Marathon Petroleum: Weaker Crack Spreads Offset Shareholder-Friendly Actions

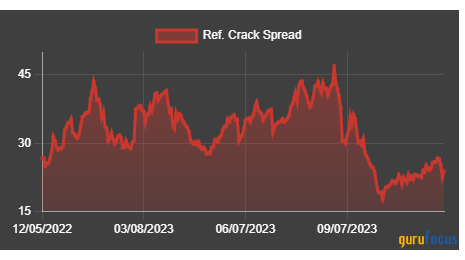

American consumers continue to enjoy the fall-off in retail gasoline prices. After peaking just shy of $4 per gallon earlier this year, and touching $5 in June 2022, the national average pump price for a gallon of regular has sunk to $3.23 as of Dec. 5, according to AAA. This general energy-market trend has been unwelcome news for refiners, though. The 3-2-1 refinery crack spread, a gauge of profitability for that industry and charted below, plunged from an Aug. 25 high to a low notched in early October. This is a key metric to watch for Marathon Petroleum Corp. (NYSE:MPC).

I am neutral on Marathon Petroleum shares given the turn lower in cracks and a stock that appears near fair value in my view. Still, the technicals and momentum appear strong.

Weaker crack spreads pressure refiners

Source: RBN Energy

Company description

For background, Marathon Petroleum, along with its subsidiaries, operates as an integrated downstream company primarily within the United States. It has two operating segments: Refining & Marketing and Midstream. Its Refining & Marketing segment refines crude oil and other products across several regions of the contiguos U.S. along with other activities. Its Midstream segment transports, stores, distributes and sells crude oil and refined products through various energy logistics channels.

Key data

With a $57.5 billion market cap, the Ohio-based oil and gas refining and marketing company within the energy sector trades at a lofty 22.5 forward non-GAAP price-earnings ratio and pays an above-market 2.2% forward dividend yield. Ahead of earnings, which are not due out until the end of January, shares trade with a moderate 27% implied volatility percentage, per Options Research & Technology Services, and short interest on the stock is modest, though material, at 2.6% as of Dec. 4.

Color on quarter and risks

Back in October, Marathon Petroleum reported a strong quarter. Third-quarter non-GAAP earnings per share of $8.14 topped Wall Street expectations by 39 cents while $41.6 billion of quarterly revenue was a 12% decline from year-ago levels, but it handily beat the consensus estimate by $2.6 billion. Shares rose 3% in the following session. The comapny produced strong operating cash flow to the tune of $5 billion and adjusted Ebitda totaled $5.7 billion during the period that featured extremely high crack spreads I do not expect that to continue given the steep fall off in gasoline prices.

The robust quarter also came with a continued execution of a stock buyback plan. Bank of America notes that 40% of outstanding shares have been repurchased since Marathon divested its retail business. The revamped capital structure and high net cash position should help it weather macro risks should they come about in the first half of next year. Still, weaker cracks will likely negatively impact margins going forward. What was positive before the third-quarter report was the company hiking its quarterly dividend by 10% and approving an additional $5 billion stock repurchase plan. These shareholder-accretive activities are encouraging.

Key risks include adverse commodity price trends (high oil prices, low prices for refined products), poor capital expenditure execution and weaker demand due to lower U.S. gross domestic product growth in the coming quarters.

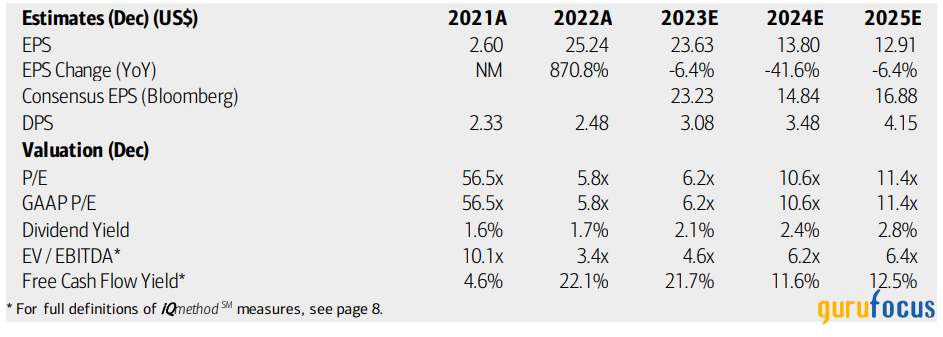

Earnings and valuation

On valuation, analysts at Bank of America see earnings moderating over the next few years. Operating earnings per share is forecasted to be around $23 this year with a significant decline to just $15 in 2024. By 2025, normalized per-share profits are seen closer to $13. Following an extraordinarily strong 2022, sales trends are expected to be in the red over the out years compared to this year and 2022.

