Markel Group Inc (MKL) Reports Robust Investment Returns and Insurance Growth in 2023

Earned Premiums: Increased by 9% to $8.3 billion in 2023.

Markel Ventures Operating Revenues: Rose by 5% to nearly $5 billion.

Net Investment Income: Grew by 64% to $734.5 million.

Comprehensive Income to Shareholders: Turned positive at $2.3 billion after a loss in the previous year.

Diluted Net Income Per Share: A significant increase to $146.98 from a loss of $(23.72) per share in 2022.

Combined Ratio: Deteriorated to 98% from 92% in 2022, reflecting a higher attritional loss ratio.

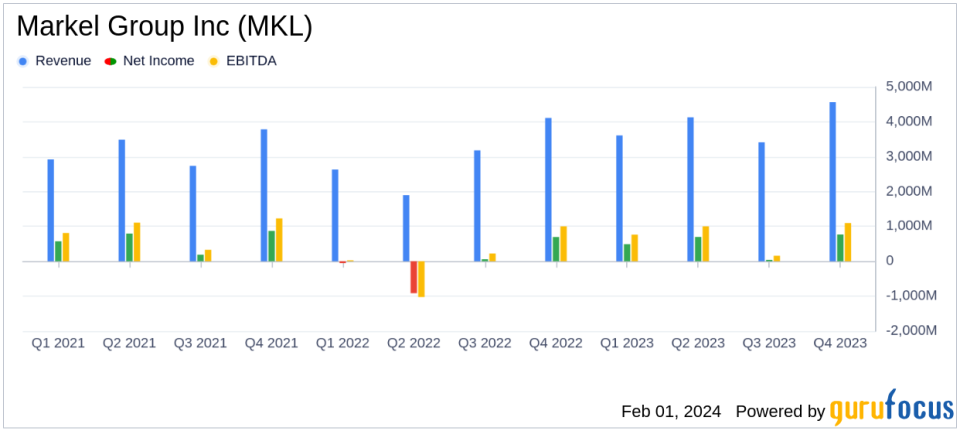

On January 31, 2024, Markel Group Inc (NYSE:MKL) released its 8-K filing, detailing the financial results for the year ended December 31, 2023. The company, known for its specialty insurance products and diversified holdings through Markel Ventures, reported significant growth in earned premiums and net investment income, contributing to a comprehensive income turnaround for shareholders.

Insurance Operations and Challenges

Markel's insurance operations saw a 9% increase in earned premiums, indicating growth in gross premium volume. However, the company faced a higher combined ratio of 98% in 2023, up from 92% in the previous year, primarily due to a higher attritional loss ratio. This deterioration is a critical point of focus as it may signal underlying issues in claims management or pricing adequacy that could affect future profitability.

Investment and Markel Ventures Performance

Markel's investment operations and Markel Ventures, its non-insurance businesses, enjoyed a 35% increase in operating income and a 64% rise in net investment income. These achievements are particularly noteworthy as they demonstrate the company's ability to generate significant returns from its diversified portfolio, which is crucial for supporting the insurance underwriting business and providing a buffer against insurance market volatility.

Financial Metrics and Importance

Key financial metrics from the income statement include a substantial increase in net investment gains to $1.5 billion, reflecting favorable market movements. The balance sheet shows invested assets growing to $30.9 billion, up from $27.4 billion, highlighting the company's strong investment performance and cash flow generation. Cash flow from operations was robust at $2.8 billion, an increase from the previous year, underscoring the company's operational efficiency and financial health.

"We enjoyed excellent returns in 2023 from Markel Ventures, our investment operations, and many portions of our insurance business," said Thomas S. Gayner, Chief Executive Officer. "While we remain focused on some areas of improvement for our insurance operations, our three-engine system continues to drive profitable growth."

Analysis of Company's Performance

Markel's performance in 2023 reflects a strong investment and diversified business strategy that has yielded positive results, particularly in the face of a challenging insurance environment. The company's ability to grow its earned premiums while also expanding its investment income is a testament to its strategic positioning and operational execution. However, the increased combined ratio presents a challenge that the company will need to address to ensure sustained profitability in its core insurance business.

Overall, Markel Group Inc (NYSE:MKL) has demonstrated resilience and adaptability in a complex financial landscape, leveraging its diverse business model to deliver value to shareholders. The company's focus on long-term growth and value creation remains a cornerstone of its strategy, as evidenced by the positive financial outcomes reported in this earnings release.

For more detailed information and to join the discussion on Markel Group's financial results, visit the GuruFocus.com website.

Explore the complete 8-K earnings release (here) from Markel Group Inc for further details.

This article first appeared on GuruFocus.