Marine Products Corp (MPX): A High-Performing Stock with a GF Score of 91

Marine Products Corp (NYSE:MPX), a prominent player in the Vehicles & Parts industry, has been making waves in the stock market. As of August 11, 2023, the company's stock price stands at $17.04, with a market cap of $587.315 million. The stock has seen a gain of 5.38% today and a modest increase of 0.81% over the past four weeks. The company's impressive performance is reflected in its high GF Score of 91/100, indicating its potential for significant outperformance.

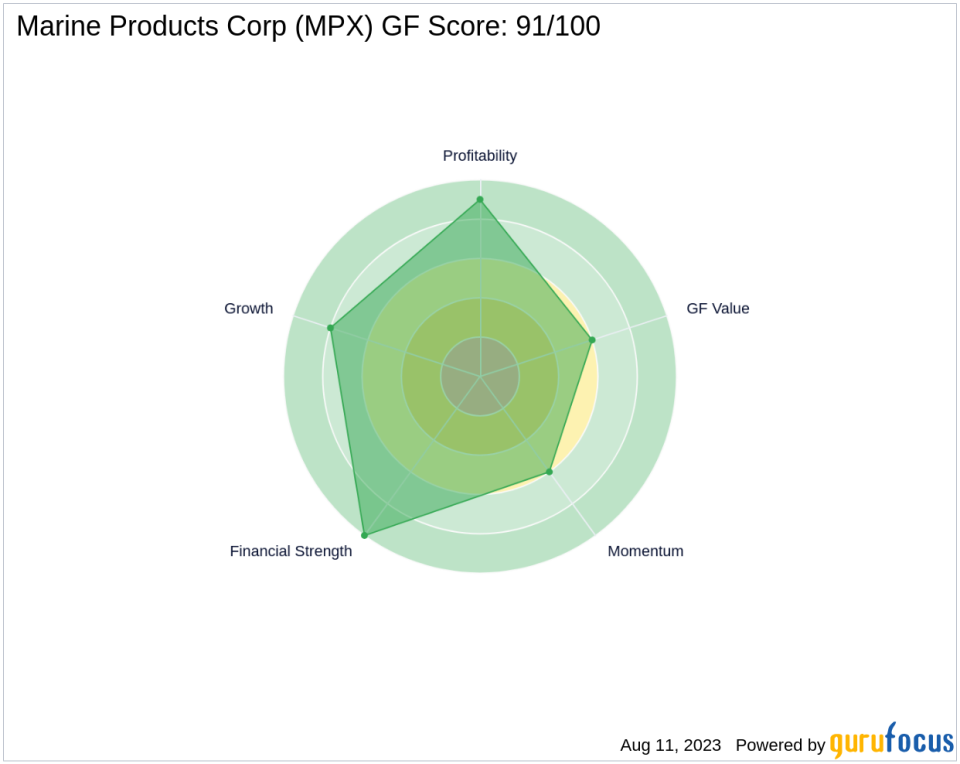

GF Score Analysis

The GF Score is a comprehensive ranking system developed by GuruFocus that evaluates a stock's performance based on five key aspects: Financial Strength, Profitability Rank, Growth Rank, GF Value Rank, and Momentum Rank. A higher GF Score generally indicates higher returns, making it a valuable tool for investors. With a GF Score of 91, Marine Products Corp is in the highest outperformance potential category, suggesting promising future performance.

Financial Strength Analysis

Marine Products Corp boasts a Financial Strength Rank of 10/10, indicating a robust financial situation. This rank is determined by factors such as interest coverage, debt to revenue ratio, and Altman Z score. With an interest coverage of 10000.00 and a debt to revenue ratio of 0.00, MPX demonstrates a minimal debt burden and a strong ability to service its debt.

Profitability Rank Analysis

The company's Profitability Rank is 9/10, reflecting its high profitability and consistency. This rank is based on factors such as Operating Margin, Piotroski F-Score, and the trend of the Operating Margin. With an Operating Margin of 13.64% and a Piotroski F-Score of 8, MPX exhibits strong profitability and financial health.

Growth Rank Analysis

Marine Products Corp's Growth Rank of 8/10 indicates solid revenue and profitability growth. This rank is calculated using criteria such as 5-year revenue growth rate and 5-year EBITDA growth rate. With a 5-year revenue growth rate of 5.50 and a 3-year revenue growth rate of 9.00, MPX demonstrates a consistent growth trajectory.

GF Value Rank Analysis

The company's GF Value Rank is 6/10, which is determined by the price-to-GF-Value ratio. This rank suggests that the stock is reasonably valued, avoiding the pitfalls of both overvaluation and undervaluation.

Momentum Rank Analysis

MPX's Momentum Rank of 6/10 reflects its solid momentum indicators and performance. This rank is determined using the standardized momentum ratio and other momentum indicators, providing insights into the stock's price performance.

Competitive Analysis

When compared to its main competitors in the Vehicles & Parts industry, Marine Products Corp holds a competitive edge. MasterCraft Boat Holdings Inc (NASDAQ:MCFT) has a GF Score of 89, OneWater Marine Inc (NASDAQ:ONEW) has a GF Score of 83, and EZGO Technologies Ltd (NASDAQ:EZGO) has a GF Score of 24. With a GF Score of 91, MPX outperforms these competitors, indicating its strong position in the industry. For more details, please visit our competitors page.

In conclusion, Marine Products Corp's high GF Score, strong financial strength, high profitability, solid growth, reasonable valuation, and good momentum make it a promising investment. Investors should consider these factors when making investment decisions.

This article first appeared on GuruFocus.