Mantle Ridge LP Reduces Stake in Aramark

On August 9, 2023, investment firm Mantle Ridge LP (Trades, Portfolio) significantly reduced its holdings in Aramark (NYSE:ARMK), a leading provider of food, facilities, and uniform services. This article will delve into the details of the transaction, provide an overview of Mantle Ridge LP (Trades, Portfolio) and Aramark, and analyze the potential implications of this move on the market.

Transaction Details

Mantle Ridge LP (Trades, Portfolio) sold 13,022,498 shares of Aramark at a price of $41.42 per share. This move resulted in a 50.70% reduction in the firm's holdings, leaving it with a total of 12,660,895 shares. The transaction had a significant impact on Mantle Ridge LP (Trades, Portfolio)'s portfolio, reducing its position by 31.21%. Despite this, Aramark still constitutes a substantial 44.11% of the firm's portfolio, and Mantle Ridge LP (Trades, Portfolio) remains a significant shareholder with 4.80% of Aramark's total shares.

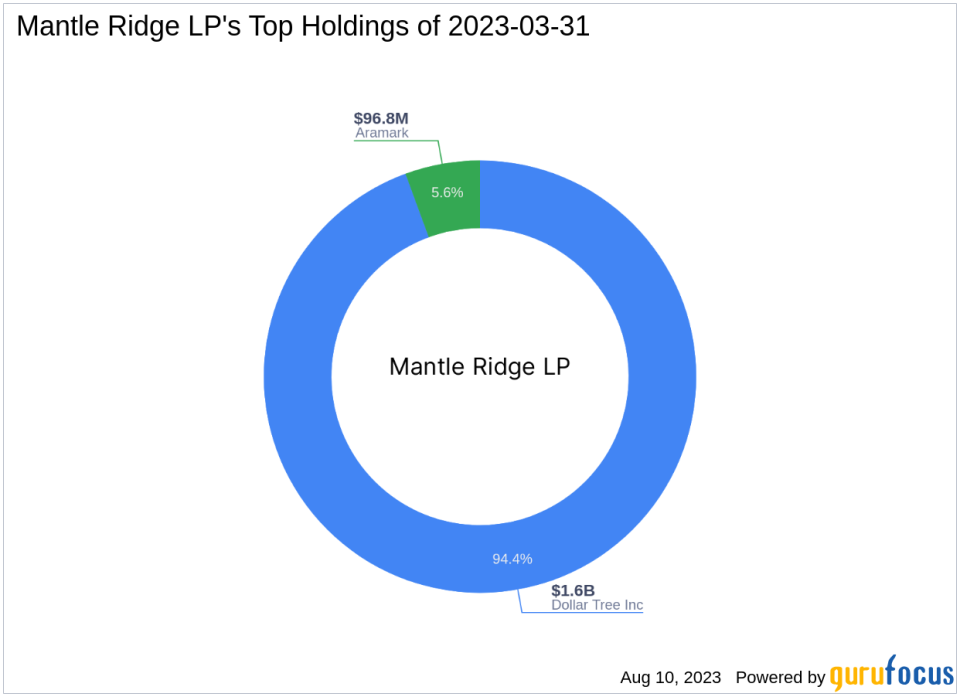

Profile of Mantle Ridge LP (Trades, Portfolio)

Mantle Ridge LP (Trades, Portfolio) is a New York-based investment firm with a focus on the Consumer Defensive and Industrials sectors. The firm currently holds two stocks in its portfolio, with a total equity of $1.73 billion. Its top holdings include Dollar Tree Inc (NASDAQ:DLTR) and Aramark (NYSE:ARMK).

About Aramark

Aramark, listed under the symbol ARMK, is a US-based company that provides food, facilities, and uniform services to a variety of clients and institutions. The company, which went public on December 12, 2013, operates in several segments including Food and Support Services (FSS) International, Food and Support Services (FSS) United States, Uniform, and Corporate. As of August 10, 2023, Aramark has a market capitalization of $10.36 billion and a PE ratio of 19.17. The company's stock is currently priced at $39.69, which is modestly undervalued according to GuruFocus's GF Value of $48.59.

