Marine Products And Two Additional Solid Dividend Stocks To Consider

The United States market has shown resilience, climbing 1.8% in the last week and boasting a robust 25% increase over the past year, with earnings projected to grow by 13% annually. In this environment, investors may find particular value in solid dividend stocks that offer potential for steady income and growth prospects.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

First Interstate BancSystem (NasdaqGS:FIBK) | 7.12% | ★★★★★★ |

Premier Financial (NasdaqGS:PFC) | 6.43% | ★★★★★★ |

AGCO (NYSE:AGCO) | 5.73% | ★★★★★★ |

Peoples Bancorp (NasdaqGS:PEBO) | 5.55% | ★★★★★★ |

Sierra Bancorp (NasdaqGS:BSRR) | 5.03% | ★★★★★★ |

Ennis (NYSE:EBF) | 4.99% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.84% | ★★★★★★ |

Burnham Holdings (OTCPK:BURC.A) | 6.58% | ★★★★★★ |

ALLETE (NYSE:ALE) | 5.02% | ★★★★★★ |

Agree Realty (NYSE:ADC) | 5.26% | ★★★★★★ |

Click here to see the full list of 172 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Marine Products (NYSE:MPX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Marine Products Corporation is a global company that specializes in the design, manufacturing, and sale of recreational fiberglass powerboats for sportboating and sportfishing enthusiasts, with a market capitalization of approximately $366.04 million.

Operations: Marine Products Corporation generates its revenues primarily through the production and sale of recreational fiberglass powerboats, amounting to $383.73 million.

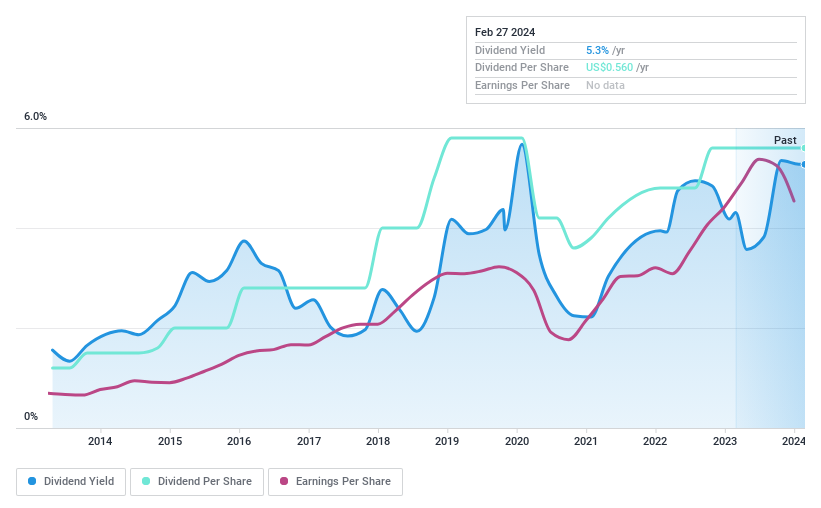

Dividend Yield: 5.3%

Marine Products Corporation's dividend yield stands at a competitive 5.27%, outpacing the US market average, and has shown growth over the past decade despite some volatility in payments. Trading significantly below estimated fair value, it also boasts a sustainable payout with earnings and cash flows comfortably covering dividends (payout ratio of 46.3% and cash payout ratio of 41.4%). However, recent earnings reflect a decline with Q4 sales dropping to US$70.87 million from US$108.51 million year-over-year, alongside a decrease in net income to US$5.42 million from US$11.86 million, indicating potential challenges ahead for maintaining dividend growth and stability.

MSC Industrial Direct (NYSE:MSM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MSC Industrial Direct Co., Inc. is a distributor of metalworking and maintenance, repair, and operations (MRO) products and services across North America and the United Kingdom, with a market capitalization of approximately $5.66 billion.

Operations: MSC Industrial Direct Co., Inc. generates its revenue primarily from the distribution of metalworking and MRO products and services, totaling $4.01 billion.

