Manulife's (MFC) Q4 Earnings Beat on Solid WAM Business

Manulife Financial Corporation MFC delivered fourth-quarter 2021 core earnings of 67 cents per share, which beat the Zacks Consensus Estimate by 3.1%. The bottom line improved 17.5% year over year.

Core earnings of $1.3 billion (C$1.7 billion) increased 8.3% from the prior-year quarter. This upside was driven by the recognition of core investment gains in 2021, higher net fee income from higher average assets under management and administration (AUMA) in Global Wealth and Asset Management, higher new business gains in the United States and Canada as well as a decrease in Corporate and Other core losses. It was partially offset by lower net gains on seed money investments in new segregated and mutual funds and in-force business growth in Asia and Canada. These items were partially offset by unfavorable policyholder experience.

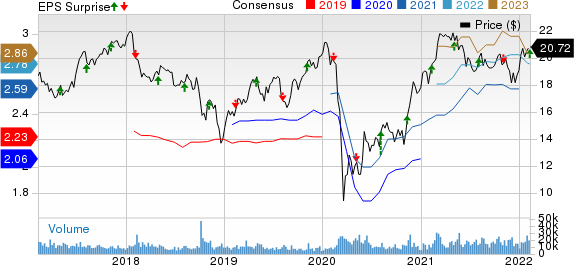

Manulife Financial Corp Price, Consensus and EPS Surprise

Manulife Financial Corp price-consensus-eps-surprise-chart | Manulife Financial Corp Quote

New business value (NBV) in the reported quarter was $440 million (C$555 million), up 17.3% year over year due to higher business in Asia, Canada and the United States.

Annualized premium equivalent (APE) sales were $1.1 billion (C$1.4 billion).

The expense efficiency ratio improved 370 basis points (bps) to 49%.

As of Dec 31, 2021, Manulife Financial’s financial leverage ratio improved 80 bps year over year to 25.8%.

Wealth and asset management assets under management and administration were $855.9 billion, up 13.6% year over year. Wealth and Asset Management business generated a net inflow of $8.1 billion, up nearly three-fold year over year.

Core return on equity, measuring the company’s profitability, expanded 210 bps year over year to 13% in 2021.

Life Insurance Capital Adequacy Test (LICAT) ratio was 142% as of Dec 31, 2021, down from 149% as of Dec 31, 2020.

Book value per share excluding AOCI increased 10.9% to $24.12 as of Dec 31, 2021.

Segmental Performance

Global Wealth and Asset Management division’s core earnings came in at $307 million (C$387 million), up 31.7% year over year.

Asia division’s core earnings totaled $434 million (C$547 million), down 0.9% year over year. In Asia, NBV increased 11% to $391 million. The increase was due to higher sales volumes, favorable interest rates and expense management in Hong Kong, and favorable product mix in Asia Other. The upside was partially offset by lower sales in Japan and lower Critical Illness sales in mainland China. APE sales decreased 6% as growth in Hong Kong was more than offset by lower COLI product sales in Japan.

Manulife Financial’s Canada division core earnings of $227 million (C$286 million) were down 6.2% year over year. NBV increased 26% year over year to $82 million, primarily due to higher margins in annuities and higher volumes in individual insurance. APE sales increased 20%, primarily driven by increased customer demand for its lower-risk segregated fund products and higher individual insurance sales.

The U.S. division reported core earnings of $370 million (C$467 million), up 0.5% year over year. NBV increased 51% year over year to $82 million, primarily driven by higher sales volumes and favorable product mix, notably due to higher international sales. APE sales increased 41% due to strong international sales, which is reported as part of the U.S. segment results, and differentiated domestic product offerings, which include the John Hancock Vitality feature and higher customer demand for insurance protection in the current COVID-19 environment of greater consumer interest in improving baseline health.

Loss at Corporate and Other was $63 million (C$79 million), narrower than the year-ago loss of $150 million.

Capital Deployment

Manulife Financial progressed capital deployment priorities by investing in the highest potential businesses, including the exclusive bancassurance transaction in Vietnam. It also increased the dividend by 18%. In 2022, the insurer will be buying back shares to generate shareholder value and to neutralize the dilution impact on core EPS from the highly successful U.S. VA transaction.

Zacks Rank

Manulife Financial currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Life Insurers

Of the life insurance industry players that have reported fourth-quarter results so far, Voya Financial, Inc VOYA beat the Zacks Consensus Estimate for earnings while Lincoln National Corporation LNC and Reinsurance Group of America, Incorporated RGA missed expectations.

Voya Financial reported fourth-quarter 2021 adjusted operating earnings of $1.90 per share, which surpassed the Zacks Consensus Estimate by 28.4%. The bottom line remained flat year over year. Total revenues amounted to $1.7 billion, which declined 19.2% year over year in the fourth quarter.

As of Dec 31, 2021, VOYA’s assets under management and assets under administration & advisement totaled $739 billion.

Lincoln National’s fourth-quarter 2021 adjusted earnings of $1.56 per share missed the Zacks Consensus Estimate of $1.98 and declined from the prior-year figure of $1.78 per share. Adjusted operating revenues increased 2.4% year over year to $4.8 billion and beat the consensus mark of $4.7 billion.

Even though the ongoing pandemic is likely to continue hurting results, Lincoln National is expected to witness rising earnings per share on the back of its Spark Initiative.

Reinsurance Group reported fourth-quarter 2021 adjusted operating loss of 56 cents per share against the Zacks Consensus Estimate of earnings of 83 cents per share. RGA had reported an operating income of $1.19 per share in the prior-year quarter. Higher COVID-19 mortality claims weighed on the performance. Operating revenues of $4.3 billion increased 5.8% year over year. Reinsurance Group’s top line beat the Zacks Consensus Estimate by 2.1%.

RGA’s net premiums of $3.4 billion rose 4.5% year over year. Investment income increased 18%, reflecting a 5% higher average asset balance and strong variable investment income. Average investment yield increased 50 bps to 4.7% primarily due to higher variable investment income.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lincoln National Corporation (LNC) : Free Stock Analysis Report

Manulife Financial Corp (MFC) : Free Stock Analysis Report

Reinsurance Group of America, Incorporated (RGA) : Free Stock Analysis Report

Voya Financial, Inc. (VOYA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research