Mario Gabelli's Top Trades of the 1st Quarter

- By Graham Griffin

Mario Gabelli (Trades, Portfolio), founder of GAMCO Investors, has revealed his portfolio for the first quarter of 2021. Major trades include reductions across dozens of positions, including Herc Holdings Inc. (NYSE:HRI), ViacomCBS Inc. (NASDAQ:VIAC), Aerojet Rocketdyne Holdings Inc. (NYSE:AJRD) and Tootsie Roll Industries Inc. (NYSE:TR) alongside a large addition to his Alphabet Inc. (NASDAQ:GOOG) holding.

Gabelli and his New York-based firm seek to generate long-term capital appreciation through their investments. The team searches for opportunities in undervalued stocks that have a catalyst for growth to generate favorable returns.

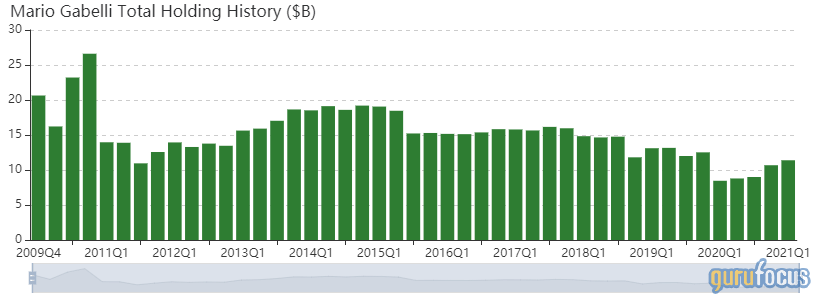

Portfolio overview

At the end of the quarter, Gabelli's portfolio contained 899 stocks, with 74 new holdings. It was valued at $11.39 billion and has seen a turnover rate of 3%. Top holdings include Herc Holdings, Sony Group Corp. (NYSE:SONY), GATX Corp. (NYSE:GATX), CNH Industrial NV (NYSE:CNHI) and American Express Co. (NYSE:AXP).

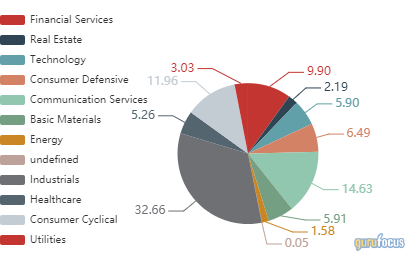

By weight, the top three sectors represented are industrials (32.66%), communication services (14.63%) and financial services (9.9%).

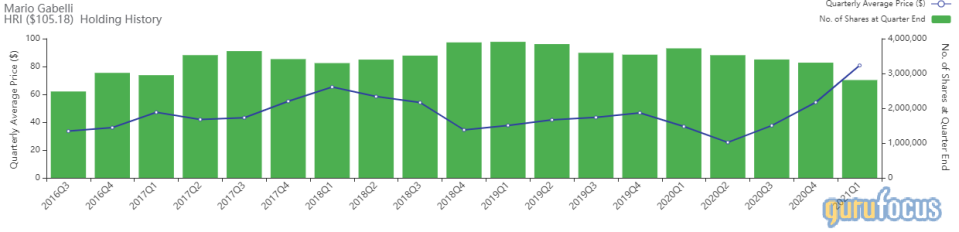

Herc Holdings

The most impactful trade on the portfolio came from Gabelli's Herc Holdings (NYSE:HRI) position. The quarter saw the sale of 499,635 shares for a 15.09% reduction. During the quarter, the shares traded at an average price of $80.78. Overall, the sale had a -0.31% impact on the equity portfolio and GuruFocus estimates the total gain of the holding at 137.45%.

Herc Holdings is an equipment rental company that was spun out of Hertz Global in 2016. It is currently the third-largest equipment rental company in North America, after United Rentals (URI) and Sunbelt Rentals, with 3% market share. It serves construction customers, the environmental sector, industrial entities and entertainment production companies. Herc Holdings' strategy now offers to industrial customers long-term rental schemes, where Herc maintains its own staff at the customer site. In 2019, Herc Holdings' fleet included $3.8 billion of equipment at original cost. Annual companywide revenue was approximately $2 billion, including $1.7 billion in equipment rentals.

