Magna (MGA) Tops Q2 Earnings Estimates, Lifts '23 Sales View

Magna International MGA reported second-quarter 2023 adjusted earnings of $1.50 per share, up 80.7% on a year-over-year basis. The bottom line also surpassed the Zacks Consensus Estimate of $1.25 a share. Better-than-expected revenues across all segments led to the outperformance. In the reported quarter, net sales increased 17% from the prior-year quarter to $10,982 million, surpassing the consensus mark of $10,198 million.

MGA currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

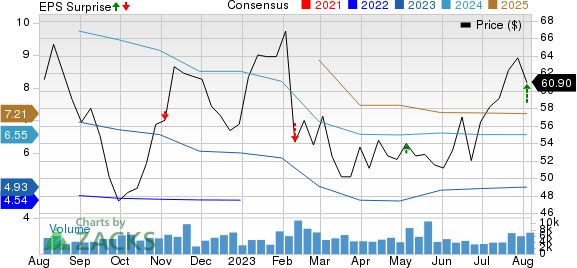

Magna International Inc. Price, Consensus and EPS Surprise

Magna International Inc. price-consensus-eps-surprise-chart | Magna International Inc. Quote

Segmental Performance

The Body Exteriors & Structures segment’s revenues in the reported quarter were $4,540 million, rising 15% year over year and topping our projection of $4,305 million on new business wins, high global light vehicle production and customer price increases. The segment reported an adjusted EBIT of $392 million, up from $191 million recorded in the year-ago period and beating our estimate of $262.1 million on better-than-expected sales and operational efficiency.

In the reported quarter, Power & Vision segment revenues increased 19.8% year over year to $3,462 million and outpaced our forecast of $3,313.1 million on new business wins, high global light vehicle production and customer price increases. The segmental EBIT soared from $91 million to $116 million. The metric, however, missed our estimate by $4 million. This can be attributed to higher-than-anticipated manufacturing and operating costs as well as adverse forex translations.

Revenues from the Seating Systems segment increased 28% year over year to $1,603 million in the reported quarter and crossed our expectation of $1,397.5 million on new business wins, high global light vehicle production and customer price increases. The segmental EBIT jumped from $2 million to $66 million and also breezed past our forecast of $24.1 million thanks to improved productivity and efficiency, including low costs at certain previously underperforming facilities.

The Complete Vehicles segment’s revenues increased 8.7% year over year to $1,526 million and outpaced our projection of $1,287 million on a favorable program mix. Adjusted EBIT, however, declined 46% year over year to $34 million and also lagged our estimate of $71.2 million owing to high engineering and other costs to launch a new assembly business.

Financials

Magna had $1,281 million in cash and cash equivalents as of Jun 30, 2023, up from $1,234 million in 2022-end. Long-term debt, as of Jun 30, 2023, was $4,159 million, up from $2,847 million in 2022-end. In the reported quarter, cash provided from operating activities totaled $547 million, up from the year-ago figure of $421 million.

The company declared a second-quarter dividend of 46 cents per common share, the same as the prior payout. The dividend will be paid on Sep 1, 2023, to shareholders on record as of the close of business on Aug 18, 2023.

Revised Guidance

Magna expects full-year 2023 revenues in the band of $41.9-$43.5 billion, up from the previous guidance of $40.2-$41.8 billion. Adjusted EBIT margin is forecast in the range of 4.8-5.2%, up from the previous guidance of 4.7-5.1%. Capex is now estimated at $2.5 billion, up from the prior projection of $2.4 billion.

Peer Releases

Autoliv Inc. ALV reported second-quarter 2023 adjusted earnings of $1.93 per share, beating the Zacks Consensus Estimate of $1.45 and rocketing 115% year over year. Higher-than-expected revenues from the Airbags and Associated Products segment led to the outperformance. The company reported net sales of $2,635 million in the quarter, which topped the Zacks Consensus Estimate of $2,508 million and soared 27% year over year.

Autoliv had cash and cash equivalents of $475 million as of Jun 30, 2023. Long-term debt totaled $1,290 million. Net capital expenditure jumped to $124 million, compared with $139 million during the corresponding period of 2022. At quarter-end, FCF was $255 million against a negative FCF of $190 million in the year-ago period.

Allison Transmission Holdings ALSN delivered second-quarter 2023 earnings of $1.92 per share, which rose 52% year over year and topped the Zacks Consensus Estimate of $1.61 on higher-than-expected sales from the North America On-Highway segment. Quarterly revenues of $783 million grew 18% from the year-ago period and beat the Zacks Consensus Estimate of $743 million.

Allison had cash and cash equivalents of $351 million on Jun 30, 2023, up from $232 million as of Dec 31, 2022. Long-term debt was $2,499 million compared with $2,501 million as of Dec 31, 2022. Net cash provided by operating activities increased to $141 million from $64 million in the same period in 2022. Adjusted FCF in the reported quarter was $122 million, an increase from $34 million a year ago.

BorgWarner BWA reported adjusted earnings of $1.35 per share for second-quarter 2023, up from $1.05 recorded in the prior-year quarter. The bottom line also outpaced the Zacks Consensus Estimate of $1.14 per share. The automotive equipment supplier reported net sales of $4,520 million, which surpassed the Zacks Consensus Estimate of $4,395 million. The top line also increased 20% year over year.

BorgWarner had $848 million in cash/cash equivalents/restricted cash at the quarter-end compared with $1,338 million as of Dec 31, 2022. Long-term debt was $4,191 million, up from $4,166 million recorded on Dec 31, 2022. Net cash provided in operating activities was $280 million in the quarter under review. Capital expenditures and FCF totaled $242 million and $38 million, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Autoliv, Inc. (ALV) : Free Stock Analysis Report

BorgWarner Inc. (BWA) : Free Stock Analysis Report

Magna International Inc. (MGA) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report