Mario Cibelli's Q2 2023 13F Filing Update: Key Trades and Portfolio Overview

Renowned investor Mario Cibelli recently disclosed his firm's portfolio updates for the second quarter of 2023, which ended on June 30, 2023. Cibelli is known for his value-oriented investment approach, focusing on long-term capital appreciation by investing in a concentrated portfolio of undervalued securities. His firm's Q2 2023 portfolio contained 29 stocks, with a total value of $81 million.

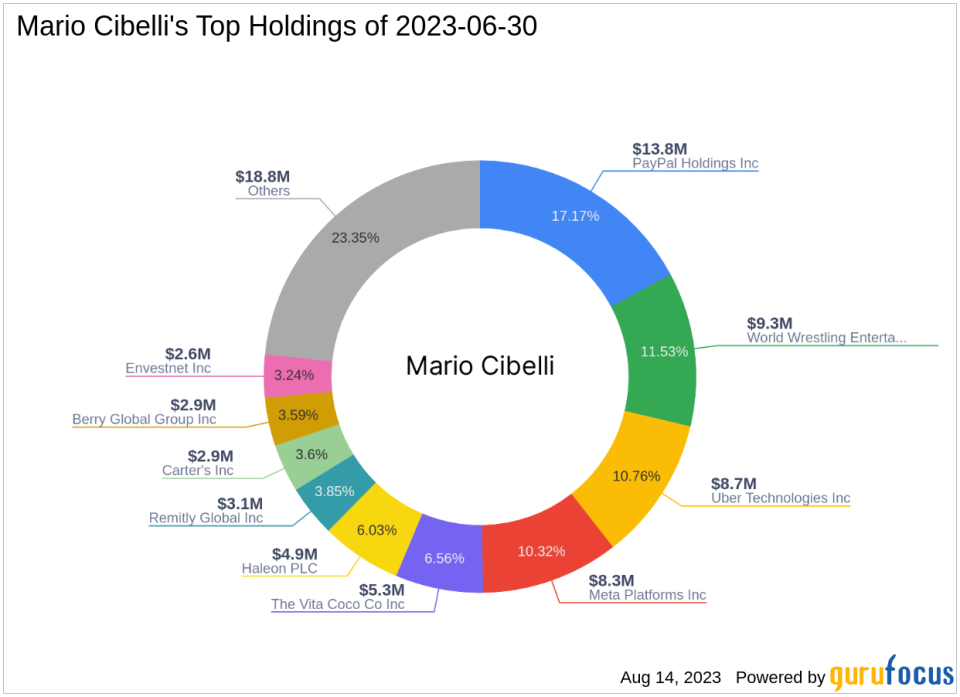

Top Holdings

The top holdings in Cibelli's portfolio were PayPal Holdings Inc (NASDAQ:PYPL) with 17.17%, World Wrestling Entertainment Inc (WWE) with 11.53%, and Uber Technologies Inc (UBER) with 10.76% of the portfolio.

Key Trades of the Quarter

During the quarter, Cibelli made significant transactions in three companies: PayPal Holdings Inc, Match Group Inc, and WESCO International Inc.

PayPal Holdings Inc (NAS:PYPL)

Cibelli purchased 61,500 shares of PayPal, increasing his total holding to 207,500 shares. This trade had a 5.09% impact on the equity portfolio. The stock traded for an average price of $68.30 during the quarter. As of August 14, 2023, PayPal's stock price was $62.962, with a market cap of $69.31 billion. The stock has returned -37.55% over the past year. GuruFocus gives PayPal a financial strength rating of 6 out of 10 and a profitability rating of 10 out of 10. The company's valuation ratios include a price-earnings ratio of 17.68, a price-book ratio of 3.54, a PEG ratio of 1.16, a EV-to-Ebitda ratio of 10.31, and a price-sales ratio of 2.48.

Match Group Inc (NAS:MTCH)

The firm completely sold out its 67,500-share investment in Match Group. The shares traded for an average price of $36.59 during the quarter. As of August 14, 2023, Match Group's stock price was $44.67, with a market cap of $12.45 billion. The stock has returned -34.16% over the past year. GuruFocus gives Match Group a financial strength rating of 4 out of 10 and a profitability rating of 8 out of 10. The company's valuation ratios include a price-earnings ratio of 27.30, a EV-to-Ebitda ratio of 19.32, and a price-sales ratio of 4.25.

WESCO International Inc (NYSE:WCC)

Cibelli established a new position in WESCO International, purchasing 11,250 shares. This gave the stock a 2.5% weight in the equity portfolio. The shares traded for an average price of $145.92 during the quarter. As of August 14, 2023, WESCO's stock price was $155.97, with a market cap of $8.03 billion. The stock has returned 11.87% over the past year. GuruFocus gives WESCO a financial strength rating of 6 out of 10 and a profitability rating of 8 out of 10. The company's valuation ratios include a price-earnings ratio of 10.35, a price-book ratio of 1.67, a PEG ratio of 0.34, a EV-to-Ebitda ratio of 8.16, and a price-sales ratio of 0.37.

In conclusion, Cibelli's Q2 2023 portfolio update reveals a strategic focus on companies with strong financial strength and profitability ratings. His top trades reflect a balanced approach between buying undervalued stocks and selling those that may have reached their potential.

This article first appeared on GuruFocus.