Maravai LifeSciences Holdings Inc (MRVI) Faces Net Loss in 2023 Despite Revenue Outperformance

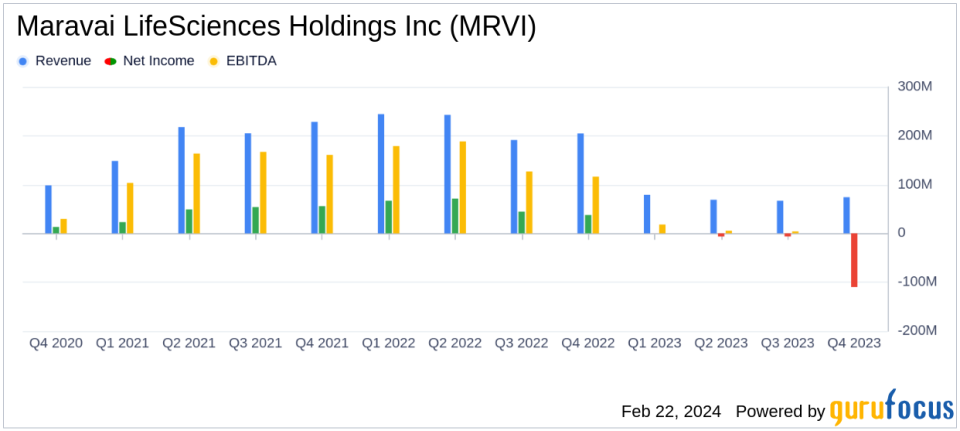

Annual Revenue: Reported at $288.9 million for 2023, a significant decrease from the previous year.

Net Loss: Recorded a net loss of $(138.4) million for the year, attributed to valuation adjustments and decreased demand.

Adjusted EBITDA Margin: Achieved 23% for the full year, reflecting cost reduction efforts and operational efficiency.

Product Innovation: TriLink BioTechnologies secures patents and enters supply agreement, signaling growth in the mRNA space.

2024 Revenue Guidance: Projected to be between $265.0 million to $285.0 million with an Adjusted EBITDA margin of 23% to 25%.

On February 22, 2024, Maravai LifeSciences Holdings Inc (NASDAQ:MRVI) released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023. The life sciences company, known for its products that enable drug therapies, diagnostics, and research on human diseases, faced a challenging year with significant revenue decline and a net loss.

Financial Performance and Challenges

Maravai LifeSciences reported a sharp decline in annual revenue to $288.9 million, a 67.3% decrease from the previous year, primarily due to reduced demand for COVID-19 related products as the pandemic subsided. The Nucleic Acid Production segment, which is a major revenue driver, experienced a 72.4% decrease year-over-year. The company also reported a net loss of $(138.4) million for the year, largely due to a valuation adjustment to certain deferred tax assets.

Despite these challenges, Maravai LifeSciences achieved an Adjusted EBITDA margin of 23% for the full year, reflecting the company's efforts to reduce costs and maintain operational efficiency. The company's focus on expanding its product portfolio and market leadership, particularly in the mRNA space, is crucial as it navigates through post-pandemic market conditions and prepares for future growth opportunities.

Financial Achievements and Industry Significance

The company's financial achievements in the face of adversity highlight its resilience and strategic focus. The Adjusted EBITDA margin is particularly important for Maravai LifeSciences and the biotechnology industry, as it demonstrates the company's ability to manage its operating costs and profitability in a challenging environment. The introduction of new products and securing of patents, such as those for TriLink BioTechnologies' CleanCap technology, are vital for sustaining innovation and competitiveness in the biotech sector.

Key Financial Metrics

Maravai LifeSciences' financial results reveal several key metrics that are important to the company's health and investor considerations:

The Nucleic Acid Production segment's revenue was $224.8 million for the year, a significant decrease from the prior year's $813.1 million.

Biologics Safety Testing revenue also saw a decrease, down 8.2% year-over-year to $64.2 million.

The company's net loss of $(138.4) million contrasts sharply with the net income of $490.7 million reported in the previous year.

Adjusted EBITDA for the year stood at $65.3 million, compared to $637.8 million in the prior year.

Management Commentary

"We closed out a challenging 2023 with better than forecasted demand for our Nucleic Acid Production products, including for CleanCap and custom chemistry, said Trey Martin, Chief Executive Officer of Maravai. Thanks to our team's strong execution, the cost reductions we implemented in the fourth quarter and our revenue outperformance, we delivered a 28% adjusted EBITDA margin in the fourth quarter.

"Maravai remains focused on expanding our product portfolio, advancing our market leadership in the mRNA space, and accelerating the introduction of innovations that support our customers rapidly evolving needs. We see continued pipeline progression among our customers development programs and are excited for our base business opportunities in 2024, Martin continued.

Looking Ahead

For 2024, Maravai LifeSciences has set a revenue guidance range of $265.0 million to $285.0 million, with Adjusted EBITDA margins expected to be between 23% and 25%. This guidance reflects the company's expectations for its existing business and does not account for potential new acquisitions or unforeseen factors.

Maravai LifeSciences' performance in 2023 underscores the transitional phase the company is undergoing as it adjusts to a post-pandemic market. While the reported net loss and revenue decline are significant, the company's strategic initiatives and focus on innovation position it for potential recovery and growth in the coming year.

For more detailed information and to stay updated on Maravai LifeSciences' progress, investors and interested parties are encouraged to visit the company's website and follow its investor relations communications.

Explore the complete 8-K earnings release (here) from Maravai LifeSciences Holdings Inc for further details.

This article first appeared on GuruFocus.