Main Street (MAIN) to Post Q3 Earnings: What's in Store?

Main Street Capital Corporation MAIN is slated to announce third-quarter 2023 results on Nov 2, after market close. The company’s net investment income per share and total investment income are expected to have increased year over year.

In the last reported quarter, net investment income per share matched the Zacks Consensus Estimate. Also, this reflected a rise of 41% from the year-ago quarter. Further, total investment income surged 50% to $127.6 million.

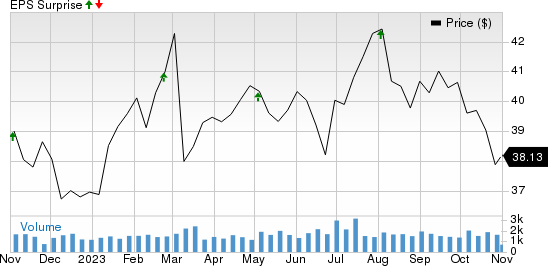

Over the trailing four quarters, Main Street’s earnings surpassed the consensus estimate on two occasions and matched twice, with the average surprise being 5.51%.

Main Street Capital Corporation Price and EPS Surprise

Main Street Capital Corporation price-eps-surprise | Main Street Capital Corporation Quote

The Zacks Consensus Estimate for Main Street’s third-quarter net investment income of $1.01 has increased 1% over the past 30 days. It indicates a rise of 21.7% from the prior-quarter year. Managements’ preliminary estimate for the metric is in the range of 98 cents to $1.00 per share.

The consensus estimate of $124.34 million for total investment income suggests a 26.4% increase.

Key Factors to Note

Main Street originated $107.3 million in new or increased commitments in its private loan portfolio during the third quarter. These investments were funded with a cost basis of $134.6 million. As of Sep 30, 2023, its private loan portfolio included total investments at a cost of around $1.6 billion. Hence, new and increased private loan commitments and investments during the quarter are anticipated to have aided the company’s top-line growth.

The Federal Reserve hiked rates by 25 basis points during the third quarter. With this, the policy rate now stands at a 22-year high of 5.25-5.5%. This is likely to have supported interest income for Main Street during the quarter.

The Zacks Consensus Estimate for interest, fee and dividend income from control investments is pegged at $47.4 million, implying a rise of 14.5% from the prior-year quarter. The consensus estimate for interest, fee and dividend income from affiliate investments is pegged at $19.9 million, indicating a 59.2% jump.

The Zacks Consensus Estimate for interest, fee and dividend income from non-control and non-affiliate investments is pegged at $57.9 million, suggesting an increase of 30% from the year-earlier quarter.

Further, per management, net unrealized appreciation and net impact of realizations from Main Street’s portfolio investments have led to a net increase in the fair value of the company’s investment portfolio. This increased net asset value (NAV) per share during the quarter. Management estimates NAV per share as of Sep 30, 2023, to be between $28.30 and $28.36.

Further, given these preliminary results, management estimates generating a quarterly annualized return on equity of 17-18% in the quarter.

Main Street has been witnessing a rise in total expenses for the past several quarters. Amid rising inflation, compensation expenses are anticipated to have led to elevated total expenditures during the quarter under review.

Earnings Whisper

The proven Zacks model does not conclusively predict an earnings beat for Main Street this time around. This is because Main Street does not have the right combination of two key ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or higher — for increasing the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Main Street is -0.50%.

Zacks Rank: Main Street carries a Zacks Rank #3.

Stocks That Warrant a Look

FS KKR Capital Corp. FSK and Runway Growth Finance Corp. RWAY are a couple of stocks that you may want to consider, as these have the right combination of elements to post an earnings beat in their upcoming releases.

The Earnings ESP for FSK is +1.83% and currently carries a Zacks Rank #2 (Buy). It is slated to report third-quarter 2023 results on Nov 6. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for FS KKR Capital’s third-quarter earnings has moved 1.3% north over the past month.

RWAY currently has an Earnings ESP of +2.67% and a Zacks Rank #3. It is scheduled to release third-quarter 2023 results on Nov 7.

The Zacks Consensus Estimate for Runway Growth Finance’s third-quarter earnings has remained unchanged over the past 30 days.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Main Street Capital Corporation (MAIN) : Free Stock Analysis Report

FS KKR Capital Corp. (FSK) : Free Stock Analysis Report

Runway Growth Finance Corp. (RWAY) : Free Stock Analysis Report