Is MakeMyTrip (MMYT) Too Good to Be True? A Comprehensive Analysis of a Potential Value Trap

Value-focused investors are constantly in search of stocks that are priced below their intrinsic value. One such stock that deserves attention is MakeMyTrip Ltd (NASDAQ:MMYT). The stock, currently priced at $38.88, recorded a loss of 1.71% in a day, and a 3-month increase of 39.19%. The stock's fair valuation is $55.64, as indicated by its GF Value.

Understanding GF Value

The GF Value represents the current intrinsic value of a stock derived from our exclusive method. The GF Value Line on our summary page provides an overview of the fair value at which the stock should be traded. It is calculated based on three factors: Historical multiples (PE Ratio, PS Ratio, PB Ratio and Price-to-Free-Cash-Flow) that the stock has traded at, GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of the business performance.

However, investors should consider a more in-depth analysis before making an investment decision. Despite its seemingly attractive valuation, certain risk factors associated with MakeMyTrip should not be overlooked. These risks are primarily reflected through its low Piotroski F-score and Beneish M-score. Furthermore, the company's revenues and earnings have been on a downward trend over the past five years, which raises a crucial question: Is MakeMyTrip a hidden gem or a value trap?

Company Snapshot

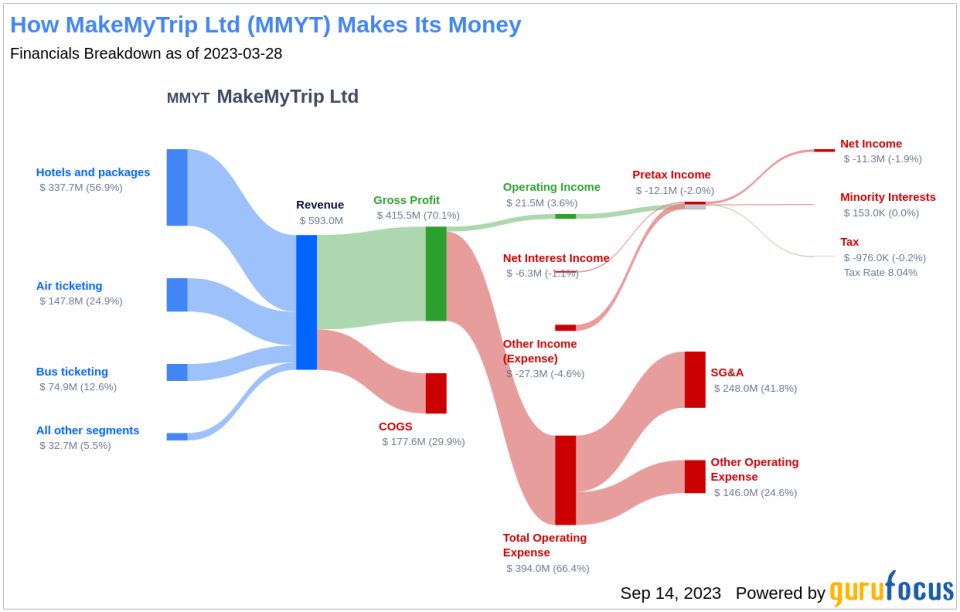

MakeMyTrip Ltd is an online travel company, providing online booking solutions for day-to-day travel needs. The company's operating segments include Air ticketing, Hotels and packages, Bus ticketing and Others. It generates maximum revenue from the Hotels and packages segment. The Hotels and packages segments include internet-based platforms, call-centers, and branch offices, which provide holiday packages and hotel reservations. Its Air ticketing segment includes internet-based platforms, provides the facility to book domestic and international air tickets. Geographically, it derives a majority of revenue from India and also has a presence in the United States; South East Asia; Europe, and other countries.

Bearish Signs: Declining Revenues and Earnings

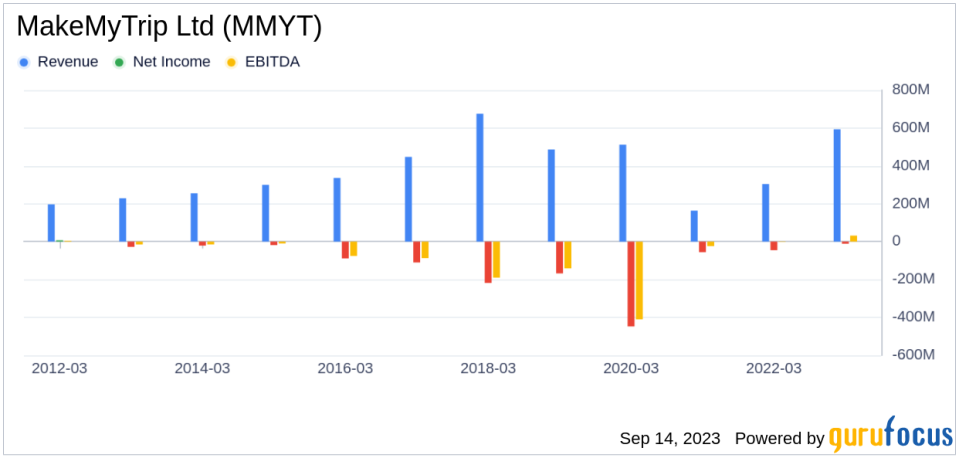

In the case of MakeMyTrip, both the revenue per share (evident from the last five years' TTM data: 2019: 4.69; 2020: 3.57; 2021: 1.77; 2022: 3.80; 2023: 5.84) and the 5-year revenue growth rate (-10.2%) have been on a consistent downward trajectory. This pattern may suggest underlying challenges such as diminishing demand for MakeMyTrip's products, or escalating competition in its market sector. Either scenario can pose serious risks to the company's future performance, warranting a thorough analysis by investors.

The Red Flag: Sluggish Earnings Growth

Despite its low price-to-fair-value ratio, MakeMyTrip's falling revenues and earnings cast a long shadow over its investment attractiveness. A low price relative to intrinsic value can indeed suggest an investment opportunity, but only if the company's fundamentals are sound or improving. In MakeMyTrip's case, the declining revenues, EBITDA, and earnings growth suggest that the company's issues may be more than just cyclical fluctuations.

Without a clear turnaround strategy, there's a risk that the company's performance could continue to deteriorate, leading to further price declines. In such a scenario, the low price-to-GF-Value ratio may be more indicative of a value trap than a value opportunity.

Conclusion

Given the declining revenues and earnings, coupled with the low Piotroski F-score and Beneish M-score, MakeMyTrip appears to be more of a value trap than a hidden gem. Investors should exercise caution, and thorough due diligence is advised before making an investment decision. Investors seeking stocks with good revenue and earnings growth may find GuruFocus' Peter Lynch Growth with Low Valuation Screener beneficial.

This article first appeared on GuruFocus.