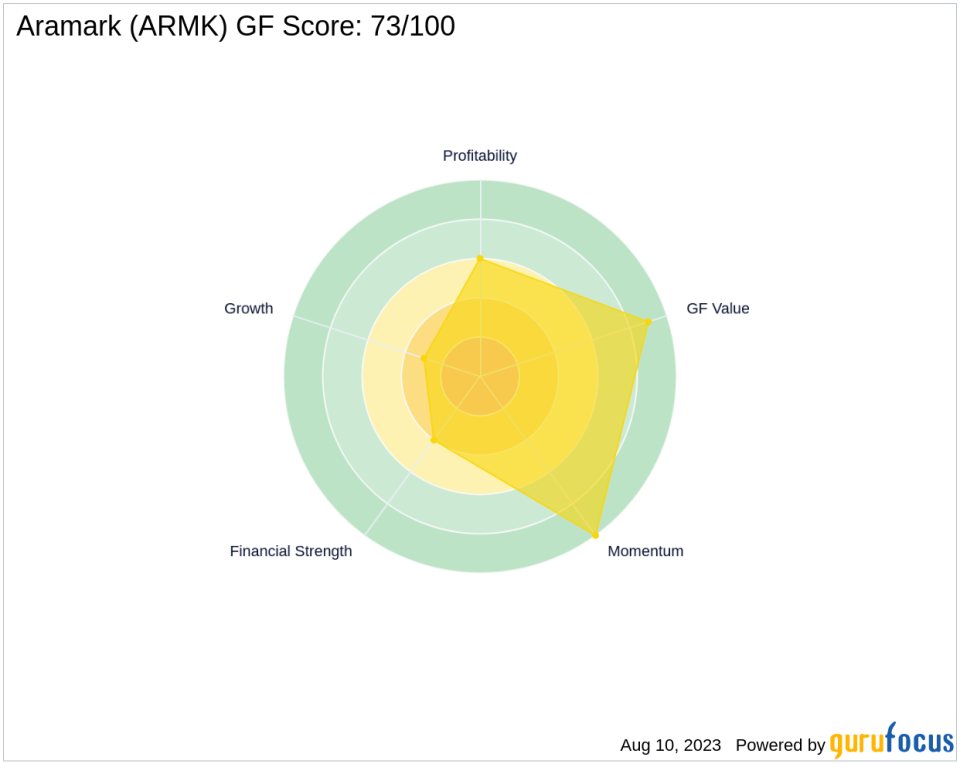

Aramark's Stock Performance and Valuation

Since its IPO, Aramark's stock has seen a 96% increase in value. However, the stock has experienced a 4.18% decrease since the transaction and a 4.13% decrease year-to-date. Aramark's GF Score is 73/100, indicating a good outperformance potential. The company's Financial Strength is ranked 4/10, its Profitability Rank is 6/10, and its Growth Rank is 3/10. Aramark's GF Value Rank is 9/10, and its Momentum Rank is 10/10.

Aramark's Financial Health and Industry Position

Aramark's financial health is characterized by a cash to debt ratio of 0.04 and an interest coverage of 1.80. The company's ROE and ROA are 8.12 and 1.63, respectively. Aramark operates in the Business Services industry and has seen a -5.20% gross margin growth and a 0.00% operating margin growth over the past three years.

Other Gurus' Involvement

Other notable gurus who hold Aramark stock include George Soros (Trades, Portfolio), Jefferies Group (Trades, Portfolio), and First Eagle Investment (Trades, Portfolio). The largest guru holder of Aramark stock is Barrow, Hanley, Mewhinney & Strauss.

Conclusion

Mantle Ridge LP (Trades, Portfolio)'s decision to reduce its stake in Aramark is a significant move that could have implications for both the firm and the market. Despite the reduction, Aramark remains a major part of Mantle Ridge LP (Trades, Portfolio)'s portfolio, and the firm continues to be a significant shareholder in Aramark. As of August 10, 2023, Aramark's stock is modestly undervalued, and the company has a good outperformance potential according to its GF Score. Investors should keep a close eye on Aramark's performance in the coming months.

This article first appeared on GuruFocus.