Manulife (MFC) Q4 Earnings Surpass Estimates, Increase Y/Y

Manulife Financial Corporation MFC delivered fourth-quarter 2023 core earnings of 68 cents per share, which beat the Zacks Consensus Estimate by 7.9%. The bottom line increased 4.6% year over year.

Core earnings of $1.3 billion (C$1.7 billion) remained unchanged year over year.

The results reflected a rise in average AUMA and fee spreads, growth in Hong Kong, higher yields, improved insurance experience and increased sales in the Asia, Canada and U.S. segments.

New business value (NBV) in the reported quarter was $463 million (C$630 million), up 59.5% year over year.

Annualized premium equivalent (APE) sales increased 22% year over year to $1.1 billion (C$1.5 billion), attributable to higher sales in the Asia, Canada and U.S. segments.

Wealth and asset management assets under management and administration were $600 billion (C$817 billion), up 4.2% year over year. The Wealth and Asset Management business generated net outflows of $0.9 billion (C$1.3 billion) compared with net outflows of $8.4 billion in the year-ago quarter.

Core return on equity, measuring the company’s profitability, expanded 230 basis points year over year to 16.4%.

The Life Insurance Capital Adequacy Test ratio was 137% as of Dec 31, 2023.

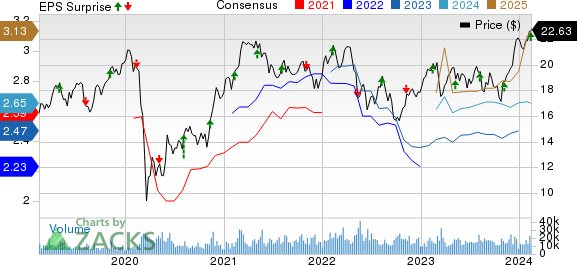

Manulife Financial Corp Price, Consensus and EPS Surprise

Manulife Financial Corp price-consensus-eps-surprise-chart | Manulife Financial Corp Quote

Segmental Performance

Global Wealth and Asset Management division’s core earnings were $259 million (C$ 353 million), up 31.5% year over year owing to higher average AUMA and fee spreads, benefiting from favorable market impacts.

Asia division’s core earnings totaled $414 million, up 14% year over year, driven by higher net insurance results reflected by the net impact of updates to actuarial methods and assumptions, along with higher interest rates and business growth. In Asia, NBV rose 5% year over year.

APE sales increased 11%, primarily driven by strong growth in Hong Kong due to a return of demand from MCV customers.

Manulife Financial’s Canada division’s core earnings of $258 million (C$352 million) remained unchanged year over year. In Canada, NBV increased 60% year over year.

APE sales jumped 44% year over year, primarily due to higher large-case and mid-size sales in Group Insurance and improved fixed annuity sales, partially offset by lower travel sales.

The U.S. division reported core earnings of $349 million, up 16% year over year, primarily due to the net impact of higher yields and improved insurance experience. NBV surged 74% year over year.

APE sales jumped 34%, primarily reflecting a rebound in demand from affluent customers.

Business Highlights

Manulife Financial entered into an agreement with Global Atlantic to reinsure four in-force blocks of legacy and low return on equity (ROE) business, including $6 billion of long-term care (LTC) insurance contract net liabilities. This agreement represents the largest-ever LTC reinsurance transaction and is intended to reshape its portfolio by reducing risk, improving ROE, strengthening capital, growing high-return businesses and delivering value to shareholders. The transaction is expected to see light by the end of this month.

In Global WAM, the company entered into an agreement to acquire multi-sector alternative credit manager CQS. The acquisition will provide Manulife Investment Management and CQS clients with improved access to combined global investment solutions.

In Canada, MFC partnered with League, a leading healthcare technology provider, to offer group benefits to members with more personalized and integrated digital healthcare experiences. This will enable them to connect their benefits directly with healthcare options.

Zacks Rank

Manulife Financial currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Life Insurers

Lincoln National Corporation LNC reported fourth-quarter 2023 adjusted earnings of $1.45 per share, which outpaced the Zacks Consensus Estimate by 9.9%. The bottom line surged 90.8% year over year. Adjusted operating revenues of $2 billion plunged 56.6% year over year in the quarter under review. The top line lagged the consensus mark by 55.7%. Fee income inched up 0.5% year over year to $1.4 billion, which almost touched the Zacks Consensus Estimate. Insurance premiums were a negative figure of $1.1 billion.

Net investment income of $1.4 billion dipped 0.1% year over year but beat the consensus mark of $1.3 billion. Meanwhile, other revenues climbed 32.1% year over year. Total expenses decreased 19% year over year to $2.3 billion in the fourth quarter. Commissions and other expenses fell 1.2% year over year, while interest and debt expenses witnessed a year-over-year increase of 5.2% during the same time frame. Lincoln National incurred a net loss of $1.2 billion against the year-ago quarter’s net income of $812 million.

Brighthouse Financial Inc. BHF reported a fourth-quarter 2023 adjusted net income of $2.92 per share, which missed the Zacks Consensus Estimate by 23.8%. The bottom line declined 16.8% year over year. The results reflected higher revenues, offset by higher expenses. Total operating revenues of $2.1 billion increased 5.4% year over year, driven by higher premiums, net investment income and other income. The top line beat the consensus mark by 0.2%. Premiums of $226 million increased 35.5% year over year.

Adjusted net investment income was $1.2 billion in the quarter under review, up 13.3% year over year, primarily driven by alternative investment income, asset growth and higher interest rates. The investment income yield was 4.16%. Total expenses were $2.6 million. Corporate expenses, pretax, were $224 million, a slight decrease from $243 million incurred in the year-ago quarter.

Sun Life Financial Inc. SLF delivered a fourth-quarter 2023 underlying net income of $1.23 per share, which beat the Zacks Consensus Estimate by 5.1%. However, the bottom line decreased 1.6% year over year. The underlying net income was $722 million (C$983 million), which increased 10% year over year. Revenues of $13.7 billion increased 51.5% on a year-over-year basis.

Wealth sales & asset management gross flows of $33.7 billion (C$45.8 billion) increased 5.7% year over year. Group - Health & Protection sales of $1.1 billion (C$1.5 billion) improved 8.5% year over year. Individual - Protection sales of $519.6 million (C$707 million) jumped 42% year over year. The new business contractual service margin was $280 million (C$381 million), up 51% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lincoln National Corporation (LNC) : Free Stock Analysis Report

Manulife Financial Corp (MFC) : Free Stock Analysis Report

Sun Life Financial Inc. (SLF) : Free Stock Analysis Report

Brighthouse Financial, Inc. (BHF) : Free Stock Analysis Report