Mario Gabelli's Firm Exits INDUS Realty Trust, Trims Valvoline and Crane

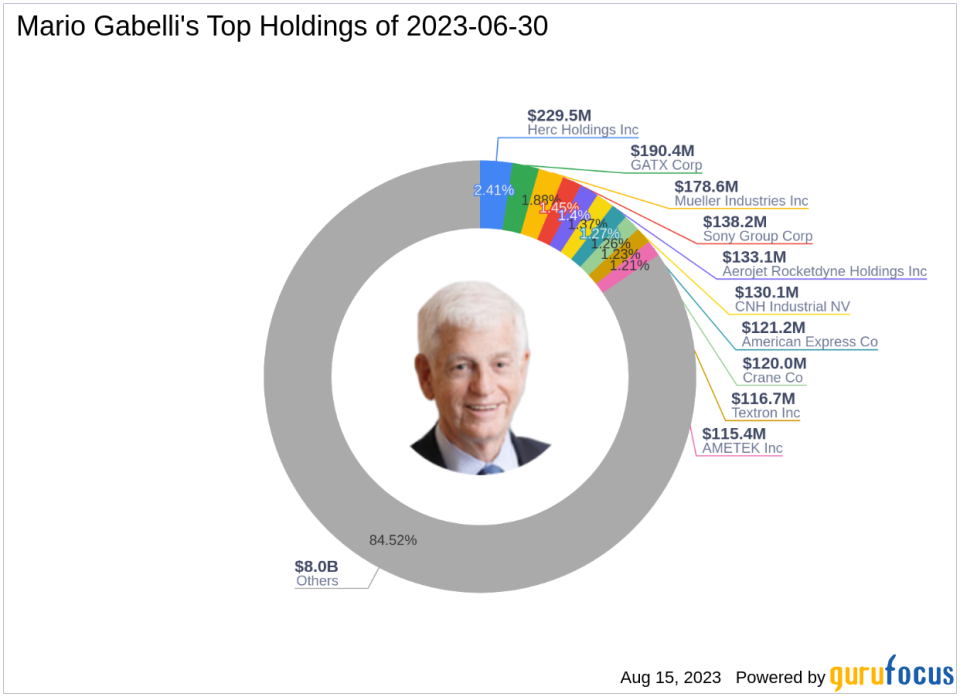

Renowned investor Mario Gabelli recently disclosed his firm's portfolio updates for the second quarter of 2023, which ended on June 30, 2023. Gabelli, known for his value investing approach, manages a diverse portfolio of 835 stocks with a total value of $9.51 billion. The top holdings for this period were HRI (2.41%), GATX (2.00%), and MLI (1.88%).

Top Three Trades of the Quarter

The following are the top three trades made by Gabelli's firm during the quarter:

INDUS Realty Trust Inc (INDT)

The firm completely sold out its 444,747-share investment in INDUS Realty Trust Inc (INDT), which previously accounted for 0.32% of the portfolio. The shares were traded at an average price of $66.69 during the quarter. As of August 15, 2023, INDT's stock price was $66.99, with a market cap of $683.16 million. The stock has returned 13.83% over the past year. GuruFocus gives the company a financial strength rating of 5 out of 10 and a profitability rating of 5 out of 10. In terms of valuation, INDT has a price-book ratio of 1.76, an EV-to-Ebitda ratio of 40.37, and a price-sales ratio of 13.44.

Valvoline Inc (NYSE:VVV)

Mario Gabelli (Trades, Portfolio)'s firm reduced its investment in Valvoline Inc (NYSE:VVV) by 681,108 shares, impacting the equity portfolio by 0.26%. The stock traded at an average price of $36.29 during the quarter. As of August 15, 2023, VVV's stock price was $34.71, with a market cap of $4.81 billion. The stock has returned 16.51% over the past year. GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rating of 8 out of 10. In terms of valuation, VVV has a price-earnings ratio of 3.93, a price-book ratio of 16.85, a EV-to-Ebitda ratio of 19.26, and a price-sales ratio of 4.29.

Crane NXT Co (NYSE:CXT)

The firm also reduced its investment in Crane NXT Co (NYSE:CXT) by 299,774 shares, impacting the equity portfolio by 0.24%. The stock traded at an average price of $51.76 during the quarter. As of August 15, 2023, CXT's stock price was $60.27, with a market cap of $3.42 billion. GuruFocus gives the company a financial strength rating of 6 out of 10 and a profitability rating of 5 out of 10. In terms of valuation, CXT has a price-earnings ratio of 18.50, a price-book ratio of 4.00, a EV-to-Ebitda ratio of 9.22, and a price-sales ratio of 1.20.

In conclusion, Mario Gabelli (Trades, Portfolio)'s firm made significant changes to its portfolio in the second quarter of 2023, with a focus on value investing. The firm's top trades reflect a strategic approach to portfolio management, with a focus on companies with strong financial and profitability ratings.

This article first appeared on GuruFocus.