Marinus Pharmaceuticals Inc (MRNS) Reports Full Year and Q4 2023 Financial Results

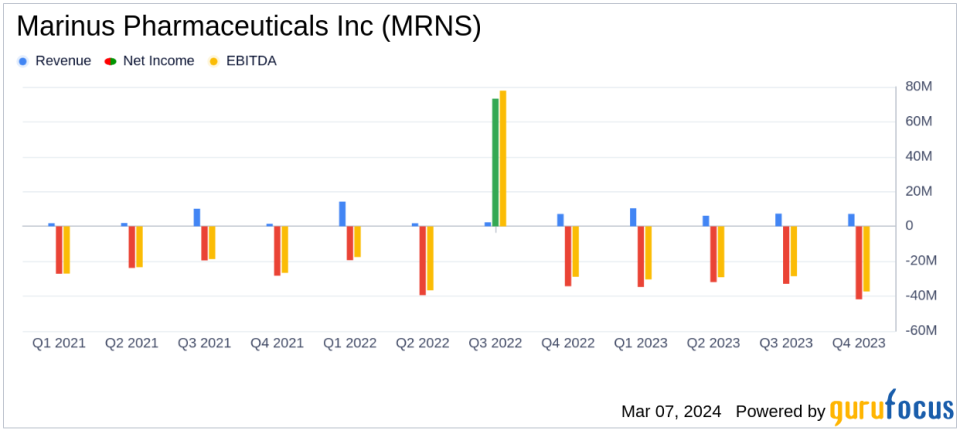

Revenue Growth: Year-over-year product revenue increased significantly from $2.872 million in 2022 to $19.561 million in 2023.

Net Loss: Reported a net loss of $141.405 million for the full year 2023, compared to a net loss of $19.816 million in the previous year.

Research and Development Expenses: R&D expenses rose to $99.388 million in 2023, up from $79.912 million in 2022.

Total Assets: Decreased to $170.908 million as of December 31, 2023, down from $259.518 million the previous year.

Cash Position: Cash and cash equivalents reduced to $120.572 million, compared to $240.551 million at the end of 2022.

On March 5, 2024, Marinus Pharmaceuticals Inc (NASDAQ:MRNS) released its 8-K filing, detailing the company's financial results for the fourth quarter and the full year ended December 31, 2023. Marinus Pharmaceuticals, a clinical-stage biopharmaceutical company focused on developing and commercializing innovative therapeutics for epilepsy and neuropsychiatric disorders, has reported several key financial and business updates.

Marinus Pharmaceuticals is actively developing ganaxolone for various indications, including refractory status epilepticus and tuberous sclerosis complex. The company has seen a steady adoption of its FDA-approved medication ZTALMY (ganaxolone) oral suspension CV, which is expected to drive growth in the coming year.

Financial Performance and Challenges

Despite the increase in product revenue, Marinus Pharmaceuticals reported a substantial net loss of $141.405 million for the full year 2023, which is significantly higher than the $19.816 million net loss in 2022. This increase in net loss is primarily due to a one-time gain from the sale of a priority review voucher in the previous year, which did not recur in 2023. Additionally, the company's total assets decreased, and its cash position weakened, with cash and cash equivalents nearly halving from the previous year's level. These financial challenges underscore the importance of the company's clinical development success and the commercial performance of its products.

Research and development expenses increased as the company continued to invest in its clinical pipeline, including the Phase 3 RAISE trial for refractory status epilepticus and the Phase 3 TrustTSC trial for tuberous sclerosis complex. Selling, general, and administrative expenses also rose, reflecting the costs associated with the commercialization of ZTALMY.

Income Statement and Balance Sheet Highlights

The company's income statement reveals a significant increase in product revenue, netting $19.561 million for the year, compared to $2.872 million in the previous year. Collaboration revenue, however, decreased from $15.671 million in 2022 to just $54 thousand in 2023. Total revenue for the year was $30.989 million, up from $25.478 million in the previous year.

On the balance sheet, Marinus Pharmaceuticals' total assets decreased to $170.908 million as of December 31, 2023, from $259.518 million at the end of 2022. This decline is partly due to a reduction in cash and cash equivalents, which stood at $120.572 million, down from $240.551 million the previous year. The company's total liabilities increased slightly to $154.143 million, up from $143.518 million in 2022.

Analysis of Company's Performance

The financial results of Marinus Pharmaceuticals reflect a company in a critical phase of transitioning from a clinical-stage to a commercial-stage entity. The increased R&D expenses and SG&A costs are indicative of the company's investment in its future growth. However, the reduced cash reserves and increased net loss highlight the need for careful financial management and successful commercialization of its products to ensure long-term sustainability.

Marinus Pharmaceuticals' focus on advancing its clinical pipeline and growing the ZTALMY franchise is crucial for its success. The company's ability to meet upcoming clinical milestones and effectively market ZTALMY will be key determinants of its financial health in the future.

Investors and stakeholders will be closely monitoring the company's progress, particularly the outcomes of the Phase 3 trials and the commercial trajectory of ZTALMY, as these will have significant implications for the company's financial position and market valuation.

For a more detailed analysis and ongoing updates on Marinus Pharmaceuticals Inc (NASDAQ:MRNS) and other value investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Marinus Pharmaceuticals Inc for further details.

This article first appeared on GuruFocus.