The "Magnificent Seven" Stocks, Ranked From Best to Worst Performance Over Time

The S&P 500 roared higher over the past year or so from its bear market low to a new all-time high -- and this movement confirmed the market has indeed shifted into bull territory. The gains weren't exactly broad-based though. Stocks dubbed the "Magnificent Seven" -- a reference to the 1960 Western -- drove gains as they soared in the double or triple digits last year.

Of course, that's just a short-term increase. But these stocks have proven themselves over a longer period too. Let's take a look at the performance of each of these players over the past five years and see if they still represent compelling buy stories. Here they are, ranked from best to worst, according to performance.

1. Nvidia, up 1,950%

Nvidia's (NASDAQ: NVDA) earnings and share price growth truly took off thanks to its crucial role in the development of artificial intelligence (AI). The company's graphics processing units (GPUs) used to be best known for their role in gaming -- but the ability to rapidly process many tasks simultaneously made Nvidia's GPUs a perfect fit for AI.

Today, Nvidia holds about 80% of the AI chip market, and that's not likely to change as the company invests heavily to stay ahead of rivals. This tech giant just recently announced its new Blackwell architecture and most powerful chips ever, set for release later this year.

2. Tesla, up 881%

Tesla's (NASDAQ: TSLA) earnings and share price performance actually have slowed in recent times as various factors weigh on the electric vehicle giant -- from higher costs linked to production ramp-ups to negative foreign exchange impact.

But Tesla surged over the past five years as the company delivered more and more vehicles, opened major new factories, delivered record earnings, and built up more than $29 billion in cash. The cash level is particularly important because it will help this ambitious EV leader continue to innovate and potentially progress on programs such as self-driving technology.

So, Tesla's slowdown looks like a temporary situation, meaning growth probably isn't over for this market giant.

3. Apple, up 268%

Apple's (NASDAQ: AAPL) brand strength has helped it keep users coming back to world-famous products like the iPhone and Mac -- and even continue to attract new customers. This has made Apple the go-to stock for the technology investor seeking growth and safety. The company even won over billionaire investor Warren Buffett, who has almost half of his portfolio invested in the tech giant.

Some may worry that Apple's growth could plateau at a certain point, but one particular thing makes me confident that won't happen. The company's services -- sold to its growing user base -- have taken off, with services revenue reaching records. And this could drive a whole new era of growth for Apple.

4. Microsoft, up 260%

Microsoft (NASDAQ: MSFT), like Apple, is a classic tech company that's proven its strength over the long haul. But in recent times, Microsoft also has shown its ability to seize a growth opportunity. The company was an early believer in AI, investing $1 billion in OpenAI, the developer of chatbot ChatGPT, back in 2019.

The tech powerhouse later extended the partnership and increased its investment, a move that also strengthened the company's cloud business, Azure. This business offers a wide variety of AI tools and has seen its revenue growth soar, rising 30% in the most recent period -- surpassing that of rivals Amazon Web Services (AWS) and Google Cloud. Their revenue advanced 13% and 26%, respectively.

So, Microsoft clearly could be a winner in the potential AI revolution.

5. Meta Platforms, up 197%

Meta Platforms (NASDAQ: META) went through a period of cost cutting in recent times, but at the same time, CEO Mark Zuckerberg planned for the next step for this social media giant. And that's building up strengths in AI. The company has gone all in on that, developing its own large language model and aiming to apply AI across its products and services.

On top of that, Meta's dominance in social media is unwavering, a key point since it, through advertising, brings in most of the company's revenue. It's easy to imagine AI further boosting the company's social media platforms and driving more growth.

6. Alphabet, up 159%

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) has an extremely solid moat, or competitive advantage, in the business that brings in the lion's share of its revenue. And that's Google Search, which holds more than 90% of the global search market. This has kept advertisers coming back, even during recent times of higher inflation.

Today, Alphabet, like many of these Magnificent Seven companies, is investing in AI, and this technology is helping it to make search faster and better. This, along with AI offerings through Google Cloud, may power earnings growth in the coming years.

7. Amazon, up 103%

Amazon (NASDAQ: AMZN) climbed during the early days of the pandemic as customers flocked to e-commerce -- but a couple of years later, higher inflation weighed on Amazon's costs and the wallets of its customers. And that hurt stock performance, making Amazon the worst-performing of the Magnificent Seven over the past five years (though a 100% gain isn't something to frown about).

But the company revamped its cost structure and shifted from an annual loss in 2022 to solid profit in 2023, and the shares went on to gain. And this may continue thanks to Amazon's focus on AI. Amazon is using AI to improve its own operations and selling AI products and services through AWS, the world's cloud services leader.

Are the Magnificent Seven stocks buys today?

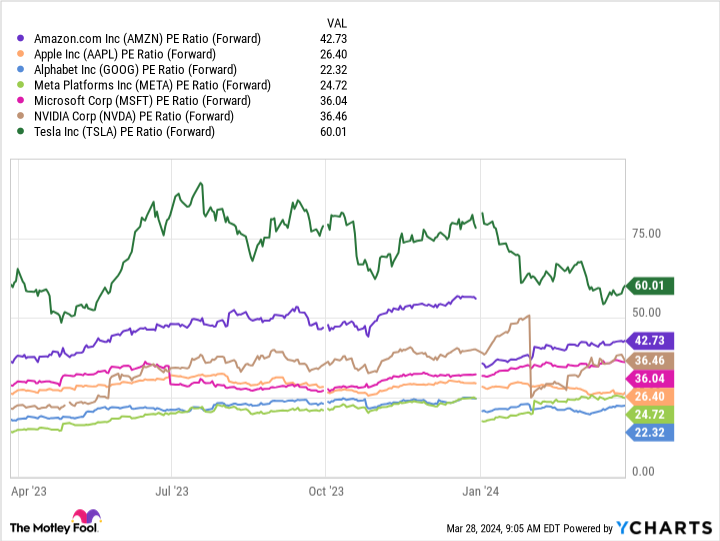

Now, let's get back to our question: Do these high-flying stocks still represent compelling buys? As you can see in the chart, they remain reasonably priced in relation to forward earnings estimates if you consider the long-term growth prospects of each of these players.

Tesla is the most expensive by this measure, but these figures consider potential earnings next year -- which is rather short term. The EV giant's moves today to lower the costs of producing its vehicles and incorporate AI in its processes could pay off over the coming years, making today's valuation look fair. Still, other players like Alphabet or Meta clearly are cheap and may represent an even better buying opportunity right now.

And here's one important thing to note: Some of these companies went through rough patches in recent times, yet they still managed to deliver big gains over a five-year period. This is a great example of the power of long-term investing, which implies holding on to a stock for at least five years.

All of this means it's not too late to get in on some or all of the Magnificent Seven, a group of quality stocks that could continue to deliver top returns over the long haul.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adria Cimino has positions in Amazon and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The "Magnificent Seven" Stocks, Ranked From Best to Worst Performance Over Time was originally published by The Motley Fool