What Makes Taiwan Semiconductor Manufacturing Company Limited (TSM) an Attractive Investment?

Wedgewood Partners, an investment management company, released its “Large Cap Focused Growth Fund” third-quarter 2022 investor letter. A copy of the same can be downloaded here. In the third quarter, the fund returned -4.1% net, compared to a -4.9% return for the Standard & Poor’s Index. In addition, you can check the top 5 holdings of the fund to know its best picks in 2022.

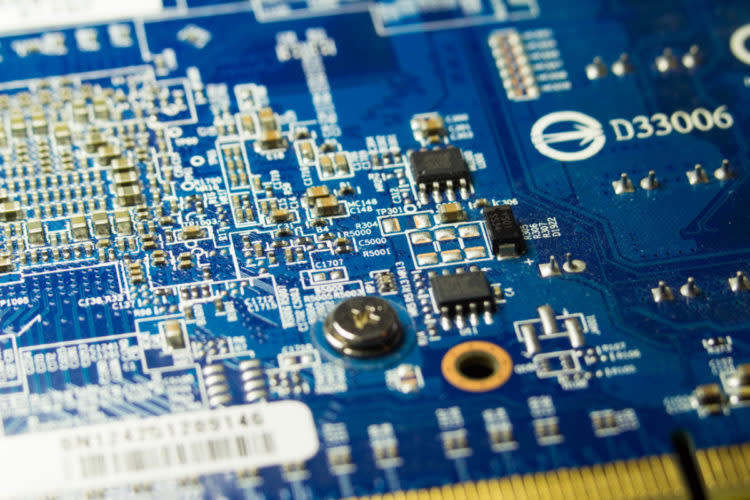

Wedgewood Partners discussed stocks like Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) in the Q3 2022 investor letter. Headquartered in Hsinchu City, Taiwan, Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) engages in the business of integrated circuits and other semiconductor devices. On October 13, 2022, Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) stock closed at $66.62 per share. One-month return of Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) was -14.47% and its shares lost 42.00% of their value over the last 52 weeks. Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) has a market capitalization of $343.502 billion.

Here is what Wedgewood Partners specifically said about Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) in its Q3 2022 investor letter:

"Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) detracted from performance despite business performance that saw revenue growth accelerate to over +40% growth (in TWD) and lapped +20% revenue growth from a year ago. The Company is one of the few fabs in the world that is capable of manufacturing leading-edge integrated circuits (IC). TSM’s leading edge capacity is being absorbed by high-performance computing applications, particularly in the case of Apple, which has become an IC powerhouse over the past decade. The Company’s aggressive investment in leading-edge equipment, tight development with fabless IC designers and embrace of open development libraries, should continue to foster a superior competitive position and attractive long-term growth."

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 72 hedge fund portfolios held Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) at the end of the second quarter which was 81 in the previous quarter.

We discussed Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) in another article and shared the best big tech stocks to buy. In addition, please check out our hedge fund investor letters Q3 2022 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

Disclosure: None. This article is originally published at Insider Monkey.