On May 17, the stock was trading at $105.27 per share with a market cap of $3.11 billion. According to the GF Value Line, the shares are trading at a significantly overvalued rating.

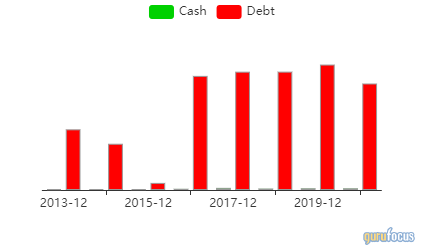

GuruFocus gives the company a financial strength rating of 3 out of 10 and a profitability rank of 6 out of 10. There are currently two severe warning signs issued for poor financial strength and an Altman Z-Score of 1.31 indicating a higher likelihood of bankruptcy. The company's cash-to-debt ratio of 0.02 ranks it worse than 95.15% of the industry and is teetering on the edge of reaching an all-time low.

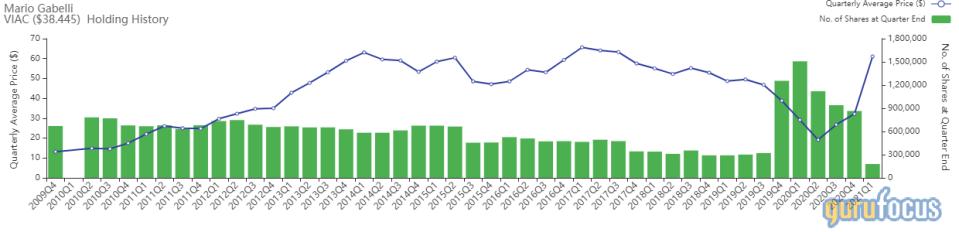

ViacomCBS

The first quarter also saw the guru's ViacomCBS (NASDAQ:VIAC) position slashed by 79.32% with the sale of 685,866 shares. Throughout the quarter, the shares traded at an average price of $61.05. GuruFocus estimates the total gain on the holding at 42.26% and the sale had a -0.24% impact on the equity portfolio overall.

ViacomCBS is the recombination of CBS and Viacom that has created a media conglomerate operating around the world. CBS's television assets include the CBS television network, 28 local TV stations and 50% of CW, a joint venture between CBS and Time Warner. The company also owns Showtime and Simon & Schuster. Viacom owns several leading cable network properties, including Nickelodeon, MTV, BET, Comedy Central, VH1, CMT and Paramount. Viacom has also built several online properties on the strength of these brands. Viacom's Paramount Pictures produces original motion pictures and owns a library of 2,500 films, including the "Mission: Impossible" and "Transformers" series.

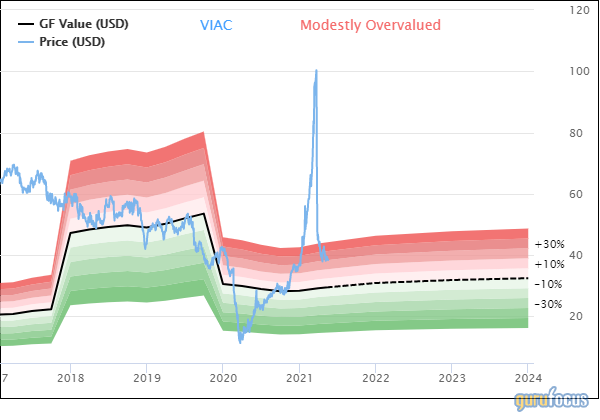

As of May 17, the stock was trading at $38.43 per share with a market cap of $25.04 billion. The shares are trading at a modestly overvalued rating according to the GF Value Line.

GuruFocus gives the company a financial strength rating of 4 out of 10, a profitability rank of 8 out of 10 and a valuation rank of 10 out of 10. There are currently three severe warning signs issued for assets growing faster than revenue, a declining operating margin and an Altman Z-Score of 1.63 placing the company in the distress column. Despite the warning sign, the company's operating margin ranks it better than 87.49% of the media industry with a similarly strong net margin following close behind.

