Marine Products Corp (MPX) Faces Headwinds as Q4 Sales Dip 35%

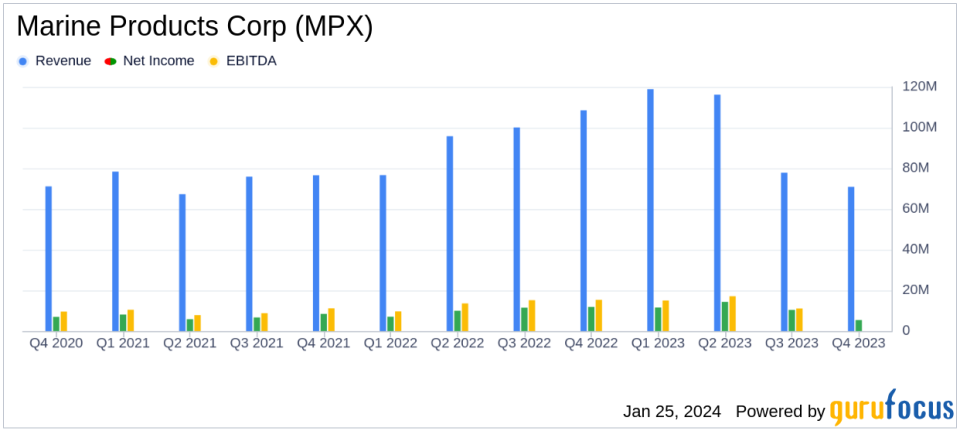

Net Sales: Q4 net sales decreased by 35% year-over-year to $70.9 million.

Gross Margin: Gross margin declined by 620 basis points to 19.0% in Q4.

Net Income: Q4 net income fell to $5.4 million, a decrease from $11.9 million in the prior year.

EBITDA: EBITDA for Q4 dropped to $6.5 million, with a margin of 9.2%.

Dividend: A regular quarterly cash dividend of $0.14 per share declared, payable on March 11, 2024.

Cash Position: Strong cash and cash equivalents of $72.0 million as of end of Q4.

Free Cash Flow: Free cash flow for the full year 2023 stood at $46.7 million.

On January 25, 2024, Marine Products Corp (NYSE:MPX), a premier manufacturer of fiberglass motorized boats, released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year ended December 31, 2023. The company, known for its Chaparral and Robalo boat brands, faced a challenging quarter with softened demand in the boating market, which has been adjusting from the high post-COVID demand levels.

Company Overview

Marine Products Corp operates in the Powerboat Manufacturing business segment, distributing its products through an independent dealer network. The company's portfolio includes Chaparral sterndrive, outboard, and jet pleasure boats, as well as Robalo outboard sport fishing boats. These offerings cater to the family recreational and cruiser markets through the Chaparral brand and the sportfishing market through the Robalo brand.

Financial Performance and Challenges

The company's fourth-quarter performance was marked by a significant 35% decline in net sales, primarily due to a 34% decrease in the number of boats sold. Despite a 4% increase in the average selling price, the introduction of higher retail incentives for a new program weighed on revenues. The gross profit followed suit, dropping by 51% to $13.5 million, with gross margin contracting to 19.0% due to lower sales volumes and manufacturing inefficiencies.

Management's commentary highlighted the industry's current challenges, including economic uncertainty, rising interest rates, and increased dealer inventory levels. President and CEO Ben M. Palmer stated,

Our fourth quarter results reflect soft retail boat demand for the second consecutive quarter as the industry has normalized from elevated post-COVID demand."

He further emphasized the company's strategic adjustments and readiness for near-term market softness.

Financial Achievements and Importance

Despite the downturn in sales and profitability, Marine Products Corp demonstrated financial resilience with a strong balance sheet, boasting over $70 million in cash. The company's ability to generate robust cash flow in 2023 is a testament to its operational efficiency and prudent capital management. This financial strength enables MPX to continue paying attractive dividends and to consider potential acquisitions, thereby enhancing shareholder value.

Key Financial Metrics

Marine Products Corp's financial stability is further underscored by its solid cash flow performance. The company reported net cash provided by operating activities of $56.8 million and free cash flow of $46.7 million for the full year 2023. The balance sheet remains healthy with no outstanding borrowings under the company's $20 million revolving credit facility. These metrics are crucial for the company as they provide the liquidity and flexibility needed to navigate market volatility and invest in growth opportunities.

Analysis of Performance

The earnings report indicates that Marine Products Corp is navigating a transitional period in the boating industry with a focus on cost management and product innovation. While the decrease in net sales and profitability metrics such as net income and EBITDA margin reflect the current headwinds, the company's strong cash position and proactive management strategies position it to weather the storm and capitalize on future market recovery.

For more detailed information on Marine Products Corp's financial performance and strategic outlook, investors and stakeholders are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Marine Products Corp for further details.

This article first appeared on GuruFocus.