Mario Gabelli's Q4 Moves Highlight Exit from Circor International Inc

Insights from the Investment Guru's Latest 13F Filing

Mario Gabelli (Trades, Portfolio), a renowned figure in the investment world, has made his latest moves public through the 13F filing for the fourth quarter of 2023. As the founder and CEO of GAMCO Investors Inc., Gabelli's investment strategy is deeply rooted in identifying undervalued companies with a catalyst for growth. His impressive credentials include being a summa cum laude graduate from Fordham University, an M.B.A. from Columbia University, and accolades such as Morningstar's Portfolio Manager of the Year and Institutional Investor's Money Manager of the Year. Gabelli's investment philosophy, Private Market Value with a Catalyst, is a testament to his commitment to rigorous fundamental analysis and value creation.

Summary of New Buys

Mario Gabelli (Trades, Portfolio)'s portfolio saw the addition of 45 new stocks in the fourth quarter. Noteworthy new positions include:

Bluegreen Vacations Holding Corp (BVH), with 62,605 shares, making up 0.05% of the portfolio and valued at $4.7 million.

Karuna Therapeutics Inc (NASDAQ:KRTX), comprising 12,540 shares, which is approximately 0.04% of the portfolio, with a total value of $3.97 million.

Olink Holding AB (NASDAQ:OLK), with 167,500 shares, accounting for 0.04% of the portfolio and a total value of $4.21 million.

Key Position Increases

Gabelli also bolstered his stakes in 204 stocks, with significant increases in:

Grupo Televisa SAB (NYSE:TV), adding 1,838,425 shares for a total of 11,633,903 shares. This represents an 18.77% increase in share count, a 0.07% impact on the current portfolio, and a total value of $38.86 million.

Callon Petroleum Co (NYSE:CPE), with an additional 137,189 shares, bringing the total to 366,740. This adjustment marks a 59.76% increase in share count and a total value of $11.88 million.

Summary of Sold Out Positions

The fourth quarter also saw Gabelli exit 45 holdings, including:

Circor International Inc (CIR), where he sold all 900,591 shares, resulting in a -0.58% impact on the portfolio.

Chase Corp (CCF), with the liquidation of all 103,394 shares, causing a -0.15% impact on the portfolio.

Key Position Reductions

Reductions were made in 411 stocks, with notable decreases in:

Griffon Corp (NYSE:GFF), reduced by 367,692 shares, leading to a -22.79% decrease in shares and a -0.17% impact on the portfolio. The stock traded at an average price of $46.22 during the quarter and has returned 42.09% over the past three months and 9.78% year-to-date.

Modine Manufacturing Co (NYSE:MOD), reduced by 300,818 shares, resulting in an -11.94% reduction in shares and a -0.16% impact on the portfolio. The stock traded at an average price of $48.9 during the quarter and has returned 51.33% over the past three months and 25.88% year-to-date.

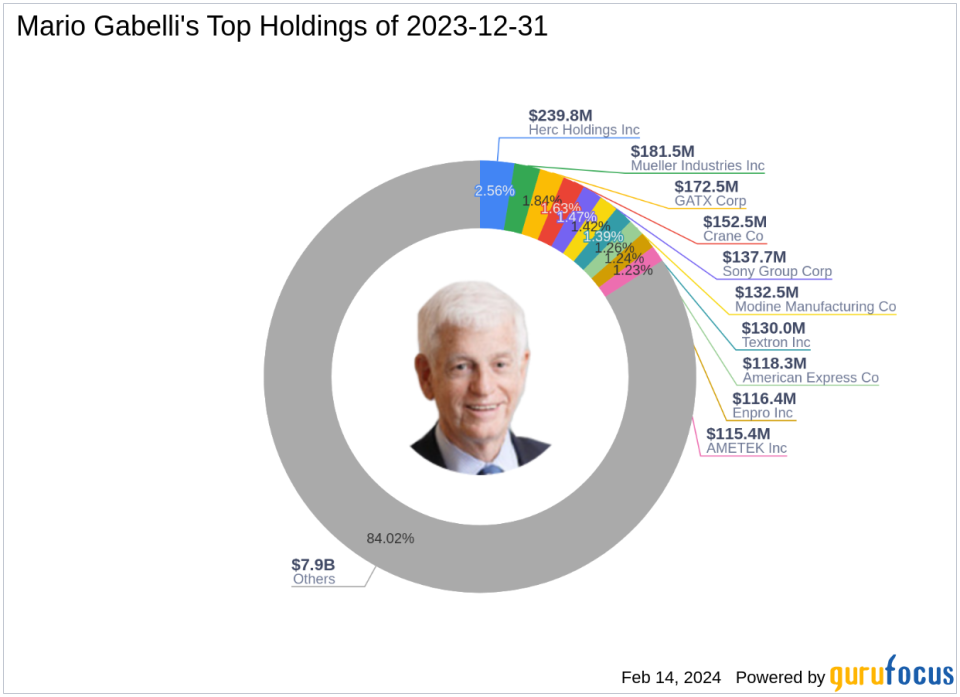

Portfolio Overview

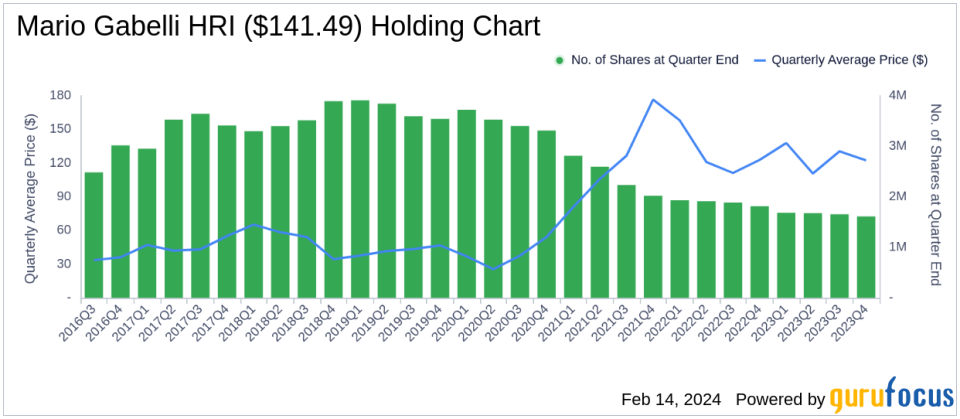

As of the fourth quarter of 2023, Mario Gabelli (Trades, Portfolio)'s portfolio included 823 stocks. The top holdings were 2.56% in Herc Holdings Inc (NYSE:HRI), 1.94% in Mueller Industries Inc (NYSE:MLI), 1.84% in GATX Corp (NYSE:GATX), 1.63% in Crane Co (NYSE:CR), and 1.47% in Sony Group Corp (NYSE:SONY). The investments span across all 11 industries, with a focus on Industrials, Consumer Cyclical, and Communication Services, among others.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.