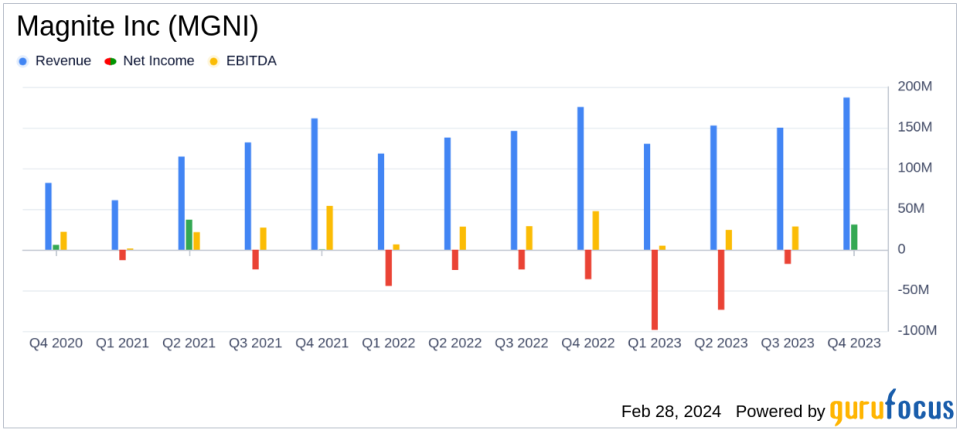

Magnite Inc (MGNI) Reports Solid Q4 and Full-Year 2023 Results with Revenue and EBITDA Growth

Revenue Growth: Q4 revenue increased by 7% year-over-year to $186.9 million.

Adjusted EBITDA Margin: Q4 Adjusted EBITDA margin expanded to 43%, up from 41% in Q4 2022.

Net Income: Q4 net income was $30.9 million, a significant improvement from a net loss of $36.4 million in Q4 2022.

CTV Ad Spend: Full-year CTV ad spend grew over 20%, signaling strong demand in this segment.

Contribution ex-TAC: Exceeded Q4 guidance with $165.3 million, up 6% from the prior year.

Free Cash Flow: Expecting higher growth in free cash flow for 2024.

On February 28, 2024, Magnite Inc (NASDAQ:MGNI), a leading provider of advertising technology, released its 8-K filing, disclosing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its supply-side platform services in online advertising, has shown resilience in a challenging ad spend environment, particularly in the Connected TV (CTV) and digital video (DV+) segments.

Magnite, which emerged from the merger of The Rubicon Project and Telaria and later acquired SpotX, has solidified its position in the CTV market. The company's focus on programmatic sales of CTV ad inventory, mobile online sites, apps, and computer-accessed websites has yielded a balanced revenue stream, with nearly 45% of its revenue coming from CTV.

The fourth quarter results were particularly noteworthy, with revenue climbing to $186.9 million, a 7% increase from the same period last year. The company's net income for the quarter was a robust $30.9 million, or $0.16 per diluted share, a stark contrast to the net loss of $36.4 million, or $0.27 per share, in Q4 2022. This turnaround is indicative of Magnite's operational efficiency and growing market demand for its services.

Adjusted EBITDA for the quarter stood at $70.4 million, representing a 43% margin, which is an improvement from the 41% margin in the previous year. This margin expansion reflects the company's ability to scale profitably. The Contribution ex-TAC, a key metric that excludes traffic acquisition costs, was $165.3 million for the quarter, surpassing the guidance and showing a 6% increase year-over-year.

Financial Highlights and Challenges

Despite the positive revenue and net income figures, the company faced a slight decline in CTV Contribution ex-TAC, which was down 2% year-over-year. However, the DV+ segment saw an 11% increase, which suggests a shift in the company's revenue mix. The full-year CTV ad spend growth of over 20% is significant, as it underscores the increasing shift of advertising dollars towards streaming platforms.

Looking ahead, Magnite has provided guidance for the first quarter of 2024, with Total Contribution ex-TAC expected to be between $122 and $126 million. Adjusted EBITDA operating expenses are projected to be between $106 and $108 million for Q1 2024, and between $101 and $103 million for Q2 2024. The company also anticipates a full-year 2024 Total Contribution ex-TAC growth of approximately 10%, with CTV growing faster than DV+, and an Adjusted EBITDA margin expansion of 100 basis points.

Michael G. Barrett, President and CEO of Magnite, commented on the results, stating,

We delivered a strong fourth quarter with CTV and DV+ revenue both exceeding the high end of our guidance ranges. We are even more encouraged to see improving top line trends to start 2024, particularly in CTV."

He also highlighted the company's strategic initiatives, including the launch of ClearLine, a direct buying solution for CTV inventory, and the expansion of relationships with leading streaming partners.

As Magnite continues to navigate the evolving ad tech landscape, its focus on CTV and programmatic advertising, along with strategic partnerships and product innovations, positions it well for sustained growth and profitability.

For a detailed analysis of Magnite Inc (NASDAQ:MGNI)'s financials and future expectations, investors and interested parties are encouraged to visit GuruFocus.com for comprehensive reports and investment tools.

Explore the complete 8-K earnings release (here) from Magnite Inc for further details.

This article first appeared on GuruFocus.