdings in Ovid Therapeutics Inc (NASDAQ:OVID). This article provides an in-depth analysis of the transaction, the profiles of both the firm and the traded company, and the potential implications of this move on their respective portfolios.

Details of the Transaction

On July 20, 2023, Madison Avenue Partners, LP (Trades, Portfolio) added 504,451 shares of Ovid Therapeutics Inc to its portfolio at a traded price of $3.52 per share. This transaction increased the firm's total holdings in the company to 3,609,054 shares, representing 2.72% of its portfolio and 5.10% of Ovid Therapeutics Inc's total shares. The transaction had a 0.38% impact on the firm's portfolio.

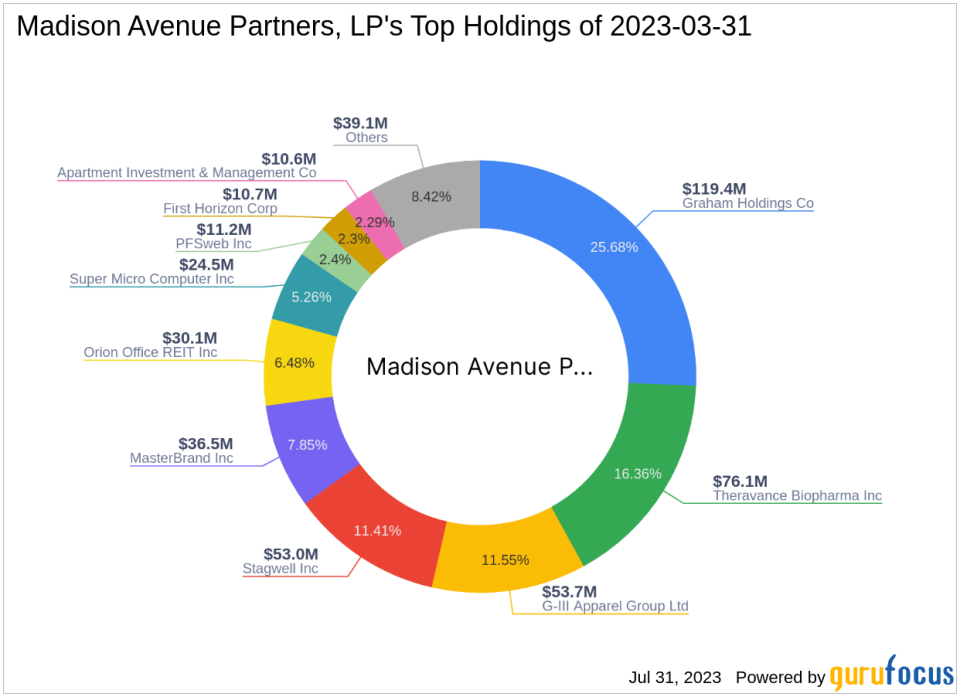

Profile of Madison Avenue Partners, LP (Trades, Portfolio)

Madison Avenue Partners, LP (Trades, Portfolio) is an investment firm located at 150 East 58th Street, New York. The firm manages 18 stocks with a total equity of $465 million. Its top holdings include G-III Apparel Group Ltd (NASDAQ:GIII), Theravance Biopharma Inc (NASDAQ:TBPH), Graham Holdings Co (NYSE:GHC), Stagwell Inc (NASDAQ:STGW), and MasterBrand Inc (NYSE:MBC). The firm's top sectors are Consumer Defensive and Healthcare.

Overview of Ovid Therapeutics Inc

Ovid Therapeutics Inc (NASDAQ:OVID) is a US-based biopharmaceutical company dedicated to reducing seizures and improving the lives of people affected by rare epilepsies and seizure-related neurological disorders. The company operates in a single segment and has a market capitalization of $253.175 million. The current stock price is $3.59 although the company does not have enough data to compute a GF Value.

