Mark Hillman Bolsters Portfolio with Baxter International Inc, Impacting 3.19%

Insight into Hillman's Q3 2023 Investment Strategies and Top Stock Picks

Mark Hillman (Trades, Portfolio), a seasoned investor and president of Hillman Capital Management, has revealed his investment moves for the third quarter of 2023. With a history of leading Custom Asset Management and Menocal Capital Management before founding his own firm in 1998, Hillman is known for his focus on undervalued companies with strong competitive advantages and temporary market mispricings. His investment decisions are guided by a thorough analysis of cash flow, dividends, sales, earnings, book value, and growth projections.

New Additions to the Portfolio

During the quarter, Hillman made strategic additions to his portfolio, including:

Baxter International Inc (NYSE:BAX), purchasing 219,248 shares, which now represent 3.19% of the portfolio, valued at $8.27 million.

U.S. Bancorp (NYSE:USB), with a new holding of 156,000 shares, accounting for 1.99% of the portfolio, worth approximately $5.16 million.

Significant Position Increases

Hillman also bolstered his stakes in several companies:

International Flavors & Fragrances Inc (NYSE:IFF) saw an addition of 52,277 shares, increasing the total to 125,277 shares. This represents a 71.61% surge in share count and a 1.37% portfolio impact, with a total value of $8.54 million.

AT&T Inc (NYSE:T) was augmented by 85,764 shares, bringing the total to 510,611. This adjustment marks a 20.19% increase in shares, valued at $7.67 million.

Exiting Positions

Mark Hillman (Trades, Portfolio) also made the decision to exit several holdings:

Enterprise Products Partners LP (NYSE:EPD) was completely sold off, with 339,224 shares divested, impacting the portfolio by -3.15%.

Compass Minerals International Inc (NYSE:CMP) was liquidated, with all 242,010 shares sold, resulting in a -2.9% portfolio impact.

Key Position Reductions

Adjustments were made to reduce exposure in certain stocks:

Lam Research Corp (NASDAQ:LRCX) was trimmed by 4,408 shares, a -32.67% decrease, affecting the portfolio by -1%. The stock's average trading price was $656.97 during the quarter, with a 3.60% return over the past three months and a 61.74% year-to-date return.

Meta Platforms Inc (NASDAQ:META) was cut by 8,940 shares, a -30.31% reduction, with a -0.91% impact on the portfolio. It traded at an average price of $301.3 and returned 9.13% over the past three months and 173.55% year-to-date.

Portfolio Overview

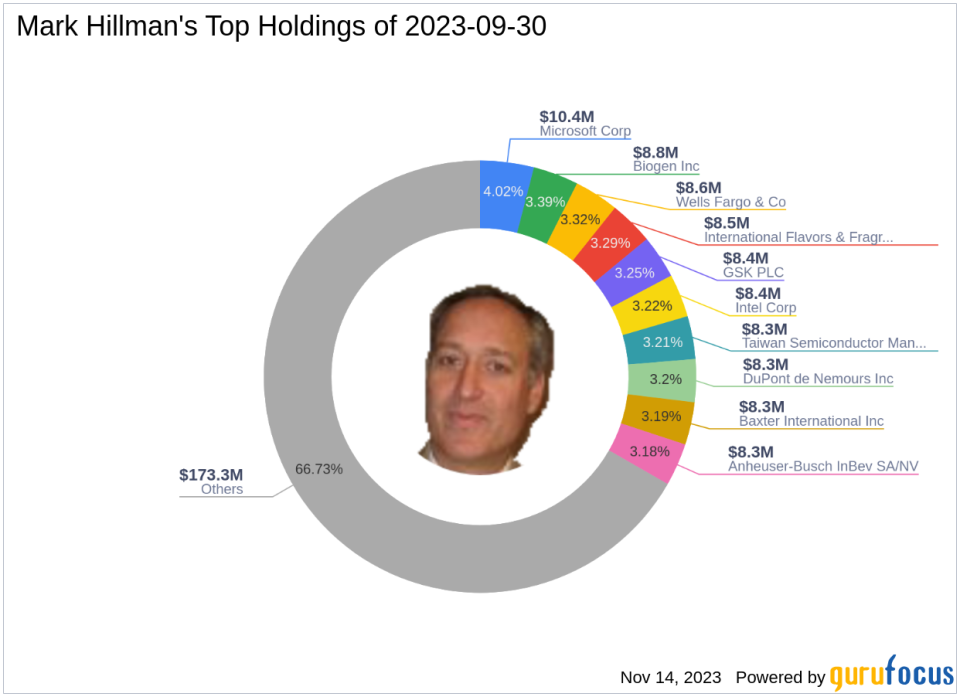

As of the third quarter of 2023, Mark Hillman (Trades, Portfolio)'s portfolio comprised 54 stocks. The top holdings included 4.02% in Microsoft Corp (NASDAQ:MSFT), 3.39% in Biogen Inc (NASDAQ:BIIB), 3.32% in Wells Fargo & Co (NYSE:WFC), 3.29% in International Flavors & Fragrances Inc (NYSE:IFF), and 3.25% in GSK PLC (NYSE:GSK). The investments span across nine industries, including Technology, Healthcare, Communication Services, Financial Services, Consumer Defensive, Industrials, Basic Materials, Consumer Cyclical, and Real Estate, showcasing a diversified approach.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.