The Mahindra Logistics (NSE:MAHLOG) Share Price Is Up 11% And Shareholders Are Holding On

Passive investing in index funds can generate returns that roughly match the overall market. But investors can boost returns by picking market-beating companies to own shares in. To wit, the Mahindra Logistics Limited (NSE:MAHLOG) share price is 11% higher than it was a year ago, much better than the market return of around -2.5% (not including dividends) in the same period. So that should have shareholders smiling. Mahindra Logistics hasn't been listed for long, so it's still not clear if it is a long term winner.

View our latest analysis for Mahindra Logistics

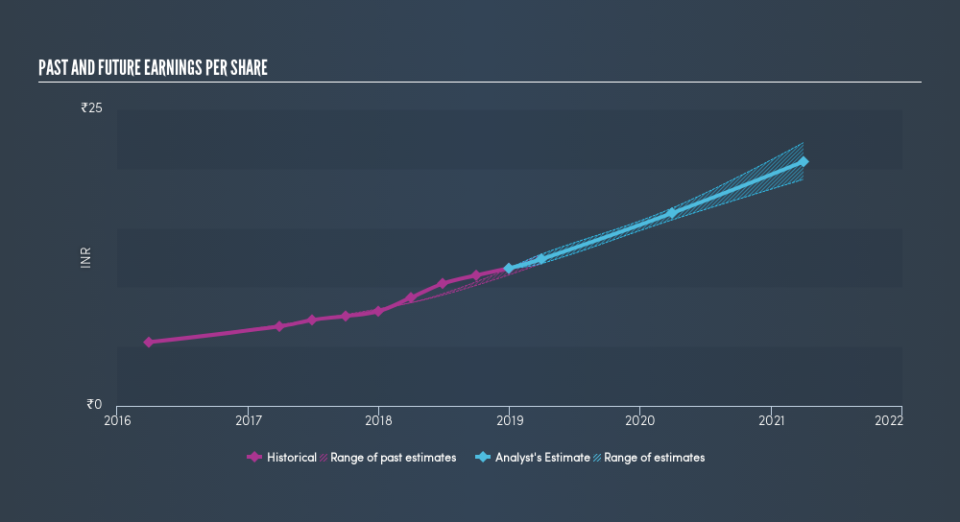

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Mahindra Logistics was able to grow EPS by 45% in the last twelve months. This EPS growth is significantly higher than the 11% increase in the share price. Therefore, it seems the market isn't as excited about Mahindra Logistics as it was before. This could be an opportunity.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Mahindra Logistics has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Mahindra Logistics will grow revenue in the future.

A Different Perspective

It's nice to see that Mahindra Logistics shareholders have gained 12% over the last year, including dividends. A substantial portion of that gain has come in the last three months, with the stock up 7.6% in that time. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

But note: Mahindra Logistics may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.