Dividends, meanwhile, are forecasted to rise, helping to boost the company's yield. Assuming normalized non-GAAP earnings of $13 per share and applying a low teens price-earnings rato (above the sector median, but well below Marathon's five-year average valuation multiple), the stock should close to $160, suggesting not too much further upside from its current share price. What's positive, though, is that Marathon has very strong free cash flow trends, with total free cash flow per share in the last four quarters of more than $35, though that should moderate over the coming quarters.

Marathon: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

Source: BofA Global Research

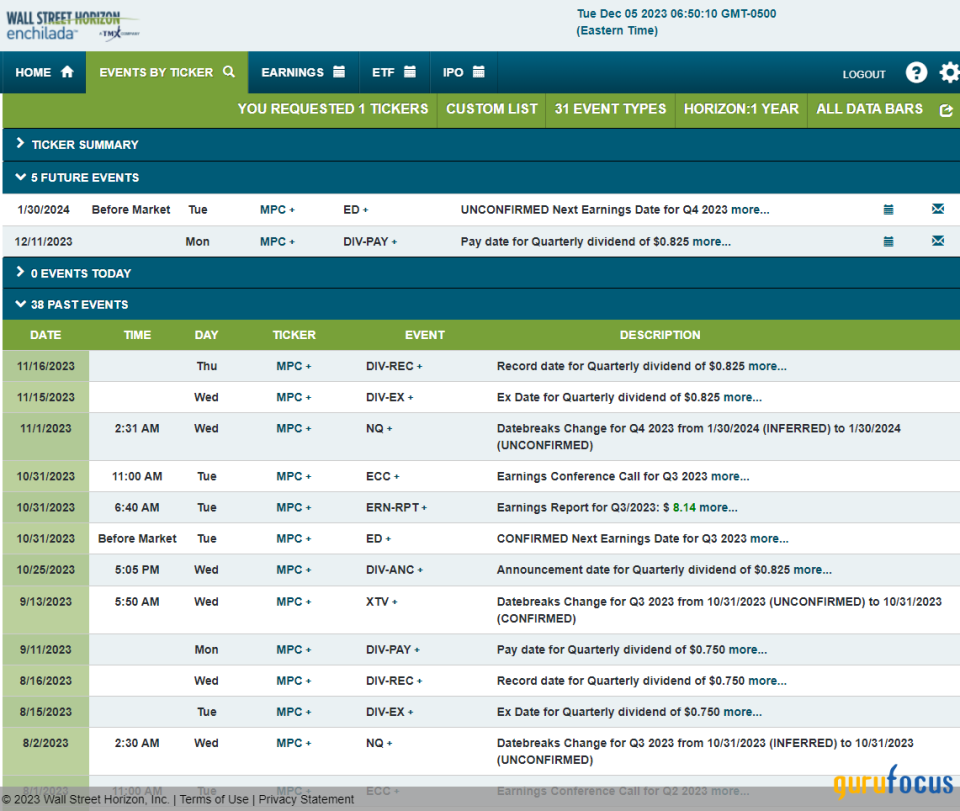

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed fourth-quarter 2023 earnings date of Tuesday, Jan. 30. Before that, Marathon Petroleum pays a quarterly dividend of 82.5 cents on Monday, Dec. 11. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

Source: Wall Street Horizon

The technical take

Marathon Petroleum has been among the strongest large-cap performers on the year. Up more than 33% on a total return basis in 2023, outperforming the Energy Select Sector SPDR ETF (XLE) and the S&P 500 Trust ETF (SPY), the stock has stagnated somewhat since hitting a September closing high above $156. Notice in the chart below that Marathon has been consolidating in a bull flag in the last three months as volume also trends lower. These are bullish technical factors, in my opinion, given the broader trend up.

With a long-term 200-day moving average that is positively sloped, and with a pronounced uptrend line in place, the bulls are in control. There is also an uptrend resistance line that would come into play near $165 today. I see near-term support around the fourth-quarter 2023 lows at $140 that is also near where the stock peaked during the first half of 2023 thus, it is a key area of polarity (former resistance becomes new support). A cautionary note is seen with its relative strength index momentum oscillator at the bottom of the chart there is some bearish negative divergence (poorer momentum as the stock advances).

Overall, Marathon Petroleum's chart is constructive despite the turn lower in momentum. I see the current price trend as a bullish consolidation and $140 is important support.

Bull flag, long-term uptrend pauses, $140 support

Source: GuruFocus

The bottom line

I see Marathon near fair value, so long-term investors might want to look elsewhere. For momentum swing investors, though, the chart is doing a lot of the right things heading into 2024.

This article first appeared on GuruFocus.