MarineMax (HZO) Lined Up for Q3 Earnings: Factors to Note

MarineMax, Inc. HZO is likely to register a decline in the top line when it reports third-quarter fiscal 2023 numbers on Jul 27 before market open. The Zacks Consensus Estimate for revenues is pegged at $667.6 million, indicating a decline of 3% from the prior-year reported figure.

The bottom line of this world’s largest recreational boat and yacht retailer is expected to have declined year over year. Although the Zacks Consensus Estimate for earnings per share for the quarter under review has risen by 2.1% over the past seven days, the figure still suggests a sharp decline of 39.1% from the year-ago period.

This Clearwater, FL-based company has a trailing four-quarter earnings surprise of 4.4%, on average. In the last reported quarter, MarineMax’s bottom line missed the Zacks Consensus Estimate by a margin of 29.7%.

Factors to Note

A return to more seasonal sales trends, a high interest rate environment and cautious consumer behavior are likely to have hurt MarineMax’s top line. The Zacks Consensus Estimate for same-store sales for the quarter under review suggests a drop of 12.8%. The metric had declined 13% in the second quarter. A decrease in new and used boat revenues had hit the top line in the last reported quarter. Additionally, SG&A expenses, as a percentage of revenues, are anticipated to have increased, given the expected same-store sales decline.

The Zacks Consensus Estimate for revenues for Retail Operations is currently pegged at $635 million, indicating a drop from $657.9 million reported in the year-ago period. Meanwhile, the Zacks Consensus Estimate for revenues for Product Manufacturing of $63 million suggests an increase from $48.8 million posted in the prior-year quarter.

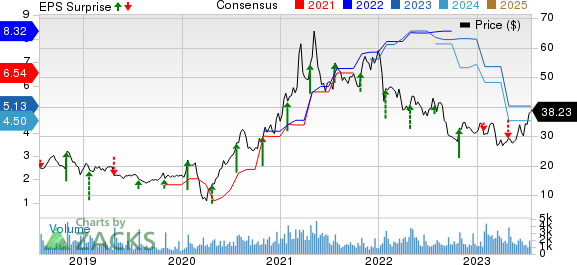

MarineMax, Inc. Price, Consensus and EPS Surprise

MarineMax, Inc. price-consensus-eps-surprise-chart | MarineMax, Inc. Quote

We believe that MarineMax’s significant geographic reach and product diversification do provide some cushion. Markedly, the company’s digitization endeavors have been helping it better engage with customers.

MarineMax’s investments in high-margin businesses, such as finance, insurance, brokerage, marina and service operations, bode well. Impressively, strategic acquisitions and organic initiatives have helped expand its footprint across high-growth areas. IGY Marinas, which the company acquired last October, continues to perform well.

What the Zacks Model Unveils

Our proven model predicts an earnings beat for MarineMax this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is the case here.

MarineMax has an Earnings ESP of +2.86% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

3 More Stocks With the Favorable Combination

Here are three other companies you may want to consider as our model shows that these too have the right combination of elements to post an earnings beat:

Arhaus ARHS currently has an Earnings ESP of +7.69% and a Zacks Rank #1. The company is expected to register a bottom-line decline when it reports second-quarter 2023 results. The Zacks Consensus Estimate for quarterly earnings per share of 26 cents suggests a decline of 7.1% from the year-ago quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

Arhaus’ top line is anticipated to rise year over year. The consensus mark for revenues is pegged at $325.7 million, indicating an increase of 6.3% from the figure reported in the year-ago quarter. ARHS has a trailing four-quarter earnings surprise of 82.4%, on average.

Kroger KR currently has an Earnings ESP of +0.27% and carries a Zacks Rank #3. The company is likely to register a bottom-line increase when it reports second-quarter fiscal 2023 numbers. The Zacks Consensus Estimate for quarterly earnings per share of 92 cents suggests an increase of 2.2% from the year-ago quarter.

Kroger's top line is expected to decline year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $34.24 billion, which indicates a decrease of 1.2% from the figure reported in the prior-year quarter. KR has a trailing four-quarter earnings surprise of 7.8%, on average.

Costco COST currently has an Earnings ESP of +2.58% and a Zacks Rank of 3. The company is likely to register an increase in the bottom line when it reports fourth-quarter fiscal 2023 numbers. The Zacks Consensus Estimate for quarterly earnings per share of $4.64 suggests a rise of 10.5% from the year-ago reported number.

Costco’s top line is expected to ascend year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $78.85 billion, which suggests an increase of 9.4% from the prior-year quarter. COST has a trailing four-quarter earnings surprise of 1.8%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Kroger Co. (KR) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

MarineMax, Inc. (HZO) : Free Stock Analysis Report

Arhaus, Inc. (ARHS) : Free Stock Analysis Report