Marathon Oil Corp's Meteoric Rise: Unpacking the 23% Surge in Just 3 Months

Marathon Oil Corp (NYSE:MRO), an independent exploration and production company primarily focusing on unconventional resources in the United States, has seen a significant surge in its stock price over the past three months. With a current market cap of $16.4 billion and a price of $27.08, the company's stock has gained 3.38% over the past week and a remarkable 22.74% over the past three months. According to the GF Value, which calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates, the stock is currently fairly valued. This is a notable improvement from three months ago when it was modestly undervalued.

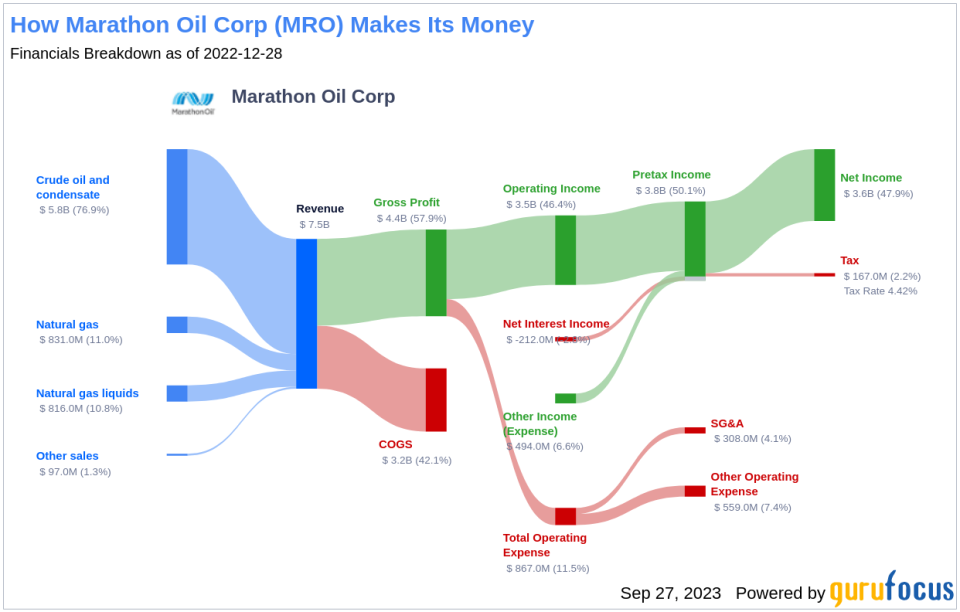

Profitability Analysis

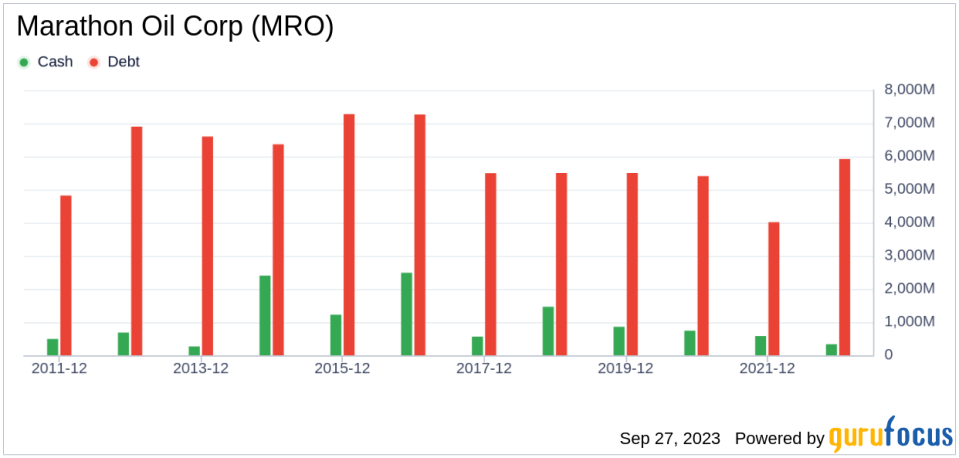

Marathon Oil Corp's profitability is relatively high, with a Profitability Rank of 6/10. The company's operating margin of 36.60% is better than 79.98% of 984 companies in the same industry. This is calculated as Operating Income divided by its Revenue. The company's ROE (Return on Equity) is 18.03%, better than 68.77% of 1031 companies, and its ROA (Return on Assets) is 10.65%, better than 77.66% of 1101 companies. Both ROE and ROA are calculated as Net Income divided by its average Total Stockholders Equity and Total Assets over a certain period of time, respectively. The company's ROIC (Return on Invested Capital), which measures how well a company generates cash flow relative to the capital it has invested in its business, is 10.67%, better than 69.82% of 1090 companies. Over the past 10 years, Marathon Oil Corp has been profitable for 6 years, which is better than 59.17% of 960 companies in the same industry.

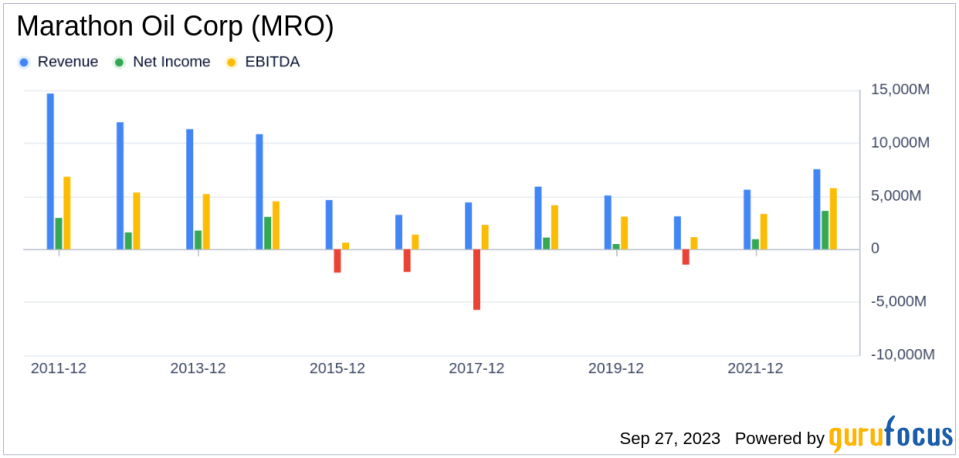

Growth Potential