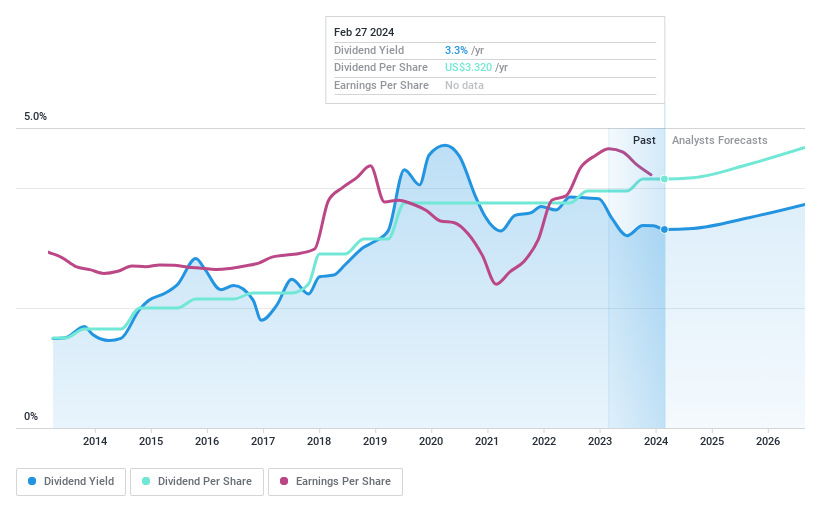

Dividend Yield: 3.3%

MSC Industrial Direct maintains a steady dividend, currently at US$0.83 per share, reflecting a yield of 3.31%, which is modest relative to the top US dividend payers. The company's dividends are well-supported by earnings and cash flows with payout ratios indicating room for sustainability. Recent share buybacks totaling US$236.65 million suggest confidence in future performance, although Q1 sales dipped slightly to US$953.97 million from last year's US$957.75 million, and net income saw a decrease to US$69.35 million from the previous year's US$81.31 million, signaling potential areas for vigilance in dividend prospects.

Garmin (NYSE:GRMN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Garmin Ltd. is a global company specializing in the design, development, manufacturing, marketing, and distribution of various wireless devices, with a market capitalization of approximately $25.93 billion.

Operations: Garmin Ltd.'s revenue is diversified across several segments, with Fitness generating $1.34 billion, Outdoor contributing $1.70 billion, Marine adding $916.91 million, Aviation bringing in $846.33 million, and Auto OEM providing $423.22 million.

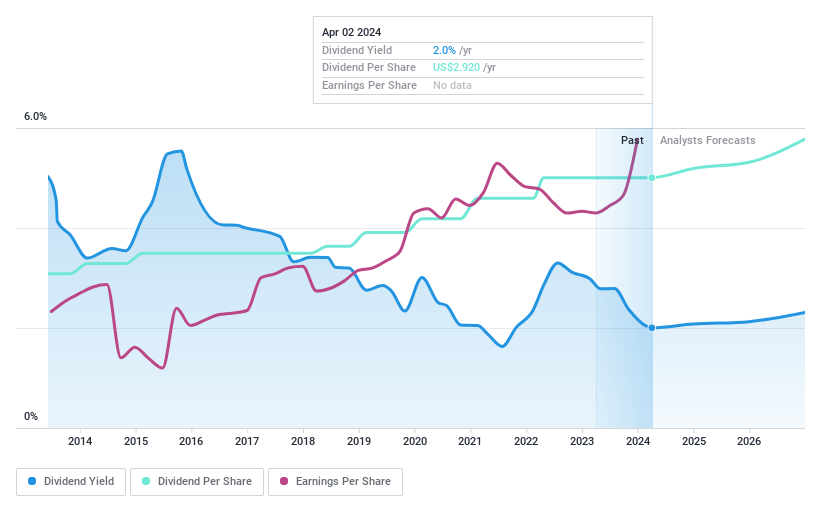

Dividend Yield: 2.2%

Garmin's robust financial performance, with Q4 sales up to US$1.48 billion and net income surging to US$542.13 million, underpins a solid foundation for dividend payouts. The company plans a US$3.00 per share annual dividend, evidencing confidence in its fiscal health and commitment to shareholder returns. Garmin's strategic product launches and share repurchase program further reflect a proactive approach in sustaining growth and shareholder value, though the dividend yield of 2.16% trails the top quartile of US market payers, suggesting room for enhancement in attractiveness to income-focused investors.

Seize The Opportunity

Access the full spectrum of 172 Top Dividend Stocks by clicking on this link.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

Explore small companies with big growth potential before they take off.

Fuel your portfolio with fast-growing stocks poised for rapid expansion.

Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com