Mammoth Energy Services Inc (TUSK) Reports Mixed Financial Results Amidst Operational Challenges

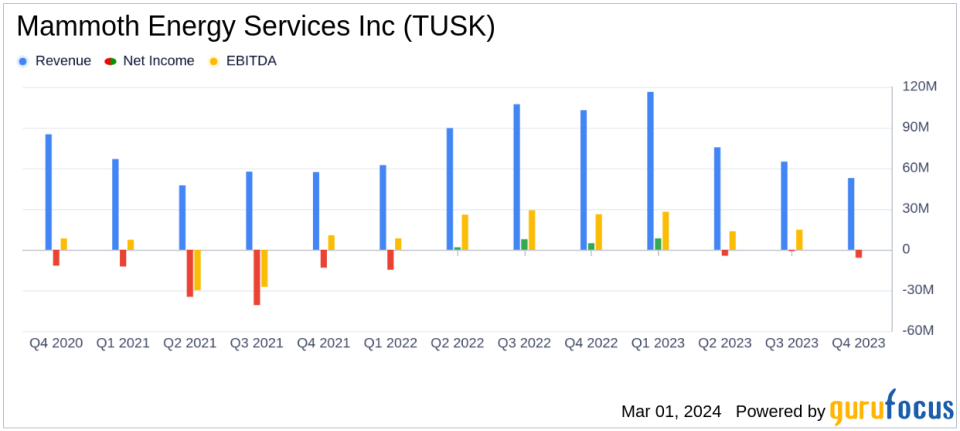

Revenue: Full-year revenue decreased by 15% to $309.5 million in 2023 from $362.1 million in 2022.

Net Loss: Reported a net loss of $3.2 million for the full year of 2023, compared to a net loss of $0.6 million in 2022.

Adjusted EBITDA: Adjusted EBITDA for 2023 was $71.0 million, down from $86.1 million in the previous year.

Liquidity: Total liquidity stood at $37.3 million as of December 31, 2023, bolstered by payments from PREPA.

Capital Expenditures: Capital expenditures totaled $19.4 million for the full year of 2023.

Operational Highlights: Well completion services and natural sand proppant services saw a decrease in revenue and stages completed.

Mammoth Energy Services Inc (NASDAQ:TUSK) released its 8-K filing on March 1, 2024, detailing its fourth quarter and full year 2023 financial and operational results. The company, an integrated energy services provider, faced a challenging year with a 15% decrease in annual revenue and a net loss, attributed to deferred activities by exploration and production companies, commodity price fluctuations, and customer budget exhaustion.

Financial Performance Overview

The company's total revenue for the fourth quarter of 2023 was $52.8 million, a significant drop from $102.9 million in the same quarter of the previous year. The full-year revenue also saw a decline to $309.5 million in 2023 from $362.1 million in 2022. The net loss for the fourth quarter was $6.0 million, compared to a net income of $4.8 million in the fourth quarter of 2022. The full-year net loss amounted to $3.2 million in 2023, deepening from a net loss of $0.6 million in 2022. Adjusted EBITDA for the fourth quarter was $10.5 million, down from $24.1 million in the same period last year, and $71.0 million for the full year, compared to $86.1 million in 2022.

Operational Challenges and Achievements

Arty Straehla, CEO of Mammoth, acknowledged the operational difficulties faced in the fourth quarter, citing industry-wide challenges. Despite this, the company achieved several milestones, including a significant debt refinancing transaction and the receipt of payments from the Puerto Rico Electric Power Authority (PREPA) for outstanding receivables. These payments have improved the company's liquidity and allowed for investment back into the business.

"We exited 2023 with a strong balance sheet and a secure financing structure that positions Mammoth for future growth," said Straehla.

Segment Performance

The well completion services division's revenue decreased to $16.1 million in the fourth quarter from $51.4 million in the same quarter of 2022. The infrastructure services division reported a slight decrease in revenue to $27.2 million in the fourth quarter, compared to $29.6 million in the same period last year. The natural sand proppant services division saw a decrease in revenue to $4.5 million in the fourth quarter from $13.8 million in the same quarter of 2022. Drilling services and other services also reported declines in revenue.

Liquidity and Capital Expenditures

As of December 31, 2023, Mammoth had cash on hand of $16.6 million and total liquidity of $37.3 million. The company's capital expenditures for the full year of 2023 were $19.4 million, with the majority allocated to well completion services.

Looking Forward

Mammoth Energy Services Inc (NASDAQ:TUSK) is optimistic about 2024, with an improving outlook in its infrastructure and sand divisions and plans to be opportunistic in its well completions business. The company's focus on safety and high-quality standards, along with its strengthened balance sheet, positions it for potential growth in the coming year.

For more detailed information on Mammoth Energy Services Inc (NASDAQ:TUSK)'s financial results, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Mammoth Energy Services Inc for further details.

This article first appeared on GuruFocus.