Marathon Oil Corp has strong growth potential, with a Growth Rank of 8/10. The company's 3-year and 5-year revenue growth rates per share are 20.60% and 10.00% respectively, better than 72.04% of 862 companies and 65.27% of 789 companies in the same industry. However, the company's future total revenue growth rate is estimated to be -1.26%, which is better than 30.27% of 261 companies. The company's 3-year EPS without NRI growth rate is 107.40%, better than 92.39% of 696 companies, and its future EPS without NRI growth rate is estimated to be 4.40%, better than 53.85% of 65 companies.

Top Holders

The top three holders of Marathon Oil Corp's stock are HOTCHKIS & WILEY, Steven Cohen (Trades, Portfolio), and Ken Fisher (Trades, Portfolio). HOTCHKIS & WILEY holds 14,650,160 shares, accounting for 2.42% of the company's stock. Steven Cohen (Trades, Portfolio) holds 5,939,305 shares, accounting for 0.98% of the company's stock. Ken Fisher (Trades, Portfolio) holds 4,628,662 shares, accounting for 0.76% of the company's stock.

Competitors Analysis

Marathon Oil Corp's main competitors within the oil and gas industry are EQT Corp (NYSE:EQT), Texas Pacific Land Corp (NYSE:TPL), and APA Corp (NASDAQ:APA). EQT Corp has a market cap of $16.36 billion, Texas Pacific Land Corp has a market cap of $14.4 billion, and APA Corp has a market cap of $12.99 billion.

Conclusion

In conclusion, Marathon Oil Corp's stock performance, profitability, and growth potential are impressive. The company's stock has seen a significant surge over the past three months, and its profitability and growth ranks are relatively high. The company's top holders and main competitors also indicate its strong position in the oil and gas industry. Despite the estimated decrease in future total revenue growth rate, the company's future EPS without NRI growth rate is estimated to increase, indicating promising future prospects for the company.

This article first appeared on GuruFocus.