Analysis of Ovid Therapeutics Inc's Stock Performance

Since its IPO on May 5, 2017, OVID's stock has decreased by 74.36%. However, the stock has gained 1.99% since the transaction and has seen a year-to-date increase of 85.05%. The company's PE percentage is currently not applicable as it is operating at a loss.

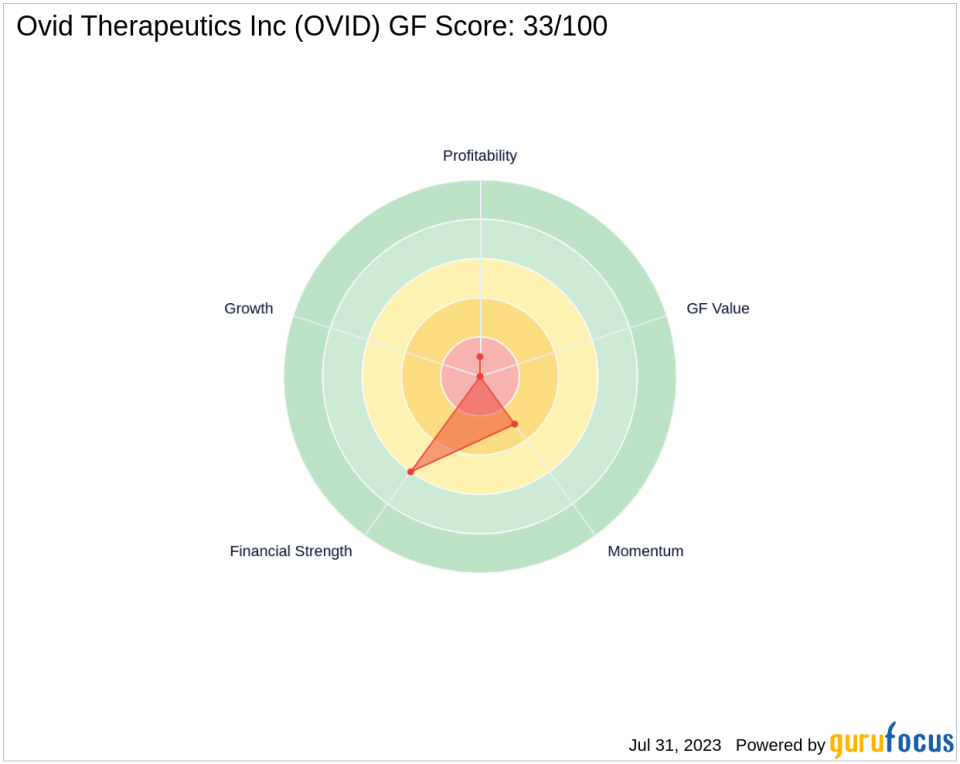

Evaluation of Ovid Therapeutics Inc's Financial Health

Ovid Therapeutics Inc has a GF Score of 33/100, indicating poor future performance potential. The company's balance sheet and profitability ranks are 6/10 and 1/10 although the company does not have enough data to compute a growth rank. The company's cash to debt ratio is 7.13, ranking it 814th in the industry. Its ROE and ROA are -36.09 and -30.90 respectively, ranking it 588th and 694th in the industry.

Assessment of Ovid Therapeutics Inc's Industry Position

Ovid Therapeutics Inc operates in the Biotechnology industry. Despite its low industry ranks based on ROE and ROA, the company has shown promising growth in its EBITDA and earnings over the past three years, with growth rates of 21.00% and 20.60% respectively.

Conclusion

In conclusion, Madison Avenue Partners, LP (Trades, Portfolio)'s recent acquisition of additional shares in Ovid Therapeutics Inc is a significant move that increases its stake in the biopharmaceutical company. Despite Ovid Therapeutics Inc's current financial challenges, the firm's investment could be a strategic move banking on the company's potential for future growth. As always, investors are advised to conduct their own comprehensive analysis before making investment decisions.

This article first appeared on GuruFocus.