MarineMax Inc (HZO) Reports Record Q1 Revenue Amidst Retail Challenges

Record Revenue: MarineMax Inc (NYSE:HZO) achieved a record December quarter revenue of $527.3 million.

Same-Store Sales Growth: The company reported a 4% increase in same-store sales.

Gross Profit Margin: Despite a high historical margin, gross profit margin declined to 33.3%.

Net Income: Net income for the quarter was $0.9 million, with diluted EPS of $0.04 and adjusted diluted EPS of $0.19.

Adjusted EBITDA: MarineMax Inc (NYSE:HZO) posted an adjusted EBITDA of $26.6 million.

Fiscal 2024 Guidance: Adjusted net income guidance updated to $3.20 to $3.70 per diluted share, with Adjusted EBITDA guidance of $190 million to $215 million.

On January 25, 2024, MarineMax Inc (NYSE:HZO), the world's largest recreational boat, yacht, and superyacht services company, released its 8-K filing, announcing financial results for its first quarter ended December 31, 2023. The company, known for its premium brand recreational boats and related marine products, operates primarily through its Retail Operations segment, which contributes the majority of its revenue through new and used boat sales across the U.S.

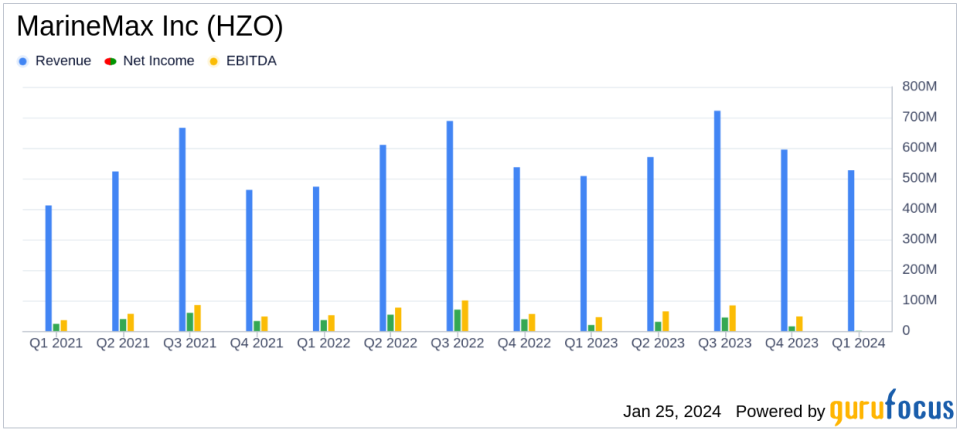

MarineMax Inc (NYSE:HZO) reported a record December quarter revenue, marking a significant achievement in a challenging retail environment. The company's revenue increase to $527.3 million, up from $507.9 million in the previous year, was driven by robust new and used boat sales, contributing to a 4% increase in same-store sales. However, gross profit margin saw a decrease to 33.3% from 36.8% in the fiscal 2023 first quarter, attributed to aggressive pricing actions in response to softer retail conditions and a greater mix of larger boats, which typically have lower margins.

Despite the positive revenue growth, MarineMax Inc (NYSE:HZO) faced a decline in net income, reporting $0.9 million, or $0.04 per diluted share, compared to $19.7 million, or $0.89 per diluted share, in the same period last year. Adjusted net income was $4.4 million, or $0.19 per diluted share, a decrease from $27.3 million, or $1.24 per diluted share, in the prior-year period. The company's adjusted EBITDA also fell to $26.6 million from $53.2 million year over year.

MarineMax Inc (NYSE:HZO) experienced increased selling, general, and administrative expenses, totaling $156.5 million, or 29.7% of revenue, primarily due to acquisitions and inflation. Interest expense also rose to $18.4 million, reflecting higher interest rates and increased inventory.

CEO Brett McGill expressed pride in the team's ability to close the December quarter strongly and acknowledged the need for more aggressive pricing actions. McGill remains cautiously optimistic about the winter boat show season and the company's long-term growth plans, including the planned acquisition of Williams Tenders USA.

Looking ahead, MarineMax Inc (NYSE:HZO) updated its fiscal year 2024 guidance, anticipating adjusted net income in the range of $3.20 to $3.70 per diluted share and adjusted EBITDA between $190 million to $215 million. These projections do not account for potential material acquisitions or unforeseen global economic changes.

MarineMax Inc (NYSE:HZO) continues to focus on capturing synergies from recent acquisitions and expanding its portfolio of higher-margin products and services. The company's strong cash position and healthy balance sheet support its strategic initiatives, even as it navigates a more challenging retail landscape.

Investors and analysts are encouraged to review the detailed financial statements and listen to the earnings conference call for a deeper understanding of MarineMax Inc (NYSE:HZO)'s performance and outlook.

Explore the complete 8-K earnings release (here) from MarineMax Inc for further details.

This article first appeared on GuruFocus.