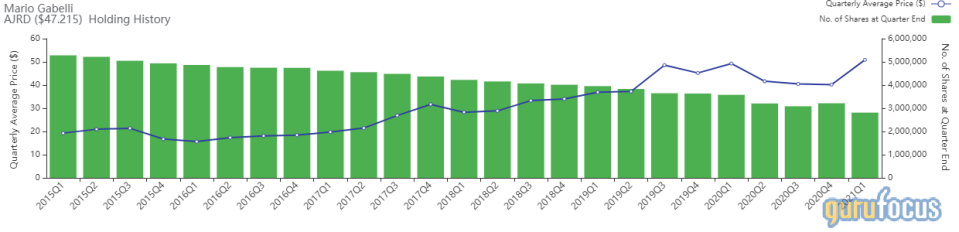

Aerojet Rocketdyne

Gabelli also cut his Aerojet Rocketdyne holding back by 12.55%. The reduction came from the sale of 403,707 shares that traded at an average price of $50.87 during the quarter. The sale had an overall impact of -0.20% and GuruFocus estimates the guru has gained 108.25% on the holding throughout its lifetime.

Aerojet Rocketdyne manufactures aerospace and defense products and systems. It produces driving and launch systems for defense and space applications, weapons and weapons systems for tactical missions. The systems can provide directional control for rockets, satellites, missiles and other technical products. It operates in two segments: aerospace and defense and real estate. The company manufactures its aerospace and defense products for the U.S. government, the National Aeronautics and Space Administration, aerospace and defense prime contractors and portions of the commercial sector. The real estate segment focuses on rezoning, entitlement, sale and leasing of real estate assets. The company's excess real estate is primarily located in California.

The stock was trading at $47.21 per share with a market cap of $3.78 billion on May 17. According to the GF Value Line, the stock is trading at a fair value rating.

GuruFocus gives the company a financial strength rating of 5 out of 10, a profitability rank of 5 out of 10 and a valuation rank of 3 out of 10. There is currently one severe warning sign issued for declining revenue per share. The weighted average cost of capital is currently supported by the return on invested capital, but the company has seen large fluctuations in the past, indicating a lack of stability in profitability.

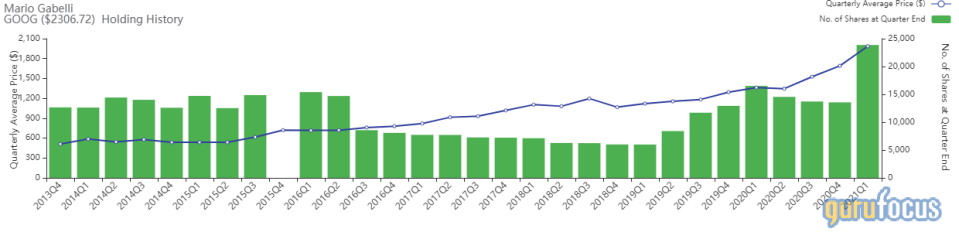

Alphabet

The most impactful addition to the portfolio came from Gabelli's Alphabet (NASDAQ:GOOG) holding. The guru boosted his position by 76.04% with the purchase of an additional 10,308 shares. The first quarter saw the shares trading at an average price of $1,986.11. GuruFocus estimates the total gain of the holding at 45.94% and the trade had a 0.19% impact on the equity portfolio.

Alphabet is a holding company, with Google, the internet media giant, as a wholly-owned subsidiary. Google generates 99% of Alphabet's revenue, of which more than 85% is from online ads. Google's other revenue is from sales of apps and content on Google Play and YouTube, as well as cloud service fees and other licensing revenue. Sales of hardware such as Chromebooks, the Pixel smartphone and smart homes products, which include Nest and Google Home, also contribute to other revenue.

