MAG Silver's (MAG) Juanicipio Starts Commercial Production

MAG Silver Corp. MAG announced that the Juanicipio Project achieved commercial production on Jun 1, 2023, which is a major milestone for the company as it marks its transition from a developer to producer.

Located in Zacatecas, MX, the Juanicipio Project is a joint venture of MAG and Fresnillo Plc. FNLPF, in which MAG owns a 44% stake.

From March 2023 to May 31, 2023, the Juanicipio processing facility produced roughly 3.2 million ounces of silver. Juanicipio is demonstrating its potential to sustain the ongoing production levels with all major construction activities being completed.

The Juanicipio mill is currently operating at roughly 85% of its 4,000 tons per day design capacity, with silver recovery consistently surpassing 88%. MAG anticipates the production to steadily increase through the third quarter of 2023, when the plant will operate at full capacity.

MAG is focused on collaborating with Fresnillo to maximize value generation from Juanicipio, as they transition into full-scale operations with the aim of making Juanicipio a Tier-1 silver producer.

MAG intends to benefit from the combination of consistent, high-margin silver production and continuous high-grade exploration prospects.

MAG recorded income from Juanicipio of $7.9 million in the first quarter of 2023 compared with $13.7 million in the prior-year quarter. This included a 44% share of net income from the sale of pre-production development and stope material, as well as loan interest earned on mining assets brought into use.

In the first quarter of 2023, the company reported adjusted earnings per share of 5 cents for first-quarter 2023, missing the Zacks Consensus Estimate of earnings of 6 cents. The company reported earnings per share of 3 cents in the year-ago quarter. The net income for the quarter was $4.7 million compared with $2.7 million in the first quarter of 2022.

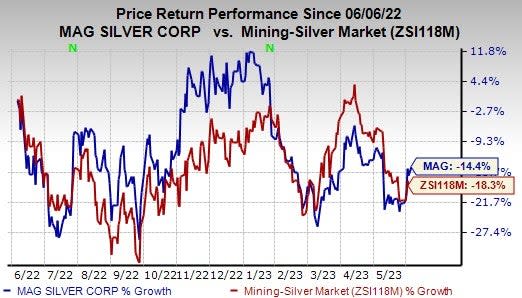

Price Performance

Shares of MAG Silver have lost 14.4% in the past year compared with the industry’s fall of 18.3%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Piedmont Lithium Inc. PLL and Gold Fields Limited GFI. PLL currently flaunts a Zacks Rank #1 (Strong Buy) and GFI carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Gold Fields’ fiscal 2023 earnings per share is pegged at $1.01. Earnings estimates have moved 6.3% north in the past 60 days. Its shares have gained 46.2% in the past year.

The Zacks Consensus Estimate for Piedmont Lithium’s earnings per share is pegged at $6.29 for 2023. Earnings estimates have been revised 62.9% upward in the past 60 days. PLL has gained 4.1% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Piedmont Lithium Inc. (PLL) : Free Stock Analysis Report

Gold Fields Limited (GFI) : Free Stock Analysis Report

Fresnillo PLC (FNLPF) : Free Stock Analysis Report

MAG Silver Corporation (MAG) : Free Stock Analysis Report