This Magnificent Dividend Stock Is Trading Close to a Once-in-a-Decade Valuation. Is It a Buy?

With artificial intelligence, gene-editing biotechnology, humanoid robots, and more, there are plenty of mind-blowing things to invest in these days. But boring businesses can make money for investors as well. And one of the most boring, surefire businesses out there is seasoning and spices giant McCormick & Company (NYSE: MKC).

McCormick reported financial results for its fiscal first quarter of 2024 on March 26, and the market responded enthusiastically. Therefore, the stock isn't quite as good a deal as it was just days ago. However, shares still trade near a once-in-a-decade valuation by one important metric.

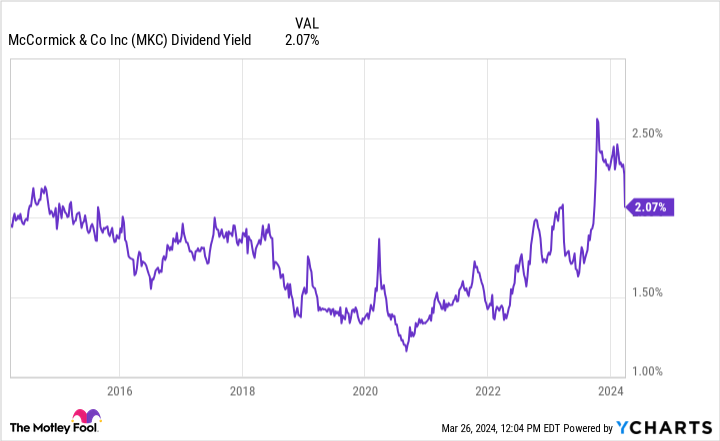

It is one of the best dividend stocks in the world (more on that in a moment). And as of this writing, its dividend yield is about 2%. This means that for every $1,000 investment, shareholders can expect $20 in annual income. As the chart below shows, the dividend yield has been above 2% for a few months now, which is the first time it's been this high in almost a decade.

Talking about its yield is appropriate because McCormick is a magnificent dividend stock. In November 2023, the company increased its quarterly payout, the 38th straight year that management has raised it. Few companies can match that streak.

When a dividend stock of McCormick's caliber trades at a rare valuation, it's worth examining whether it's a good investment. And as I'll explain, this could be a solid addition to a dividend portfolio right now.

What to know about McCormick's business

McCormick seemingly dominates shelf space at the grocery store with its variety of labels for seasonings and spices. The company owns its eponymous brands as well as others, such as Old Bay, French's, Frank's RedHot, and more. It owns other food brands as well, such as Zatarain's and Thai Kitchen.

Given the variety in its products and branding, the company is constantly experimenting. It launches new products with existing branding, acquires other brands, and even divests brands at times. This constant tinkering doesn't necessarily result in outsize revenue growth, but it often boosts profit margins when they're struggling.

As an example, net sales were only up 3% year over year in the first quarter. And sales volume was down, in part because it divested a small canning operation. But the company's operating margin improved from the prior-year period. And this led to a 19% increase in its diluted earnings per share (EPS).

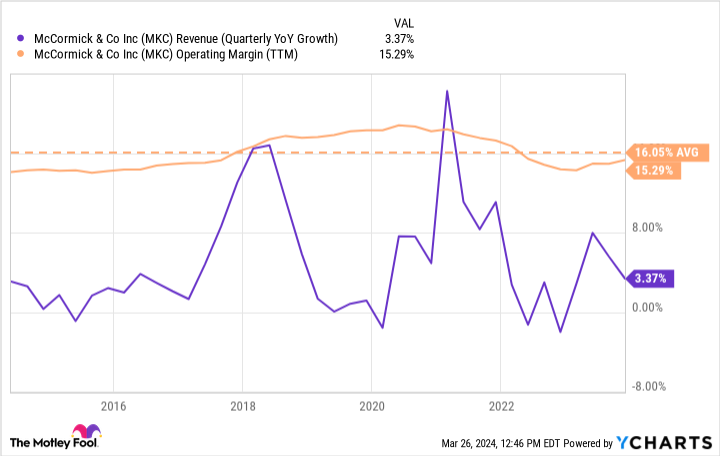

As the chart below shows, McCormick rarely has high revenue growth. But sales rarely take a step back. Moreover, its operating margin is fairly consistent and usually above 15%.

This is essentially the outlook for the rest of the year as well. Management expects modest sales growth, full-year operating income growth of 8% to 10%, and double-digit EPS growth as well.

That last point is important for dividend investors. As of this writing, McCormick is paying out around 60% of its earnings in dividends. That leaves room to increase the payout in future years. But ongoing double-digit EPS growth also supports further increases.

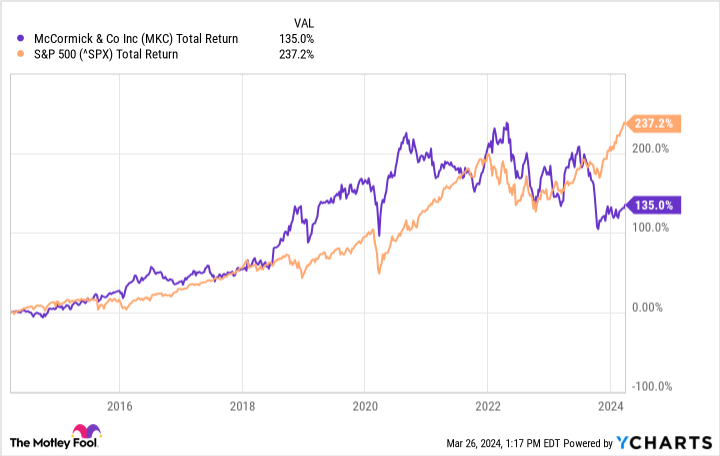

I'm not necessarily saying that McCormick stock has the highest upside. Over the last 10 years, it has underperformed the S&P 500, which is worth noting.

That said, McCormick sells products that are always in demand, which is reassuring. It also has a track record for churning out profits regardless of headwinds.

Management's priority for shareholders is the dividend, so I fully expect it to continue growing for years to come. And the company's ability to consistently increase its profits will provide the ability to continue doing just that.

Therefore, McCormick is a solid business and worth a spot in a portfolio. And with its dividend yield over 2%, it's one of the best times in the past decade to be a buyer.

Should you invest $1,000 in McCormick right now?

Before you buy stock in McCormick, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and McCormick wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool recommends McCormick. The Motley Fool has a disclosure policy.

This Magnificent Dividend Stock Is Trading Close to a Once-in-a-Decade Valuation. Is It a Buy? was originally published by The Motley Fool