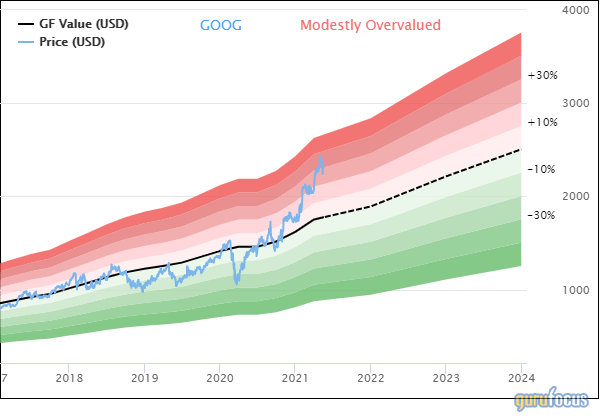

On May 17, the stock was trading at $2,308.89 per share with a market cap of $1.54 trillion. The shares are trading at a modestly overvalued rating according to the GF Value Line.

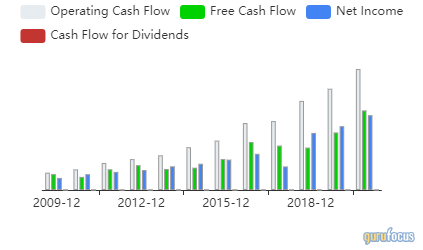

GuruFocus gives the company a financial strength rating of 8 out of 10, a profitability rank of 9 out of 10 and a valuation rank of 3 out of 10. There are currently three severe warning signs issued for assets growing faster than revenue, a declining gross margin and a declining net margin. The company's cash flows have been increasing steadily over the last decade and have reached an all-time high.

Tootsie Roll

Rounding out the guru's top five trades was another large reduction coming from his Tootsie Roll (NYSE:TR) holding. The sale of 718,330 shares cut back the holding by 88.5%. The shares traded at an average price of $31.83 during the quarter. Overall, the sale had a -0.19% impact on the equity portfolio and GuruFocus estimates the total representation in the portfolio at 37.61%.

Tootsie Roll manufactures and sells candy products. Notable varieties include Tootsie Roll and Tootsie Pops, Charms, Blow-Pops, Dots, Junior Mints, Sugar Daddy and Sugar Babies, Andes, Dubble Bubble and Razzles. The company sells its products to wholesale distributors and directly to retail stores. Geographically, it generates a majority of its revenue from the United States.

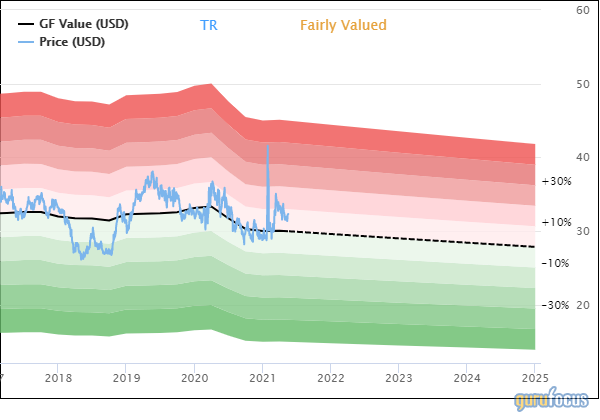

As of May 17, the stock was trading at $32.33 per share with a market cap of $2.13 billion. The shares are trading at a fair value rating according to the GF Value Line.

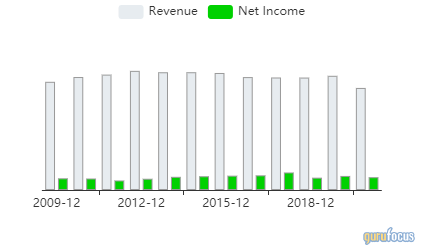

GuruFocus gives the company a financial strength rating of 7 out of 10, a profitability rank of 7 out of 10 and a valuation rank of 3 out of 10. There are currently two severe warning signs issued for the company for a declining operating margin and declining revenue per share. Prior to 2020, the company had relatively consistent revenue and net revenue figures, but took a small hit last year amidst the pandemic.

Disclosure: Author owns no stocks mentioned.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.