Mairs and Power Bolsters Position in Alliant Energy Corp with a 0.93% Portfolio Impact

Insight into Mairs and Power (Trades, Portfolio)'s Q3 2023 Investment Moves and Portfolio Adjustments

With a storied history dating back to 1931, Mairs and Power (Trades, Portfolio) is a Minnesota-based investment firm known for its disciplined long-term investment approach. The firm manages three mutual fundsthe Growth Fund, the Balanced Fund, and the Small-Cap Fundeach reflecting a commitment to above-average growth, strong returns on invested capital, and durable competitive advantages. Mairs and Power (Trades, Portfolio)'s low turnover strategy and focus on less efficient market areas distinguish it from the short-term focus prevalent among many active managers and hedge funds.

New Additions to the Portfolio

Mairs and Power (Trades, Portfolio) has expanded its portfolio with nine new stock additions in the third quarter of 2023. Noteworthy new investments include:

BlackRock Inc (NYSE:BLK), with 380 shares valued at $262.63 million.

Cardinal Health Inc (NYSE:CAH), comprising 2,238 shares with a total value of $211,650.

Chipotle Mexican Grill Inc (NYSE:CMG), adding 100 shares valued at $213,900.

Significant Position Increases

The firm has also increased its stakes in 50 stocks. Key position increases are highlighted below:

Alliant Energy Corp (NASDAQ:LNT) saw an additional 1,629,634 shares, bringing the total to 2,717,431 shares. This 149.81% increase in share count had a 0.93% impact on the portfolio, with a total value of $142,610,780.

JPMorgan Chase & Co (NYSE:JPM) received an additional 362,609 shares, resulting in a total of 1,648,888 shares. This 28.19% increase in share count has a total value of $239,814,270.

Complete Exits from Holdings

In the third quarter of 2023, Mairs and Power (Trades, Portfolio) exited 19 positions entirely, including:

Envestnet Inc (NYSE:ENV), selling all 49,786 shares, impacting the portfolio by -0.03%.

PolyMet Mining Corp (PLM), liquidating all 54,000 shares, with a negligible impact on the portfolio.

Key Position Reductions

Position reductions were made in 123 stocks. The most significant reductions were:

NVIDIA Corp (NASDAQ:NVDA) was reduced by 208,668 shares, a -18.32% decrease, impacting the portfolio by -0.67%. The stock traded at an average price of $331.15 during the quarter and has returned 12.92% over the past three months and 238.17% year-to-date.

Alphabet Inc (NASDAQ:GOOG) was reduced by 475,328 shares, a -12.07% decrease, impacting the portfolio by -0.57%. The stock traded at an average price of $115.57 during the quarter and has returned 3.55% over the past three months and 53.85% year-to-date.

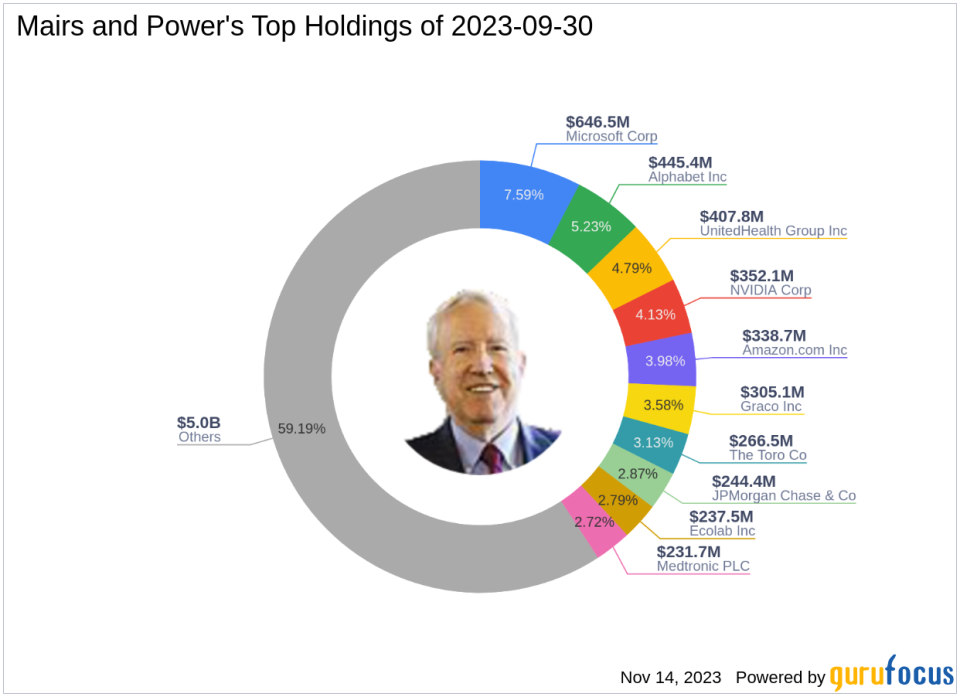

Portfolio Overview

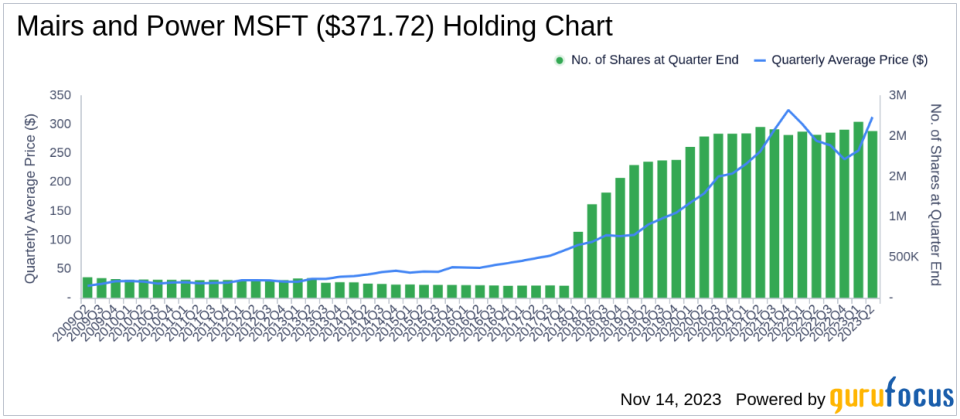

As of the third quarter of 2023, Mairs and Power (Trades, Portfolio)'s portfolio consisted of 215 stocks. The top holdings included 7.64% in Microsoft Corp (NASDAQ:MSFT), 4.56% in Alphabet Inc (NASDAQ:GOOG), 4.28% in NVIDIA Corp (NASDAQ:NVDA), 4.11% in UnitedHealth Group Inc (NYSE:UNH), and 3.92% in Graco Inc (NYSE:GGG). The firm's investments are primarily concentrated in the technology sector, reflecting a strategic focus on innovation and growth potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.