Many Still Looking Away From OceanPal Inc. (NASDAQ:OP)

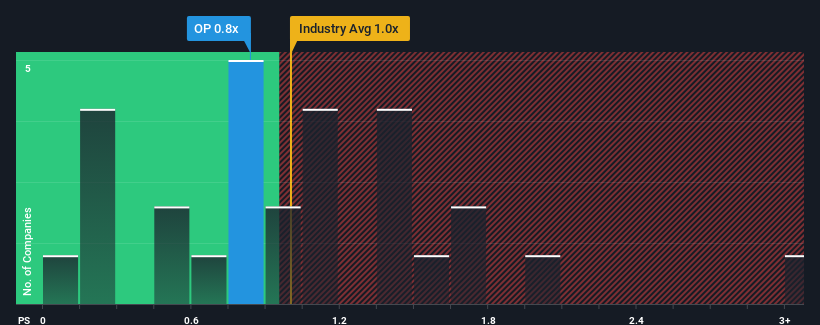

With a median price-to-sales (or "P/S") ratio of close to 1x in the Shipping industry in the United States, you could be forgiven for feeling indifferent about OceanPal Inc.'s (NASDAQ:OP) P/S ratio of 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for OceanPal

What Does OceanPal's P/S Mean For Shareholders?

Revenue has risen at a steady rate over the last year for OceanPal, which is generally not a bad outcome. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. Those who are bullish on OceanPal will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on OceanPal will help you shine a light on its historical performance.

Is There Some Revenue Growth Forecasted For OceanPal?

In order to justify its P/S ratio, OceanPal would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 6.5% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 101% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

In contrast to the company, the rest of the industry is expected to decline by 5.6% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this in mind, we find it intriguing that OceanPal's P/S matches its industry peers. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

What We Can Learn From OceanPal's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of OceanPal revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. When we see a history of positive growth in a struggling industry, but only an average P/S, we assume potential risks are what might be placing pressure on the P/S ratio. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. The fact that the company's relative performance has not provided a kick to the share price suggests that some investors are anticipating revenue instability.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for OceanPal (3 are a bit unpleasant) you should be aware of.

If these risks are making you reconsider your opinion on OceanPal, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.