Manitowoc Co Inc (MTW) Reports Mixed 2023 Results; Provides 2024 Guidance

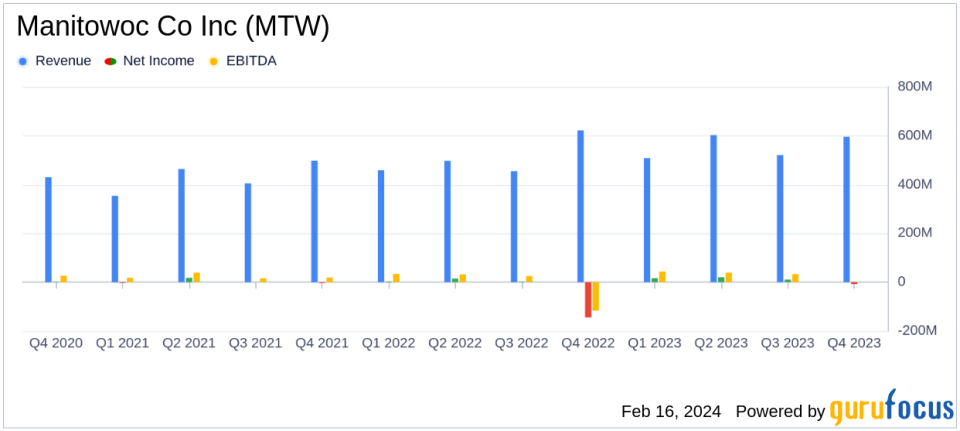

Net Sales: Full-year net sales rose 9.6% to $2.23 billion, Q4 sales down 4.2% to $595.8 million.

Adjusted EBITDA: Full-year adjusted EBITDA increased to $175.3 million, Q4 adjusted EBITDA fell 29.1% to $36.5 million.

Net Income: Full-year adjusted net income per share grew to $1.52, Q4 adjusted net loss of $0.23 per diluted share.

Free Cash Flow: Q4 free cash flow decreased to $22.3 million, reflecting a $27.9 million drop from the prior year.

Backlog: Ended Q4 at $917.2 million, with foreign currency exchange rates contributing favorably.

2024 Guidance: Projects net sales between $2.275 billion and $2.375 billion, with adjusted EBITDA of $150 million to $180 million.

On February 15, 2024, Manitowoc Co Inc (NYSE:MTW) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, a leading provider of engineered lifting solutions, reported a mixed set of results with full-year net sales increasing by 9.6% to $2.23 billion, while fourth-quarter sales saw a decline of 4.2% to $595.8 million.

Manitowoc operates through three segments: the Americas, Europe and Africa, and the Middle East and Asia-Pacific, with the Americas being the largest revenue contributor. The company's portfolio includes mobile telescopic cranes, tower cranes, lattice-boom crawler cranes, and boom trucks, marketed under brands like Grove, Manitowoc, and National Crane.

The full-year adjusted EBITDA margin was 7.9%, with a reported value of $175.3 million, while the fourth-quarter adjusted EBITDA margin was 6.1%, totaling $36.5 milliona 29.1% decrease from the previous year. The company's adjusted net income per share for the full year was $1.52, an increase from the prior year, but the fourth quarter saw a net loss of $7.9 million, or $0.23 per diluted share.

President and CEO Aaron H. Ravenscroft commented on the results, stating,

I am pleased with the overall performance in 2023 where we delivered strong financial results and continued to execute on our CRANES+50 strategy. We increased our adjusted EBITDA 22.5% year-over-year, and we grew our non-new machine sales 12.4%,"

indicating a strategic focus beyond just new machine sales.

Despite the positive full-year figures, the fourth quarter presented challenges, with a significant decrease in orders and free cash flow. Orders in Q4 totaled $475.7 million, a 32.8% decrease from the prior year, and free cash flow dropped to $22.3 million, a $27.9 million decrease from the previous year. The company's backlog, however, remained strong at $917.2 million, ending the quarter with a favorable impact from foreign currency exchange rates.

Looking ahead, Manitowoc provided guidance for the full year of 2024, anticipating net sales between $2.275 billion and $2.375 billion, and adjusted EBITDA between $150 million and $180 million. The company expects the global demand for mobile cranes to remain robust, while the European tower crane market may present challenges.

Manitowoc's balance sheet reflects a solid financial position, with total assets of $1.71 billion as of December 31, 2023. The company's cash and cash equivalents stood at $34.4 million, a decrease from $64.4 million at the end of the previous year. Total liabilities and stockholders' equity matched the asset figures, indicating a balanced financial structure.

In conclusion, Manitowoc's 2023 performance showcased resilience and strategic growth in certain areas, despite a challenging fourth quarter. The company's forward-looking statements suggest cautious optimism for 2024, with a strong backlog and strategic initiatives expected to drive performance in a dynamic market environment.

For more detailed financial analysis and news on Manitowoc Co Inc (NYSE:MTW) and other value investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Manitowoc Co Inc for further details.

This article first appeared on GuruFocus.