ManpowerGroup Inc (MAN) Faces Headwinds: Q4 Earnings Reveal Challenges and Resilience

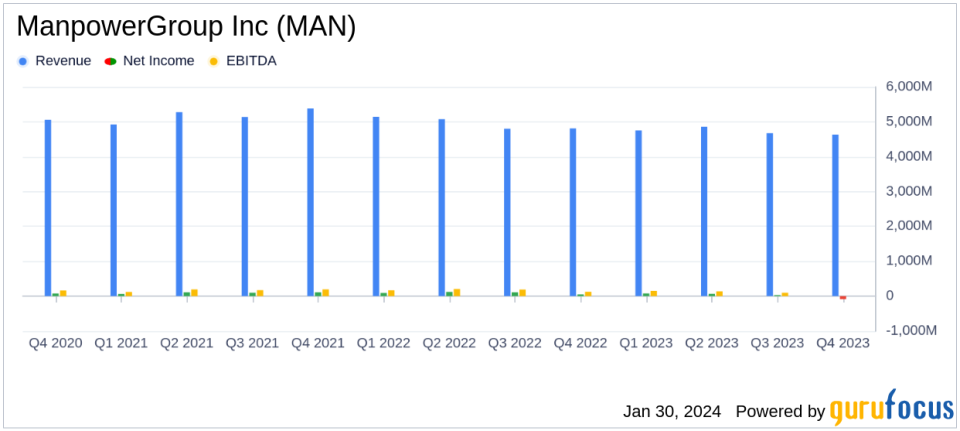

Revenue: $4.6 billion, a decrease of 4% as reported and 5% in constant currency.

Net Loss: Reported a net loss of $84.5 million, or $1.73 per diluted share.

Gross Profit Margin: Held steady at 17.5%, despite challenging conditions.

Restructuring and Impairment Charges: Took a non-cash goodwill impairment charge of $55 million and restructuring charges of $90 million.

Stock Repurchase: Repurchased $50 million of common stock during the quarter.

Outlook: Anticipates diluted earnings per share in Q1 to be between $0.88 and $0.98, excluding certain costs and impacts.

On January 30, 2024, ManpowerGroup Inc (NYSE:MAN) released its 8-K filing, revealing the financial results for the fourth quarter of 2023. The company, a global leader in workforce solutions, reported revenues of $4.6 billion, marking a 4% decrease from the previous year. This decline was slightly sharper on a constant currency basis, with a 5% drop, reflecting ongoing challenges in North America and Europe, although there was solid demand in Latin America and the Asia Pacific Middle East (APME) region.

Despite the revenue decline, ManpowerGroup's gross profit margin remained resilient at 17.5%. However, the company faced a net loss of $84.5 million, or $1.73 per diluted share, a stark contrast to the net earnings of $48.7 million, or $0.95 per diluted share, in the same quarter of the previous year. This loss includes significant restructuring costs and non-cash charges such as goodwill impairment, pension settlements, and currency translation losses related to Argentina's economic volatility.

Financial Performance and Strategic Actions

ManpowerGroup's Chairman & CEO, Jonas Prising, commented on the results, emphasizing the challenging operating environment in key markets but also highlighting solid demand in other regions. Prising noted the company's progress on its Diversification, Digitization, and Innovation agenda and significant actions taken to improve business resilience. He expressed confidence in the company's ability to navigate such environments and prepare for future profitable growth.

"Our fourth quarter and full year results reflect a challenging operating environment in North America and Europe, while we continued to see solid demand across Latin America and Asia Pacific Middle East. During 2023, we progressed our Diversification, Digitization and Innovation agenda and took significant actions to improve our business for todays environment and into the future," said Jonas Prising.

ManpowerGroup's performance in the fourth quarter was also impacted by the stronger U.S. dollar, which affected earnings per share by 1 cent more favorably than anticipated in their guidance. When excluding the restructuring costs and other special items, earnings per share for the quarter would have been $1.45, representing a 30% decrease in constant currency from the previous year.

Annual Performance and Future Outlook

For the full year ended December 31, 2023, ManpowerGroup reported net earnings of $88.8 million, or $1.76 per diluted share, compared to $373.8 million, or $7.08 per diluted share, in the prior year. The full-year results were similarly affected by restructuring costs and other non-cash charges, which reduced earnings per share by $4.28. Excluding these charges, earnings per share for the year would have been $6.04, a decrease of 28% in constant currency.

Looking ahead, the company anticipates diluted earnings per share for the first quarter of 2024 to be between $0.88 and $0.98. This guidance includes an estimated unfavorable currency impact of 2 cents and excludes unfavorable operating losses estimated at 14 cents for the run-off of the Proservia business in Germany, as well as any potential restructuring costs and Argentina-related currency translation losses.

ManpowerGroup's earnings report underscores the company's resilience in the face of a challenging global environment. While the company navigates through headwinds, including currency fluctuations and regional market difficulties, its strategic actions and confidence in future growth prospects signal a commitment to long-term success. Investors and stakeholders will be watching closely to see how ManpowerGroup's diversification and innovation strategies unfold in the coming quarters.

For more detailed information, investors are encouraged to review the full earnings release and financial statements available on the ManpowerGroup website.

Explore the complete 8-K earnings release (here) from ManpowerGroup Inc for further details.

This article first appeared on GuruFocus.