Marcus & Millichap Inc (MMI) Faces Market Headwinds: A Dive into the 2023 Earnings Report

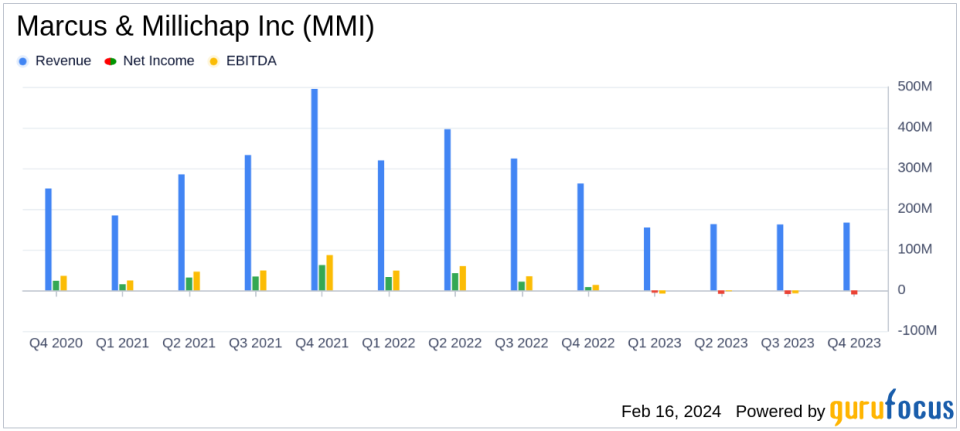

Total Revenue: $645.9 million in 2023, a 50.4% decrease from $1,301.7 million in 2022.

Net Loss: Reported a net loss of $34.0 million in 2023, compared to a net income of $104.2 million in 2022.

Earnings Per Share (EPS): Diluted EPS of $(0.88) in 2023, down from $2.59 in 2022.

Adjusted EBITDA: Dropped to $(19.6) million in 2023 from $165.5 million in 2022.

Brokerage Commissions: Decreased by 52.2% to $559.8 million in 2023 from $1,170.3 million in 2022.

Financing Fees: Declined to $66.9 million in 2023, a 41.0% decrease from $113.0 million in 2022.

Investment Sales and Financing Professionals: Reduced to 1,783 in 2023 from 1,904 in 2022.

Marcus & Millichap Inc (NYSE:MMI), a leading national brokerage firm in the commercial real estate sector, released its 8-K filing on February 16, 2024, detailing its financial results for the fourth quarter and the full year of 2023. The company, known for its investment sales, financing, research, and advisory services, faced significant headwinds in a year marked by market disruptions due to the Federal Reserve's inflation control measures and interest rate volatility.

MMI's performance in 2023 was notably impacted by a substantial decrease in total revenue, which fell by over 50% to $645.9 million from $1,301.7 million in the previous year. The company also reported a net loss of $34.0 million, a stark contrast to the net income of $104.2 million in 2022. This downturn is attributed to a decline in transactions across its brokerage and financing services, coupled with increased expenses from growth initiatives, including talent acquisition and retention efforts.

The significance of these financial results lies in the company's position within the real estate industry. MMI's ability to generate revenue through brokerage commissions and financing fees is a key indicator of the health of the commercial real estate market. The reported decline reflects broader market challenges that could signal a slowdown in real estate transactions and valuations.

MMI's financial achievements, such as maintaining a strong balance sheet and executing capital allocation strategies, including dividends and share repurchases, are crucial for navigating through periods of market volatility. These measures demonstrate the company's commitment to shareholder value and financial stability, which are particularly important for a company operating in the cyclical real estate sector.

The company's income statement reveals a sharp decline in brokerage commissions and financing fees, which are central to MMI's revenue model. The balance sheet shows a solid cash position, although total assets have decreased year-over-year. The cash flow statement details the company's operational efficiency and capital management strategies, which remain vital for sustaining operations during challenging economic periods.

President and CEO Hessam Nadji commented on the results, stating:

"Our fourth quarter results continued to reflect the ongoing market disruption created by the Feds fight against inflation and persistent interest rate volatility impacting real estate valuations. We continue to take advantage of our leading brand and strong financial position to leverage the current period by attracting leading professionals, pursuing strategic investments and acquisitions, and enhancing our technology."

Despite the current challenges, MMI is focused on maintaining a strong balance sheet and fostering client relationships to strengthen the business for the long term. The company's strategic investments and acquisitions, along with enhancements to its technology, are aimed at positioning MMI to lead in the eventual market recovery.

In conclusion, Marcus & Millichap Inc (NYSE:MMI) faced a difficult year in 2023, with significant declines in revenue and net income. However, the company's strategic focus on growth initiatives and maintaining a strong financial foundation suggests a proactive approach to overcoming current market challenges. As the commercial real estate market navigates through interest rate uncertainty and economic headwinds, MMI's efforts to adapt and position itself for recovery will be critical for its long-term success.

For a more detailed analysis of Marcus & Millichap Inc's financial performance and to stay updated on the latest developments in the commercial real estate market, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Marcus & Millichap Inc for further details.

This article first appeared on GuruFocus.