Maplebear Inc (CART) CEO Fidji Simo Sells 20,750 Shares

Maplebear Inc (NASDAQ:CART), a company known for its innovative technology solutions in the retail space, has reported an insider sale according to the latest SEC filings. Fidji Simo, the President and Chief Executive Officer of Maplebear Inc, sold 20,750 shares of the company on March 26, 2024. The transaction was disclosed in a Form 4 filing with the Securities and Exchange Commission.Over the past year, the insider has sold a total of 120,750 shares of Maplebear Inc and has not made any purchases of the stock. This latest sale continues a trend of insider transactions that have been observed at the company.

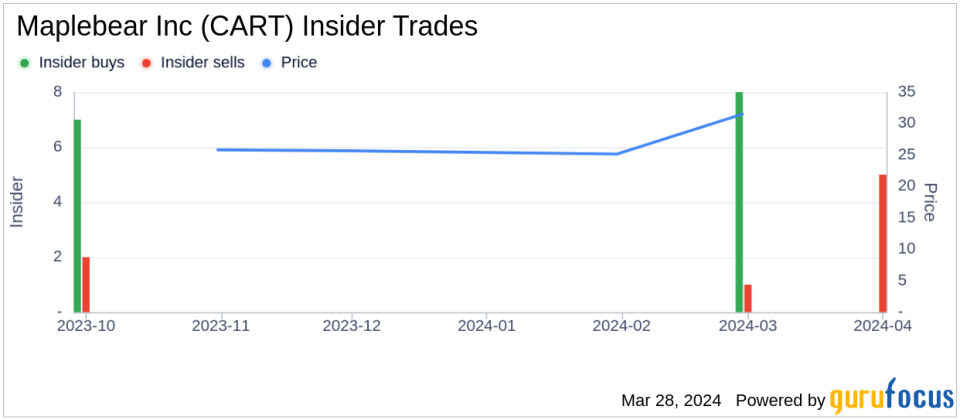

The insider transaction history for Maplebear Inc shows a pattern of insider activity. There have been 15 insider buys and 9 insider sells over the past year. This activity provides a glimpse into the sentiment insiders have about the company's stock performance and future prospects.On the valuation front, shares of Maplebear Inc were trading at $38.06 on the date of the insider's recent sale. The company's market capitalization stands at $9.937 billion, reflecting the size and scale of its operations in the retail technology market.Maplebear Inc is at the forefront of transforming the retail experience through its advanced technology platforms and solutions. The company's commitment to innovation has positioned it as a key player in the industry, catering to a diverse range of clients seeking to enhance their retail operations and customer engagement.For investors and market watchers, the insider selling activity at Maplebear Inc may serve as one of many factors to consider when evaluating the company's stock and overall performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.