Marinus (MRNS) Up 20% on Financial and Pipeline Updates

Marinus Pharmaceuticals MRNS gains 20% on Sep 19, as the company highlights updates on its financial performance and pipeline progress focused on the development of therapies targeting major central nervous system disorders, during an Investor and Analyst Event in New York.

MRNS has been witnessing rapid adoption of its lead product, Ztalmy (ganaxolone), approved for treating seizures associated with CDKL5 deficiency disorder (CDD) in patients aged two years and older. For the third quarter of 2023, Marinus expects net product revenues in the range of $5-$5.2 million. The Zacks Consensus Estimate for product revenues is pegged at $6.54 million. The company remains on track to meet its full-year net product projection of $17-$18.5 million.

Ztalmy received approval in the United States in March 2022. In July 2023, it also gained approval in Europe for the adjunctive treatment of epileptic seizures associated with CDD in patients aged between two and 17 years. The drug is already generating incremental sales, exceeding management’s expectations. The company recorded sales of $7.58 million in the first half of 2023.

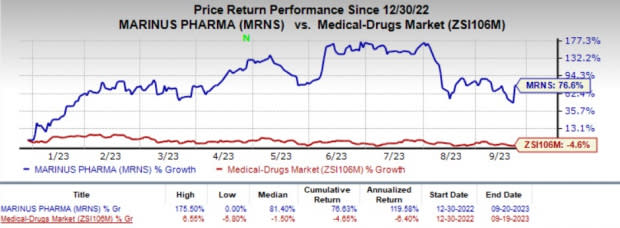

Shares of Marinus have rallied 76.6% year to date against the industry’s 4.6% decline.

Image Source: Zacks Investment Research

Looking ahead, the company expects its cash, cash equivalents, and short-term investments to be in the range of $170-$175 million at the end of the third quarter of 2023. This balance is expected to support MRNS’ operating expenses and capital expenditure requirements in the fourth quarter of 2024.

These projected balances will help Marinus to efficiently evaluate its two late-stage studies of ganaxolone for refractory status epilepticus (RSE) and tuberous sclerosis complex (TSC).

Status epilepticus is a severe neurological disease, and over 50% of patients are unresponsive to first or second-line therapies. The company is evaluating ganaxolone in a phase III RAISE study for RSE. The company has enrolled more than 70% patients in the study and expects to complete enrollment for an interim analysis by January 2024. The top-line data is expected in the first quarter of 2024 if the study meets the pre-defined stopping criteria from the interim analysis.

Furthermore, MRNS is evaluating ganaxolone in a phase III Trust TSC study for patients with TSC. Data from the study is expected by mid-2024.

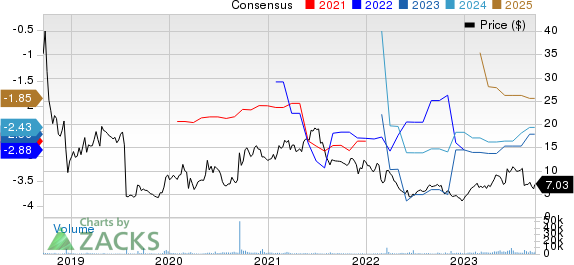

Marinus Pharmaceuticals, Inc. Price and Consensus

Marinus Pharmaceuticals, Inc. price-consensus-chart | Marinus Pharmaceuticals, Inc. Quote

Zacks Rank & Other Stocks to Consider

Marinus currently carries a Zacks Rank #3 (Hold).

Some other top-ranked stocks in the same industry are Anika Therapeutics ANIK, Annovis Bio ANVS and Corcept Therapeutics CORT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 90 days, the Zacks Consensus Estimate forAnika Therapeutics has narrowed from a loss of $1.41 per share to a loss of $1.24 for 2023. The bottom-line estimate has widened from a loss of 79 cents to a loss of 82 cents for 2024 during the same time frame. Shares of the company have lost 40.0% year to date.

ANIK’s earnings beat estimates in one of the trailing four quarters and missed the mark in the remaining three, delivering an average negative surprise of 32.12%.

In the past 90 days, the Zacks Consensus Estimate for Annovis Bio has narrowed from a loss of $4.89 per share to a loss of $4.38 for 2023. The bottom-line estimate has narrowed from a loss of $3.18 to a loss of $2.77 for 2024 during the same time frame. Shares of the company have lost 20.0% year to date.

ANVS’ earnings beat estimates in three of the trailing four quarters and missed the mark in one, delivering an average surprise of 13.40%.

In the past 90 days, the Zacks Consensus Estimate for Corcept’s earnings has gone up from 62 cents per share to 78 cents for 2023. The bottom-line estimate has also improved from 61 cents to 83 cents for 2024 during the same time frame. Shares of the company have rallied 62.3% year to date.

CORT’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 6.99%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report

Anika Therapeutics Inc. (ANIK) : Free Stock Analysis Report

Marinus Pharmaceuticals, Inc. (MRNS) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report