Marathon (MPC) Q4 Earnings Top Despite a Decline in Margins

Independent oil refiner and marketer Marathon Petroleum Corp. MPC reported fourth-quarter adjusted earnings per share of $3.98, which comfortably beat the Zacks Consensus Estimate of $2.36. The outperformance primarily reflects the stronger-than-expected performance of its key Refining & Marketing segment. Operating income of the segment totaled $1.2 billion, above the consensus mark of $812 million.

However, the company’s bottom line fell from the year-ago adjusted profit of $6.65 due to a higher unit operating cost and a drop in refining margin.

Marathon Petroleum reported revenues of $36.8 billion, which beat the Zacks Consensus Estimate of $33.7 billion but declined 8.2% year over year.

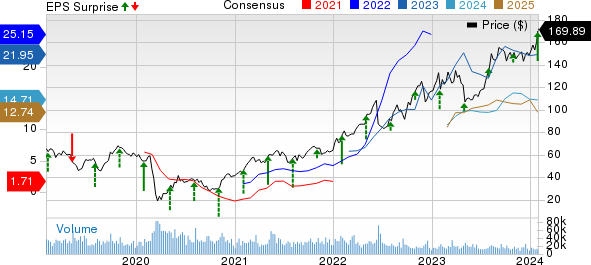

Marathon Petroleum Corporation Price, Consensus and EPS Surprise

Marathon Petroleum Corporation price-consensus-eps-surprise-chart | Marathon Petroleum Corporation Quote

Inside MPC’s Segments

Refining & Marketing: The Refining & Marketing segment reported an operating income of $1.2 billion, which fell 68.2% from the year-ago profit of $3.9 billion. The drop primarily reflects lower year-over-year margins and a decrease in capacity utilization.

Specifically, the refining margin of $17.79 per barrel declined from $28.82 a year ago. Capacity utilization during the quarter was 91%, down from 94% in the corresponding period of 2022.

Meanwhile, total refined product sales volumes were 3,612 thousand barrels per day (mbpd), up from 3,532 mbpd in the year-ago quarter. Also, throughput rose from 2,895 mbpd in the year-ago quarter to 2,931 mbpd and outperformed the Zacks Consensus Estimate of 2,891 mbpd.

MPC’s operating costs per barrel increased from $5.62 in the year-ago quarter to $5.67.

Midstream: This unit mainly reflects Marathon Petroleum’s general partner and majority limited partner interests in MPLX LP MPLX — a publicly traded master limited partnership that owns, operates, develops and acquires pipelines and other midstream assets.

Segment profitability was $1.3 billion, up 18.1% from the fourth quarter of 2022. Earnings were buoyed up by higher throughputs and taxes.

Financial Analysis

Marathon Petroleum reported expenses of $34.4 billion in fourth-quarter 2023, down 2.6% from the year-ago quarter.

In the reported quarter, Marathon Petroleum spent $780 million on capital programs (50% on Refining & Marketing and 46% on the Midstream segment) compared to $849 million in the year-ago period.

MPC guided that its standalone capital expenditure (excluding MPLX) will come in at $1.25 billion for 2024.

As of Dec 31, the Zacks Rank #3 (Hold) company had cash and cash equivalents of $5.4 billion and total debt, including that of MPLX, of $27.3 billion, with a debt-to-capitalization of 47.2%.

In the fourth quarter, MPC repurchased $2.5 billion of shares and a further $900 million worth of shares in January. The company currently has a remaining authorization of $5.9 billion.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Important Energy Earnings So Far

While it's early in the earnings season, there have been a few key energy releases thus far. Let’s glance through a couple of them.

SLB SLB, the largest oilfield contractor, announced fourth-quarter 2023 earnings of 86 cents per share (excluding charges and credits), which beat the Zacks Consensus Estimate of 84 cents. SLB’s bottom line also increased from the year-ago quarter’s earnings of 71 cents.

SLB’s strong quarterly earnings resulted from higher evaluation and stimulation activity in the international market. As of Dec 31, 2023, the company had approximately $4 billion in cash and short-term investments. It had a long-term debt of $10.8 billion at the end of 2023.

Meanwhile, energy infrastructure provider Kinder Morgan KMI reported fourth-quarter adjusted earnings per share of 28 cents, slightly below the Zacks Consensus Estimate of 31 cents. The bottom line was adversely affected by a decline in realized weighted natural gas liquid price and milder winter conditions observed in 2023. However, KMI’s fourth-quarter DCF was $1.2 billion, down $46 million from a year ago.

As of Dec 31, 2023, Kinder Morgan reported $83 million in cash and cash equivalents. Its long-term debt amounted to $27.9 billion at quarter-end. In its initial budget for 2024, KMI set its adjusted EBITDA guidance of $8.2 billion and a dividend of $1.15 per share, suggesting an increase from the prior-year reported figure of $1.13.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Schlumberger Limited (SLB) : Free Stock Analysis Report

Marathon Petroleum Corporation (MPC) : Free Stock Analysis Report

Kinder Morgan, Inc. (KMI) : Free Stock Analysis Report

MPLX LP (MPLX) : Free Stock Analysis Report